UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ☒ | |

| Filed by a Party other than the Registrant ☐ | |

| Check the appropriate box: |

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

ACTELIS NETWORKS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a–6(i)(1) and 0–11 |

ACTELIS NETWORKS, INC.

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

Meeting to be held on August 12, 2025, at 10:00 a.m. (Eastern Standard Time)

The Meeting to be held virtually at the following link: www.virtualshareholdermeeting.com/ASNS2025.

ACTELIS NETWORKS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 12, 2025

An annual meeting of stockholders (the “Annual Meeting”) of Actelis Networks, Inc. (“Actelis”, the “Company”, “we”, “us”, or “our”) will be held virtually on August 12, 2025, at 10:00 a.m. (Eastern Standard Time), virtually at the following link: www.virtualshareholdermeeting.com/ASNS2025, to consider the following proposals:

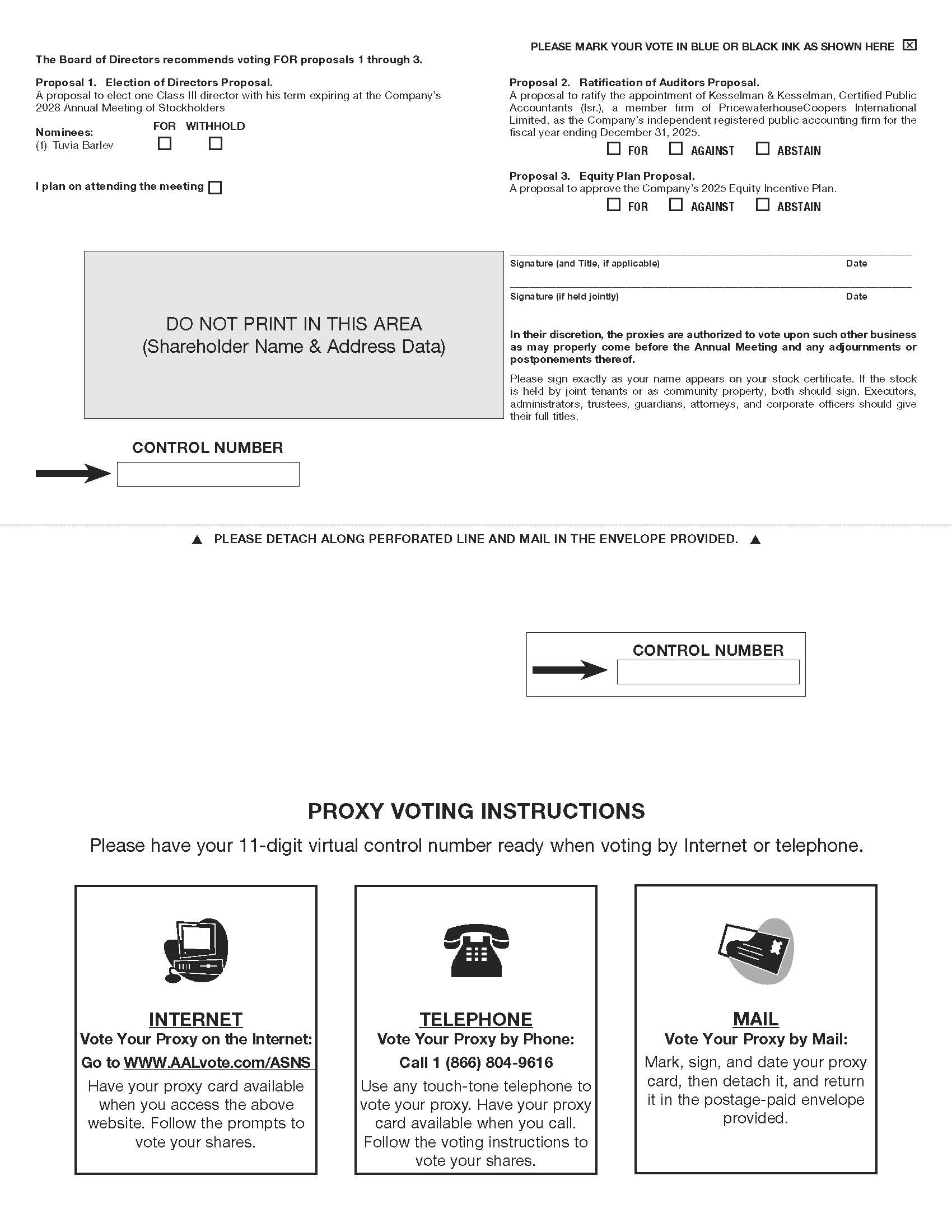

| 1. | To elect one Class III director to serve on our board of directors for a term of three years or until our 2028 Annual Meeting of Stockholders, for which Tuvia Barlev is the nominee (“Proposal No. 1”); | |

| 2. | To ratify the appointment of Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers International Limited, as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 (“Proposal No. 2”); | |

| 3. | To approve the Actelis 2025 Equity Incentive Plan (the “2025 Plan”) (“Proposal No. 3”); | |

| 4. | To approve the adjournment of the Annual Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Annual Meeting, there are not sufficient votes to approve Proposal No. 1, Proposal No. 2 and/or Proposal No. 3 (“Proposal No. 4”); and | |

| 5. | To transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof. |

BECAUSE OF THE SIGNIFICANCE OF THESE PROPOSALS TO THE COMPANY AND ITS STOCKHOLDERS, IT IS VITAL THAT EVERY STOCKHOLDER VOTES AT THE ANNUAL MEETING IN PERSON OR BY PROXY.

These proposals are fully set forth in the accompanying Proxy Statement, which you are urged to read thoroughly. For the reasons set forth in the Proxy Statement, your board of directors recommends a vote “FOR” Proposal Nos. 1, 2, 3 and 4. The Company intends to mail the Proxy Statement and Proxy Card enclosed with this notice on or about June 27, 2025 to all stockholders entitled to vote at the Annual Meeting. Only stockholders of record at the close of business on June 13, 2025 (the “Record Date”) will be entitled to attend and vote at the meeting. A list of all stockholders entitled to vote at the Annual Meeting will be available at the principal office of the Company during usual business hours, for examination by any stockholder for any purpose germane to the Annual Meeting for 10 days prior to the date thereof. Stockholders are cordially invited to attend the Annual Meeting. However, whether or not you plan to attend the meeting in person, your shares should be represented and voted. After reading the enclosed Proxy Statement, please sign, date, and return promptly the enclosed Proxy in the accompanying postpaid envelope we have provided for your convenience to ensure that your shares will be represented. If you do attend the meeting and wish to vote your shares personally, you may revoke your Proxy.

| By Order of the Board of Directors | |

| /s/ Tuvia Barlev | |

| Tuvia Barlev | |

|

Chairman of the Board of Directors June , 2025 |

WHETHER OR NOT YOU PLAN ON ATTENDING THE MEETING IN PERSON, PLEASE VOTE AS PROMPTLY AS POSSIBLE TO ENSURE THAT YOUR VOTE IS COUNTED.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be

held on August 12, 2025. The Proxy Statement is available at www.proxyvote.com.

TABLE OF CONTENTS

i

Actelis Networks, Inc.

4039 Clipper Court

Fremont, CA 94538

(510) 545-1045

ANNUAL MEETING OF STOCKHOLDERS

August 12, 2025

This Proxy Statement is furnished in connection with the solicitation of proxies by the board of directors of the Company to be voted at the Annual Meeting of Stockholders, which will be held on August 12, 2025, at 10:00 a.m. (Eastern Standard Time), virtually at the following link: www.virtualshareholdermeeting.com/ASNS2025, and at any postponements or adjournments thereof. The proxy materials will be mailed to stockholders on or about June 27, 2025.

REVOCABILITY OF PROXY AND SOLICITATION

Any stockholder executing a proxy that is solicited hereby has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the Annual Meeting and voting the shares of stock in person, or by delivering to the Secretary of the Company at the principal office of the Company prior to the Annual Meeting a written notice of revocation or a later-dated, properly executed proxy. Solicitation of proxies may be made by directors, officers and other employees of the Company by personal interview, telephone, facsimile transmittal or electronic communications. No additional compensation will be paid for any such services. This solicitation of proxies is being made by the Company which will bear all costs associated with the mailing of this proxy statement and the solicitation of proxies.

1

Stockholders of record at the close of business on June 13, 2025, the Record Date, will be entitled to receive notice of, attend and vote at the meeting.

Why am I receiving these materials?

The Company has delivered printed versions of these materials to you by mail, in connection with the Company’s solicitation of proxies for use at the Annual Meeting. These materials describe the proposals on which the Company would like you to vote and also give you information on these proposals so that you can make an informed decision.

What is included in these materials?

These materials include:

| ● | this Proxy Statement for the Annual Meeting; |

| ● | the Proxy Card or voting instruction form for the Annual Meeting; and |

| ● | the Company’s Annual Report on Form 10-K for the year ended December 31, 2024. |

What is the Proxy Card?

The Proxy Card enables you to appoint Tuvia Barlev, our Chief Executive Officer, and Yoav Efron, our Chief Financial Officer and Deputy Executive Officer, as your representative at the Annual Meeting. By completing and returning a Proxy Card, you are authorizing each of Mr. Barlev and Mr. Efron, to vote your shares at the Annual Meeting in accordance with your instructions on the Proxy Card. This way, your shares will be voted whether or not you attend the Annual Meeting.

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the Notice of Annual Meeting on the cover page of this Proxy Statement, including (i) the election of one Class III director to serve on the Company’s board of directors for a term of three years until our 2028 Annual Meeting of Stockholders for which Tuvia Barlev is the nominee (Proposal No. 1); (ii) the ratification of the appointment of Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers International Limited (“PwC”), as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal No. 2); (iii) the approval of the Company’s 2025 Equity Incentive Plan (Proposal No. 3); and (iv) the approval of the adjournment of the Annual Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Annual Meeting, there are not sufficient votes to approve Proposal No. 1, Proposal No. 2 and/or Proposal No. 3 (Proposal No. 4).

2

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of one third of the number of shares of common stock issued and outstanding on the Record Date will constitute a quorum permitting the meeting to conduct its business. As of the Record Date, there were 9,211,797 shares of the Company’s common stock issued and outstanding, each share entitled to one vote at the meeting. Thus, the presence of the holders of 3,070,599 shares of common stock will be required to establish a quorum. Abstentions, withhold votes and broker non-votes are counted as shares present and entitled to vote for purposes of determining a quorum.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

Most of our stockholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially in street name.

Stockholder of Record

If on the Record Date, your shares were registered directly in your name with our transfer agent, Vstock Transfer, LLC, you are considered a stockholder of record with respect to those shares, and the Notice of Annual Meeting and Proxy Statement was sent directly to you by the Company. As the stockholder of record, you have the right to direct the voting of your shares by returning the Proxy Card to us. Whether or not you plan to attend the Annual Meeting, please complete, date, sign and return a Proxy Card to ensure that your vote is counted.

Beneficial Owner of Shares Held in Street Name (non-Israeli brokerage firm, bank, broker-dealer, or other nominee holders)

If on the Record Date, your shares were held in an account at a brokerage firm, bank, broker-dealer, or other nominee holder, then you are considered the beneficial owner of shares held in “street name,” and the Notice of Annual Meeting and Proxy Statement was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct that organization on how to vote the shares held in your account. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from the organization.

How do I vote?

Your vote is very important to us. Whether or not you plan to attend the Annual Meeting, please vote by proxy in accordance with the instructions on your proxy card or voting instruction form (from your broker or other intermediary). There are three convenient ways of submitting your vote:

| ● | By Telephone or Internet – All record holders can vote by touchtone telephone from the United States using the toll free telephone number on the proxy card, or over the Internet, using the procedures and instructions described on the proxy card. “Street name” holders may vote by telephone or Internet if their bank, broker or other intermediary makes those methods available, in which case the bank, broker or other intermediary will enclose the instructions with the proxy materials. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to vote their shares, and to confirm that their instructions have been recorded properly. | |

| ● | In Person – All record holders may vote in person at the Annual Meeting. “Street name” holders may vote in person at the Annual Meeting if their bank, broker or other intermediary has furnished a legal proxy. If you are a “street name” holder and would like to vote your shares by proxy, you will need to ask your bank, broker or other intermediary to furnish you with an intermediary issued proxy. You will need to bring the intermediary issued proxy with you to the Annual Meeting and hand it in with a signed ballot that will be provided to you at the Annual Meeting. You will not be able to vote your shares without an intermediary issued proxy. Note that a broker letter that identifies you as a stockholder is not the same as an intermediary issued proxy. | |

| ● | By Mail – You may vote by completing, signing, dating and returning your proxy card or voting instruction form in the pre-addressed, postage-paid envelope provided. |

3

The board of directors has appointed Tuvia Barlev, our Chief Executive Officer, and Yoav Efron, our Chief Financial Officer and Deputy Chief Executive Officer, to serve as the proxies for the Annual Meeting.

If you complete and sign the proxy card but do not provide instructions for one or more of the proposals, then the designated proxies will or will not vote your shares as to those proposals, as described under “What happens if I do not give specific voting instructions?” below. We do not anticipate that any other matters will come before the Annual Meeting, but if any other matters properly come before the meeting, then the designated proxies will vote your shares in accordance with applicable law and their judgment.

If you hold your shares in “street name,” and complete the voting instruction form provided by your broker or other intermediary except with respect to one or more of the proposals, then, depending on the proposal(s), your broker may be unable to vote your shares with respect to those proposal(s). See “What is a broker non-vote?” above.

Even if you currently plan to attend the Annual Meeting, we recommend that you vote by telephone or Internet or return your proxy card or voting instructions as described above so that your votes will be counted if you later decide not to attend the Annual Meeting or are unable to attend.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, for the election of directors, “For,” “Withhold” and broker non-votes and, with respect to the other proposals, votes “For” and “Against,” abstentions and broker non-votes.

What is a broker non-vote?

If your shares are held in street name, you must instruct the organization who holds your shares how to vote your shares. If you sign your proxy card but do not provide instructions on how your broker should vote on “routine” proposals, your broker will vote your shares as recommended by the board of directors. If a stockholder does not give timely customer direction to its broker or nominee with respect to a “non-routine” matter, the shares represented thereby (“broker non-votes”) cannot be voted by the broker or nominee, but will be counted in determining whether there is a quorum. Of the proposals described in this Proxy Statement, Proposal Nos. 1, 3 and, 4 are considered “non-routine” matters. Proposal No. 2 is considered a “routine” matter.

What is an abstention?

An abstention is a stockholder’s affirmative choice to decline to vote on a proposal. Under Delaware law, abstentions are counted as shares present and entitled to vote at the Annual Meeting.

What happens if I do not give specific voting instructions?

Stockholders of Record. If you are a stockholder of record and you sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by the board of directors on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters, but cannot vote on non-routine matters.

4

What is the required vote for each proposal?

Proposal No. 1: The affirmative vote of a plurality of the votes cast at the Annual Meeting is required for the election of directors. “Plurality” means that the nominees who receive the largest number of votes cast “for” are elected as directors. As a result, any shares not voted “for” a particular nominee (whether as a result of stockholder abstention or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of the election. The proxies cannot be voted for a greater number of persons than one.

Proposal No. 2: The affirmative vote of a majority of the voting power of the shares present in person or represented by proxy at the meeting and entitled to vote on the subject matter is required for the approval of Proposal No. 2. Stockholder ratification of the selection of PwC, as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025 is not required by our Bylaws or other applicable legal requirement; however, our board is submitting the selection PwC, to stockholders for ratification as a matter of good corporate practice. In the event that the stockholders do not approve the selection of PwC, the audit committee will reconsider the appointment of the independent registered accounting firm. Even if the selection is ratified, the audit committee in its discretion may direct the appointment of a different independent registered accounting firm at any time during the year if the audit committee believes that such a change would be in the best interests of the Company and its stockholders. Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote “against” the proposal. Because this proposal is considered a “routine” matter under applicable stock exchange rules, we do not expect to receive any broker non-votes on this proposal.

Proposal No. 3: The affirmative vote of a majority of the voting power of the shares present in person or represented by proxy at the meeting and entitled to vote on the subject matter is required for the approval of Proposal No. 3. Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote “against” the proposal. Broker non-votes will have no effect on the outcome of the vote for this proposal.

Proposal No. 4: The affirmative vote of a majority of the voting power of the shares present in person or represented by proxy at the meeting and entitled to vote on the subject matter is required for the approval of Proposal No. 4. Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote “against” the proposal. Broker non-votes will have no effect on the outcome of the vote for this proposal.

5

What are the board’s recommendations?

The board’s recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the board recommends a vote:

| ● | “FOR” the approval of Proposal No. 1; | |

| ● | “FOR” the approval of Proposal No. 2; | |

| ● | “FOR” the approval of Proposal No. 3; | |

| ● | “FOR” the approval of Proposal No 4; |

With respect to any other matter that properly comes before the meeting, the proxy holder will vote as recommended by the board of directors or, if no recommendation is given, in his own discretion.

Dissenters’ Right of Appraisal

Holders of shares of our common stock do not have appraisal rights under Delaware law or under the governing documents of the Company in connection with this solicitation.

How are proxy materials delivered to households?

With respect to eligible stockholders who share a single address, we may send only one Notice or other Annual Meeting materials to that address unless we receive instructions to the contrary from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if a stockholder of record residing at such address wishes to receive a separate notice or proxy statement in the future, he or she may contact Actelis Networks, Inc., 4039 Clipper Court, Fremont, CA 94538, Attention: Corporate Secretary or by calling us at +1 (510) 545-1045. Eligible stockholders of record receiving multiple copies of our Notice or other Annual Meeting materials can request householding by contacting us in the same manner. Stockholders who own shares through a bank, broker or other intermediary can request householding by contacting the intermediary.

We hereby undertake to deliver promptly, upon written or oral request, a copy of Notice or other Annual Meeting materials to a stockholder at a shared address to which a single copy of the document was delivered. Requests should be directed to the Corporate Secretary at the address or phone number set forth above.

A copy of our bylaws may be obtained by accessing our public filings on the SEC’s website at www.sec.gov. You may also contact our Secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

6

ACTIONS TO BE TAKEN AT THE MEETING

ELECTION OF DIRECTORS

The members of our board of directors are classified into three classes with staggered three-year terms, as follows:

| ● | Class I, comprised of two directors, Gideon Marks and Julie Kunstler (with their terms expiring at our 2026 annual meeting of stockholders); | |

| ● | Class II, comprised of one director, Niel Ransom (with his term expiring at our 2027 annual meeting of stockholders); and | |

| ● | Class III, comprised of one director, Tuvia Barlev (with his term expiring at this annual meeting of stockholders and who is the nominee for re-election). |

To preserve the classified board structure, a director elected by the board of directors to fill a vacancy holds office until the next election of the class for which such director has been chosen, and until that director’s successor has been elected and qualified or until his or her earlier death, resignation, retirement or removal.

Tuvia Barlev been nominated by our Nominating and Governance Committee for reelection as the Class III director at the Annual Meeting. Tuvia Barlev is currently serving a term which expire at our Annual Meeting.

Biographical and certain other information concerning the Company’s nominees for election to the board of directors and additional directors is set forth below. Except as indicated below, none of our directors is a director in any other reporting companies. We are not aware of any proceedings to which any of our directors, or any associate of any such director is a party adverse to us or any of our subsidiaries or has a material interest adverse to us or any of our subsidiaries.

The following sets forth certain information with respect to each of our directors who are up for election or re-election at the Annual Meeting (Class III director) and each additional director currently serving on our board of directors:

| Name | Age | Class | Position(s) | |||

| Tuvia Barlev | 63 | Class III | Chief Executive Officer and Chairman | |||

| Niel Ransom* | 75 | Class II | Director | |||

| Julie Kunstler* | 69 | Class I | Director | |||

| Gideon Marks* | 70 | Class I | Director |

| * | Independent, as that term is defined by the rules of the Nasdaq Stock Market. |

Biography of Class III Director Nominee Subject to Re-election at the Annual Meeting

Tuvia Barlev – Chief Executive Officer, Chairman of the Board, and Secretary

Mr. Barlev has served as our Chief Executive Officer and Secretary since January 2013 and as the Chairman of the board since 2010. Previously, Mr. Barlev founded our company in 1998 and served as the Chief Executive Officer until January 2010. Mr. Barlev is a seasoned serial entrepreneur with more than 25 years of experience in high-technology leadership in military, telecommunications, e-commerce, Big Data and clean energy. Prior to joining Actelis, he was head of the R&D organization at Teledata (acquired by ADC in 1998), a global supplier of advanced digital loop carrier (DLC) equipment from 1996 to 1998. Previously, Mr. Barlev served as a senior research officer with the Israeli government, and he was also founder, Chairman/Acting CEO at companies including Superfish Inc., a leading provider of visual search technology, from 2007 to 2015; Leyden Energy, a leading supplier of breakthrough battery technology from 2010 to 2012; Adyounet Inc., provider of advanced direct marketing services over the Web from 2006 to 2009; and SafePeak LTD., provider of hot data acceleration platform for Big Data across the cloud from 2011 to 2012. Mr. Barlev holds BSC and MSEE degrees from Tel Aviv University, both Summa Cum Laude.

7

Biographies of Other Directors

Julie Kunstler – Director

Julie Kunstler, age 69, is a seasoned professional with broad experience in the communications components, equipment, and software industry, having served as an executive, venture-fund investor, analyst, and board member. Since April 2024, Ms. Kunstler has been serving as an External Non-Executive Director for Ethernity Networks, a company traded on the London Stock Exchange. Previously, between November 2010 and April 2024, Ms. Kunstler worked at Omdia (a division of InformaTech), lastly holding the position of Chief Analyst for the Broadband Access Intelligence Service, covering the fixed broadband access industry ecosystem. Prior to her role at Omdia, between 2006 and 2010, Ms. Kunstler was the Vice President of Business Development at Teknovus, a venture-backed startup specializing in Passive Optical Network (PON) chip technology. Ms. Kunstler holds a Bachelor's degree from University of Cincinnati and an MBA degree from University of Chicago.

Gideon Marks – Director

Mr. Marks is a seasoned professional with over 35 years of experience in leading technology companies, specializing in financial, business, and corporate development roles. Mr. Marks has served as an advisory board member of Deepdub, Inc., a company specializing in dubbing and voice over localization, since July 2023, and as the co-founder of DogLog, an app that connects all aspects of a dog’s life in one app, since January 2018. In addition, Mr. Marks has served as a mentor for the Google for Startups Accelerator since January 2018. Mr. Marks’ previous experience includes taking three companies public on Nasdaq as their Chief Financial Officer (Lannet Data Communications Ltd., Radcom Ltd. (Nasdaq: RDCM), and Silicom Ltd. (Nasdaq: SILC)), and successfully leading four others to acquisitions as their Chief Financial Officer (Radnet Inc., RealTime Image, Ltd., Adamind Ltd., and Net Optics, Inc.). Mr. Marks holds a B.A. in Economics and an MBA Finance from Tel Aviv University in Israel.

Niel Ransom – Director

Dr. Ransom, age 75, is a seasoned professional with five decades of experience in the communications, networking, and venture capital. From 2018 to 2024, he was a Partner at Celesta Capital, a venture capital firm investing in and directing deep-tech startups. He served as a director of Radisys Corp (NASDAQ: RSYS). between August 2010 and June 2018, of Cyan, Inc (NYSE: CYNI) from June 2009 and August 2015, of AppliedMicro NASDAQ: AMCC) from July 2006 to August 2009, and of ECI Telecom (NASDAQ: ECIL) from June 2006 to September 2007. Mr. Ransom was a principal of Ransomshire Associates, Inc., an advisory firm he founded in 2005. He previously served as Chairman of Saguna Networks, a provider of MobileEdge computing solutions, and Chairman of Teknovus, a provider of fiber-to-the-home semiconductors. He served on the board of directors of Kbro (CATV service provider in Taiwan), CoreOptics (optical networking modules), Turin Networks (carrier ethernet equipment), Overture Networks (Broadband service optimization solutions), DesignArt Networks (semiconductors for mobile base stations), Capella Photonics (wavelength selective switch), OPNT (optical positioning navigation and timing), and Polatis (fiber switching systems. Previously, as worldwide Chief Technology Officer of Alcatel (telecommunications equipment provider) and a member of its Executive Committee, he was responsible for research, corporate strategy, intellectual property and R&D investment. Prior to that, he directed Alcatel's access and metro optical business in North America. Earlier in his career, he directed the Advanced Technology Systems Center at BellSouth and various development and applied research organizations in voice and data switching at Bell Laboratories. He holds a Ph.D. in electrical engineering from the University of Notre Dame, BSEE and MSEE degrees from Old Dominion University, and an MBA from the University of Chicago.

Biographies of Executive Officers

Yoav Efron, Deputy Chief Executive Officer and Chief Financial Officer

Mr. Efron serves as our Chief Financial Officer since January 2018, and as our Deputy Chief Executive Officer since May 2024. Mr. Efron is responsible for all financial aspects of our business and for strategy, as well as Information Technology and Human Resources. Prior to joining Actelis, Mr. Efron was the CFO of TriPlay Inc. and eMusic Inc., a B2C cloud media services company from 2012 to 2017. From 2010 to 2014, Mr. Efron was an entrepreneur in energy efficiency and from 1998 through 2010 worked at Avaya Inc., a Fortune 500 telecommunications company in various executive financial roles including Finance Director. Mr. Efron earned his bachelor’s degree in economics and management from the Hebrew University of Jerusalem.

8

Elad Domanovitz, Chief Technology Officer

Dr. Domanovitz serves as our Chief Technologies Officer since April 2017, prior to that he served as director of technologies from 2014. Dr. Domanovitz brings extensive experience envisioning and developing Actelis’ research capabilities. As Actelis’ Chief Scientist, Dr. Domanovitz is responsible for driving Actelis’ technology development and aligning it with the company’s overall vision and worldwide go-to-market strategies. Dr. Domanovitz is also responsible for enriching the Actelis IT portfolio and he also actively participates in standards committees. Dr. Domanovitz joined Actelis in November 2005 and has since held several positions in the Algorithms and CTO groups. Dr. Domanovitz holds a Ph.D., MSc. and a BSc (cum laude) in Electrical Engineering from Tel Aviv University.

Eyal Aharon, VP R&D

Mr. Aharon serves as our Vice President of R&D since January 2018. Previously, Mr. Aharon served as our director of software engineering from 2011 through December 2017. Mr. Aharon brings extensive experience in Research and Development to Actelis, having over 20 years in the telecommunication industry. As Actelis’ VP of R&D, Mr. Aharon is responsible for all current and strategic activities of the R&D group. Mr. Aharon joined Actelis in 2000 and has since held several positions within the R&D group. Prior to joining Actelis, he held several positions in ADC Teledata. Mr. Aharon holds a BA in Computer Science and Economics from Tel-Aviv University, and a Master’s in Economics from Tel-Aviv University.

Michal Winkler-Solomon, VP Marketing

Ms. Winkler-Solomon serves as our Vice President of Marketing since March 2017 and prior as AVP of Product Marketing from March 2016. Ms. Winkler-Solomon has more than 20 years of Product Marketing and Product Management experience. Since joining Actelis in 2001, Ms. Winkler-Solomon has held Product Management, and Product Marketing positions, where she has been responsible for product specifications, positioning, and marketing of the company’s industry-leading Ethernet in the First Mile product line.

Prior to Actelis, Ms. Winkler-Solomon held positions as Chief Technology Officer of BeConnected. Prior, Ms. Winkler-Solomon held positions as Product Manager of the Access Division at Telrad Telecommunications where she led Nortel Networks product development. Prior, Ms. Winkler-Solomon spent five years developing communication systems for the Israeli army. Ms. Michal Winkler-Solomon holds a B.Sc in Electrical Engineering from the Technion and an MBA from Tel Aviv University.

Yaron Altit, Executive Vice President, International Sales

Mr. Altit serves as our Vice President of International Sales since June 2017. Prior to joining us, Mr. Altit was self-employed from 2013 to 2017. Mr. Altit brings more than 25 years of experience to his position as Actelis’ Executive Vice President International Sales business unit, including vast experience in sales management positions in the Telecom, Datacom, and control plane industries. In his role, Mr. Altit is responsible for all EMEA & APAC regions customer-facing functions, including sales, customer support, pre-sale engineering, business development and regional marketing. Mr. Altit held executive positions in several telecommunication companies, including management of Sales, Customer Support and Business Development at Schema, where he was the General Manager of EMEA Business unit. Previously, Mr. Altit held top sales management positions at Mindspeed Technologies. Mr. Altit was responsible for European and International sales at T-Soft (now Cramer Systems, an Amdocs OSS division). Mr. Altit studied towards a B.A. in Economics and Accounting at the Ramat Gan College.

Hemi Kabir, Vice President, Operations

Mr. Kabir serves as our Vice President of Operations since January 2015. With more than 20 years of experience in operations, supply chain and engineering, Mr. Kabir manages Actelis’ Supply Chain, Purchasing, Quality Assurance and Operations Engineering departments, and is responsible for Actelis’ operations including manufacturability, continuous improvement initiatives and cost-savings activities. Prior to joining Actelis, Mr. Kabir was head of Supply Chain management and purchasing at “Better place” Israel, where he was in charge of defining and managing the supply chain divisions. Mr. Kabir holds MBA degree from Heriot Watt University, BA degree in management from the Open University and Industrial practical engineering diploma from Israeli College of Management.

9

Bret Harrison, Senior Vice President of Sales, North Americas

Mr. Harrison brings more than 20 years of experience including sales leadership, strategy and business development in various technology fields such as communications and cyber security. Prior to joining the Company, since September 2023, Mr. Harrison was the President of Sage Holdings, LLC. From June 2020 until August 2023, Mr. Harrison was the RVP of Sales at Palo Alto Networks. From June 2019 until June 2020, Mr. Harrison served as the VP of North American Banking Service Sales at NCR Corporation. From January 2017 until June 2019, Mr. Harrison served as the VP of Telco Sales at Check Point Software Technologies. From October 2012 until January 2017, Mr. Harrison served as a Vice President of Sales at Avaya. From October 2002 until January 2012, Mr. Harrison served as the VP of Sales at the Company. Mr. Harrison holds a Bachelor of Science degree in Electronics from Chapman University.

Family Relationships

There are no family relationships among any of our current or former directors or executive officers.

Arrangements between Officers and Directors

To our knowledge, there is no arrangement or understanding between any of our officers and any other person, including directors, pursuant to which the officer was selected to serve as an officer.

Involvement in Certain Legal Proceedings

We are not aware of any of our directors or officers being involved in any legal proceedings in the past ten years relating to any matters in bankruptcy, insolvency, criminal proceedings (other than traffic and other minor offenses), or being subject to any of the items set forth under Item 401(f) of Regulation S-K.

Board Meetings

The board met on twelve occasions during the fiscal year ended December 31, 2024. Each of the members of the board attended at least 80% of the meetings held by the board during the fiscal year ended December 31, 2024. None of our directors attended our 2024 annual meeting of stockholders.

Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we strongly encourage our directors to attend.

Committees of the Board

Audit Committee

Our audit committee is comprised of Niel Ransom, Julie Kunstler, and Gideon Marks, with Gideon Marks serving as Chairperson. The audit committee is responsible for retaining and overseeing our independent registered public accounting firm, approving the services performed by our independent registered public accounting firm and reviewing our annual financial statements, accounting policies and our system of internal controls. The audit committee acts under a written charter, which more specifically sets forth its responsibilities and duties, as well as requirements for the audit committee’s composition and meetings. The audit committee charter is available on our website www.actelis.com.

10

The board of directors has determined that each member of the audit committee is “independent,” as that term is defined by applicable SEC rules. In addition, the board of directors has determined that each member of the audit committee is “independent,” as that term is defined by the rules of the Nasdaq Stock Market.

The board of directors has determined that Gideon Marks is an “audit committee financial expert” serving on its audit committee as the SEC has defined that term in Item 407 of Regulation S-K.

The audit committee met on four occasions during the fiscal year ended December 31, 2024. Each of the members of the audit committee attended at least 80% of the meetings held by the audit committee during the fiscal year ended December 31, 2024.

Compensation Committee

Our compensation committee consists of Niel Ransom, Julie Kunstler, and Gideon Marks, with Julie Kunstler serving as Chairperson.

The compensation committee’s roles and responsibilities include making recommendations to the board of directors regarding the compensation for our executives, the role and performance of our executive officers, and appropriate compensation levels for our CEO, which are determined without the CEO present, and other executives. Our compensation committee also administers our 2015 Equity Incentive Plan. The compensation committee acts under a written charter, which more specifically sets forth its responsibilities and duties, as well as requirements for the compensation committee’s composition and meetings. The compensation committee charter is available on our website www.actelis.com.

Our compensation committee is responsible for the executive compensation programs for our executive officers and reports to our board of directors on its discussions, decisions and other actions. Our compensation committee reviews and approves corporate goals and objectives relating to the compensation of our Chief Executive Officer, evaluates the performance of our Chief Executive Officer in light of those goals and objectives and determines and approves the compensation of our Chief Executive Officer based on such evaluation. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the compensation committee regarding his compensation or individual performance objectives. Our compensation committee has the sole authority to determine our Chief Executive Officer’s compensation. In addition, our compensation committee, in consultation with our Chief Executive Officer, reviews and approves all compensation for other officers, including the directors. Our Chief Executive Officer and Chief Financial Officer also make compensation recommendations for our other executive officers and initially propose the performance objectives to the compensation committee.

The compensation committee is authorized to retain the services of one or more executive compensation and benefits consultants or other outside experts or advisors as it sees fit, in connection with the establishment of our compensation programs and related policies.

Our board of directors has determined that all three members of the compensation committee are “independent,” as that term is defined by the rules of the Nasdaq Stock Market.

The compensation committee met on one occasion during the fiscal year ended December 31, 2024. Each of the members of the compensation committee attended at least 80% of the meetings held by the compensation committee during the fiscal year ended December 31, 2024.

Nominations and Corporate Governance Committee

The members of the nominations and corporate governance committee are Niel Ransom, Julie Kunstler, and Gideon Marks, with Niel Ransom serving as Chairperson.

11

The nominations and corporate governance committee acts under a written charter, which more specifically sets forth its responsibilities and duties, as well as requirements for the nominations and corporate governance committee’s composition and meetings. The nominations and corporate governance committee charter is available on our website www.actelis.com.

The nominations and corporate governance committee develops, recommends and oversees implementation of corporate governance principles for us and considers recommendations for director nominees. The nominations and corporate governance committee also considers stockholder recommendations for director nominees that are properly received in accordance with applicable rules and regulations of the SEC. Our stockholders that wish to nominate a director for election to the board of directors should follow the procedures set forth in our bylaws. See “When are Stockholder Proposals Due for the 2026 Annual Meeting?”

The nominations and corporate governance committee will consider persons identified by its members, management, stockholders, investment bankers and others. The guidelines for selecting nominees, which are specified in the nominating committee charter, generally provide that a candidate for nomination:

| ● | should be accomplished in his or her field and have a reputation, both personal and professional, that is consistent with our image and reputation; |

| ● | should have relevant experience and expertise and would be able to provide insights and practical wisdom based upon that experience and expertise; and |

| ● | should be of high moral and ethical character and would be willing to apply sound, objective and independent business judgment, and to assume broad fiduciary responsibility. |

The nominations and corporate governance committee will consider a number of qualifications relating to management and leadership experience, background and integrity and professionalism in evaluating a person’s candidacy for membership on the board of directors. The nominations and corporate governance committee may require certain skills or attributes, such as financial or accounting experience, to meet specific board needs that arise from time to time and will also consider the overall experience and makeup of its members to obtain a broad and diverse mix of board of directors members. The nominations and corporate governance committee will not distinguish between nominees recommended by stockholders and those recommended by other persons.

Our board of directors has determined that all three members of the nominations and corporate governance committee are “independent” as that term is defined by the rules of the Nasdaq Stock Market.

The nominations and corporate governance committee met on one occasion during the fiscal year ended December 31, 2024. Each of the members of the nominations and corporate governance committee attended the meeting held by the nominations and corporate governance committee during the fiscal year ended December 31, 2024.

Stockholder Communications with the Board of Directors

Historically, we have not provided a formal process related to stockholder communications with the board. Nevertheless, every effort has been made to ensure that the views of stockholders are heard by the board or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. Stockholders or other interested parties may communicate with any director by writing to them at Actelis Networks, Inc., 4039 Clipper Court, Fremont, CA 94538, Attention: Corporate Secretary.

12

Code of Business Conduct and Ethics

We have a Code of Business Conduct and Ethics that applies to all our employees. The text of the Code of Business Conduct and Ethics is publicly available on our website at www.actelis.com. Information contained on, or that can be accessed through, our website does not constitute a part of this report and is not incorporated by reference herein. Disclosure regarding any amendments to, or waivers from, provisions of the code of business conduct and ethics that apply to our directors, principal executive and financial officers will be posted on the “Investors- Governance” section of our website at www.actelis.com or will be included in a Current Report on Form 8-K, which we will file within four business days following the date of the amendment or waiver.

Board Role in Risk Oversight

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including economic risks, financial risks, legal and regulatory risks and others, such as the impact of competition. Management is responsible for the day-to-day management of the risks that we face, while our board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our board is responsible for satisfying itself that the risk management processes designed and implemented by management are adequate and functioning as designed. Our board assesses major risks facing our Company and options for their mitigation in order to promote our stockholders’ interests in the long-term health of our Company and our overall success and financial strength. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for us. The involvement of our full board in the risk oversight process allows our board to assess management’s appetite for risk and also determine what constitutes an appropriate level of risk for our Company. Our board regularly includes agenda items at its meetings relating to its risk oversight role and meets with various members of management on a range of topics, including corporate governance and regulatory obligations, operations and significant transactions, risk management, insurance, pending and threatened litigation and significant commercial disputes.

While our board is ultimately responsible for risk oversight, various committees of our board oversee risk management in their respective areas and regularly report on their activities to our entire board. In particular, the audit committee has the primary responsibility for the oversight of financial risks facing our Company. The audit committee’s charter provides that it will discuss our major financial risk exposures and the steps we have taken to monitor and control such exposures. Our board has also delegated primary responsibility for the oversight of all executive compensation and our employee benefit programs to the compensation committee. The compensation committee strives to create incentives that encourage a level of risk-taking behavior consistent with our business strategy.

We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing our Company and that our board’s leadership structure provides appropriate checks and balances against undue risk taking.

Anti-hedging Policy

Our insider trading policy prohibits directors, officers and other employees or contractors from engaging in short sales, transactions in put or call options, hedging transactions or other inherently speculative transactions with respect to our stock at any time.

13

Director Compensation

The following table sets forth compensation information for our non-employee directors for the year ended December 31, 2024.

| Name | Cash Fees Earned ($) | RSU ($) | All

Other | Total ($) | ||||||||||||

| Dr. Israel Niv (1) | 19,000 | - | - | 19,000 | ||||||||||||

| Dr. Naama Halevi-Davidov (2) | 7,125 | - | - | 7,125 | ||||||||||||

| Joseph Moscovitz (3) | 19,000 | - | - | 19,000 | ||||||||||||

| Noemi Schmayer (4) | 7,415 | - | - | 7,415 | ||||||||||||

| Gideon Marks (5) | 11,875 | - | - | 11,785 | ||||||||||||

| (1) | Mr. Niv departed the Company on April 1, 2025. |

| (2) | Ms. Halevi-Davidov departed the Company on May 9, 2024. |

| (3) | Mr. Moscovitz departed the Company on February 1, 2025. |

| (4) | Ms. Schmayer departed the Company on May 15, 2024. |

| (5) | Mr. Marks joined the Company on May 15, 2024. |

Our board adopted a non-employee director compensation policy pursuant to which each of our directors who is not an employee or consultant of our company will be eligible to receive an annual cash retainer of $10,000 for his or her service on our board of directors and an annual cash retainer of $2,000 for his or her service on a committee of our board of directors, with the chairperson of each committee receiving an additional $3,000 annually. Additionally, following the IPO, as compensation for serving on the board, our former board members Dr. Naama Halevi-Davidov, Israel Niv, Noemi Schmayer and Joseph Moscovitz were each granted 2,500 RSUs, of which shall fully vest over 36 months, subject to each member’s continued service on the board. Furthermore, in connection with our IPO, on May 2, 2023, the board approved the annual issuance of RSUs worth $100,000 at their time of their grant to each of our members of the board at the time: Dr. Naama Halevi-Davidov, Israel Niv, Noemi Schmayer and Joseph Moscovitz (the “Annual RSU Grants”). The Annual RSU Grants shall fully vest over 36 months, subject to each member’s continued service on the board, as compensation for serving on the board. Each Annual RSU Grant will be subject to their availability under the 2025 Plan (if approved). The former members of our board did not receive any new grants of options during 2023 or 2024.

Vote Required

The affirmative vote of a plurality of the votes cast at the Annual Meeting is required for the election of directors. “Plurality” means that the nominees who receive the largest number of votes cast “for” are elected as directors. As a result, any shares not voted “for” a particular nominee (whether as a result of stockholder abstention or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of the election. The proxies cannot be voted for a greater number of persons than one.

RECOMMENDATION OF THE BOARD FOR PROPOSAL NO. 1:

THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF THE NOMINEE NAMED ABOVE

UNTIL THE TERM OF SUCH DIRECTOR EXPIRES IN ACCORDANCE WITH HIS CLASS, AND

PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR THEREOF UNLESS

A STOCKHOLDER HAS INDICATED OTHERWISE ON THE PROXY.

14

RATIFICATION OF THE APPOINTMENT OF PWC AS INDEPENDENT PUBLIC ACCOUNTANT FOR

THE FISCAL YEAR ENDING DECEMBER 31, 2025

The audit committee has appointed PwC, independent public accountant, to audit our financial statements for the fiscal year ending December 31, 2025. The board proposes that the stockholders ratify this appointment. We expect that representatives of PwC will be either present or available via phone at the Annual Meeting, will be able to make a statement if they so desire, and will be available to respond to appropriate questions.

The following table sets forth the fees billed by PwC for each of our last two fiscal years for the categories of services indicated.

| Fee category | 2024 | 2023 | ||||||

| Audit Fees | $ | 241,516 | $ | 255,938 | ||||

| Audit – related fees | $ | 51,000 | $ | 39,463 | ||||

| Tax fees | $ | 29,685 | $ | 15,571 | ||||

| All other fees | $ | - | $ | - | ||||

| Total fees | $ | 322,201 | $ | 310,972 | ||||

Audit Fees

PwC billed us audit fees in the aggregate amount of $241,516 and $255,938 for the years ended December 31, 2024 and 2023, respectively. These fees relate to the audit of our annual financial statements and the review of our interim quarterly financial statements.

Audit-Related Fees

PwC billed us audit-related fees in the aggregate amount of $51,000 and $39,463 for the year ended December 31, 2024 and 2023, respectively.

Tax Fees

PwC billed us tax fees in the aggregate amount of $29,685 and $15,571 for the year ended December 31, 2024 and 2023, respectively. These fees relate to professional services rendered for tax compliance, tax advice and tax planning.

All Other Fees

PwC did not bill us for any other fees for the year ended December 31, 2024 and 2023.

Pre-Approval Policies and Procedures

In accordance with the Sarbanes-Oxley Act of 2002, as amended, our audit committee charter requires the audit committee to pre-approve all audit and permitted non-audit services provided by our independent registered public accounting firm, including the review and approval in advance of our independent registered public accounting firm’s annual engagement letter and the proposed fees contained therein. The audit committee has the ability to delegate the authority to pre-approve non-audit services to one or more designated members of the audit committee. If such authority is delegated, such delegated members of the audit committee must report to the full audit committee at the next audit committee meeting all items pre-approved by such delegated members. In the fiscal years ended December 31, 2024 and December 31, 2023 all of the services performed by our independent registered public accounting firm were pre-approved by the audit committee.

Vote Required

The affirmative vote of a majority of the voting power of the shares present in person or represented by proxy at the meeting and entitled to vote on the subject matter is required for the approval of Proposal No. 2. Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote “against” the proposal.. Broker non-votes will have no effect on the outcome of the vote for this proposal.

RECOMMENDATION OF THE BOARD FOR PROPOSAL NO. 2:

THE BOARD RECOMMENDS A VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF PwC

AS INDEPENDENT PUBLIC ACCOUNTANT FOR THE FISCAL YEAR ENDING DECEMBER 31, 2025.

15

A PROPOSAL TO APPROVE THE COMPANY’S 2025 EQUITY INCENTIVE PLAN

Background

At the Annual Meeting, stockholders are requested to approve and adopt the Actelis 2025 Equity Incentive Plan, which we refer to as the “2025 Plan”.

The 2025 Plan will replace the Company’s existing equity plan, the 2015 Equity Incentive Plan.

The Company’s board of directors is submitting for stockholder approval the 2025 Plan, after declaring it advisable for the Company.

The Company believes that incentives and stock-based awards focus employees on the objective of creating shareholder value and promoting the success of the Company, and that incentive compensation plans like the 2025 Plan are an important attraction, retention and motivation tool for participants in the 2025 Plan. Our long-term equity incentives help align our executive officers’ interests with those of our shareholders, help hold executives accountable for performance, and help us attract, motivate and retain executives. Our board of directors approved the 2025 Plan based on a belief that the number of shares currently available for new award grants under the existing 2015 Plan does not give the Company sufficient authority and flexibility to adequately provide for future incentives. Our board of directors believe that the 2025 Plan will give us the necessary flexibility to structure future incentives and better attract, retain and reward our executives and key employees.

If approved by the Company’s stockholders, the 2025 Plan will be effective as of the date the stockholders approved the 2025 Plan. Capitalized terms used but not defined in this proposal shall have the meaning ascribed to them in the 2025 Plan document.

The following is a summary of the principal features of the 2025 Plan. This summary does not purport to be a complete description of all of the provisions of the 2025 Plan. It is qualified in its entirety by reference to the full text of the 2025 Plan, which is included as Exhibit A to this Proxy Statement.

Administration

The compensation committee, which is comprised of non-employee directors, generally will administer awards granted under the 2025 Plan and determine which eligible individuals are to receive option grants or stock issuances under the 2025 Plan, the times when the grants or issuances are to be made, the number of shares of Common Stock subject to each grant or issuance, the status of any granted option as either an incentive stock option or a non-statutory stock option under the federal tax laws, the vesting schedule to be in effect for the option grant or stock issuance and the maximum term for which any granted option is to remain outstanding. To the extent permitted by applicable law, the compensation committee or the Board may delegate its authority to one or more employees or directors of the Company. Further, the board of directors has reserved to itself the authority to grant awards to the non-employee members of the board of directors, and the board of directors may reserve to itself any of the compensation committee’s other authority and may act as the administrator of the 2025 Plan.

Eligibility

Persons eligible to receive options, SARs or other awards under the 2025 Plan are those employees, directors and consultants of the Company or any subsidiary. The 2025 Plan provides for granting awards under various tax regimes, including, without limitation, for awards granted to our United States employees or service providers, including those who are deemed to be residents of the United States for tax purposes, Section 422 of the Code and Section 409A of the Code and in compliance with Section 102 of the Ordinance and Section 3(i) of the Ordinance under the Israel Subplan.

16

Number of Shares Authorized

Shares Subject to the 2025 Plan. As of June 13, 2025, 99,289 shares of the Company’s common stock remain available for future grants under the 2015 Plan ("Unissued 2015 Plan Shares").

The number of shares of Common Stock that may be issued or transferred pursuant to awards under the 2025 Plan (the “Plan Share Limit”) will be 1,899,298 shares, which include 1,800,000 shares authorized by this Proposal No. 3, and 99,289 shares of the Company’s common stock that remain available for future grants under the 2015 Plan as of June 13, 2025.

Any shares of common stock subject to an award that expires or is canceled, forfeited, or terminated without issuance of the full number of shares of common stock to which the award related will again be available for issuance under the 2025 Plan. No shares subject to an award will become available again if such shares are (a) shares tendered in payment of an option, (b) shares delivered or withheld by the Company to satisfy any tax withholding obligation, or (c) shares covered by a stock-settled SAR or other awards that were not issued upon the settlement of the award.

The compensation committee, in its sole discretion, may grant awards under the 2025 Plan in assumption of, or in substitution for, outstanding awards previously granted by an entity acquired by the Company or with which the Company combines (“Substitute Awards”). Substitute Awards are not counted against the 2025 Plan Share Limit; provided, that, Substitute Awards issued in connection with the assumption of, or in substitution for, outstanding options intended to qualify as Incentive Stock Options shall be counted against the ISO Limit. Subject to applicable stock exchange requirements, available shares under a shareholder-approved plan of an entity directly or indirectly acquired by the Company or with which the Company combines (as appropriately adjusted to reflect such acquisition or transaction) may be used for awards under the 2025 Plan and shall not count toward the 2025 Plan Share Limit.

The number of shares authorized for issuance under the 2025 Plan and the foregoing share limitations are subject to customary adjustments for stock splits, stock dividends, similar transactions or any other change affecting our common stock.

Awards Available for Grant

The 2025 Plan authorizes the grant of equity-based and cash-based compensation awards to those officers and employees of, and consultants to, the Company and its subsidiaries who are selected by the compensation committee, and the 2025 Plan also authorizes the board of directors to grant awards to the non-employee directors of the Company. Awards under the 2025 Plan may be granted in the form of stock options, stock appreciation rights (or “SARs”), restricted shares, restricted share units, and other share-based awards

Options

Options granted under the 2025 Plan may be either “Incentive stock options” (“ISOs”), which are intended to meet the requirements of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), or non-qualified stock (“NSOs”) options that do not meet the requirements of Section 422 of the Code. ISOs may be granted under the 2025 Plan with respect to all of the shares of common stock authorized for issuance under the 2025 Plan (the “ISO Limit”). Options may also be issued in compliance with Section 102 of the Ordinance and Section 3(i) of the Ordinance under the Israel Subplan.

The duration of any option shall be within the sole discretion of the Board; provided, however, that any incentive stock option granted to a 10% or less stockholder or any nonqualified stock option shall, by its terms, be exercised within 10 years after the date the option is granted and any incentive stock option granted to a greater than 10% stockholder shall, by its terms, be exercised within five years after the date the option is granted. The exercise price of all options will be determined by the Board; provided, however, that the exercise price of an option (including incentive stock options or nonqualified stock options) will be equal to, or greater than, the fair market value of a share of our stock on the date the option is granted and further provided that incentive stock options may not be granted to an employee who, at the time of grant, owns stock possessing more than 10% of the total combined voting power of all classes of our stock or any parent or subsidiary, as defined in section 424 of the Code, unless the price per share is not less than 110% of the fair market value of our stock on the date of grant.

17

Stock Appreciation Rights

The compensation committee in its discretion may grant SARs to participants under the 2025 Plan. A SAR entitles the holder to receive from the Company upon exercise an amount equal to the excess, if any, of the aggregate fair market value of a specified number of shares that are the subject of such SAR over the aggregate exercise price for the underlying shares. The exercise price for each SAR may not be less than 100% of the fair market value of a share on the date of grant, and each SAR shall have a term no longer than 10 years.

We may make payment in settlement of the exercise of a SAR by delivering shares, cash or a combination of shares and cash as set forth in the applicable award agreement.

Restricted Stock

Under the 2025 Plan, the compensation committee may grant or sell restricted shares to participants (i.e., shares that are subject to conditions or restrictions including a requirement that the Participant pay a purchase price for each restricted share or a substantial risk of forfeiture based on continued service to the Company and/or the achievement of performance objectives, and that are subject to restrictions on transferability). Except for these restrictions and any others imposed by the compensation committee, upon the grant of restricted shares, the recipient generally will have rights of a stockholder with respect to the restricted shares, including the right to vote the restricted shares and to receive dividends and other distributions paid or made with respect to the restricted shares. However, any dividends payable with respect to unvested restricted shares will be accumulated or reinvested in additional restricted shares on a contingent basis, subject to forfeiture until the vesting of the underlying award. During the applicable restriction period, the participant may not sell, transfer, pledge, exchange or otherwise encumber the restricted shares.

Restricted Share Unit Awards

The compensation committee may grant or sell restricted share units to participants under the 2025 Plan. Restricted share units constitute an agreement to deliver shares (or an equivalent value in cash) to the participant at the end of a specified restriction period and/or upon the achievement of specified performance objectives, subject to such other terms and conditions as the compensation committee may specify, consistent with the provisions of the 2025 Plan. Restricted share units are not shares of common stock and do not entitle the participants to any of the rights of a stockholder. Restricted share units will be settled, in cash or shares, in an amount based on the fair market value per share on the settlement date. Each restricted share unit award will be evidenced by an award agreement that specifies the terms of the award and such additional limitations, terms and conditions as the compensation committee may determine, which may include restrictions based upon the achievement of performance objectives.

Other Share-Based Awards

The compensation committee may grant other share-based awards to participants under the 2025 Plan. Other share-based awards are awards that are valued in whole or in part by reference to shares or are otherwise based on the value of our common stock, such as unrestricted shares or time-based or performance-based units that are settled in shares and/or cash. Each other share-based award will be evidenced by an award agreement that specifies the terms of the award and such additional limitations, terms and conditions as the compensation committee may determine, consistent with the provisions of the 2025 Plan.

Performance Compensation Awards

The compensation committee may award performance shares and/or performance units under the 2025 Plan. Performance shares and performance units are awards, denominated in shares of common stock, which are earned during a specified performance period subject to the attainment of performance criteria, as established by the compensation committee. The compensation committee will determine the restrictions and conditions applicable to each award of performance shares and performance units.

18

Transferability

Except as the compensation committee otherwise determines, awards granted under the 2025 Plan will not be transferable by a participant other than by will or the laws of descent and distribution. Except as otherwise determined by the compensation committee, stock options and SARs will be exercisable during a participant’s lifetime only by him or her or, in the event of the participant’s incapacity, by his or her guardian or legal representative. Any award made under the 2025 Plan may provide that any shares issued as a result of the award will be subject to further restrictions on transfer.

Amendment

Our Board may at any time terminate the 2025 Plan or make such amendments thereto as it deems advisable, without action on the part of our stockholders unless their approval is required under any rule promulgated by the SEC or any securities exchange on which the Company's securities are listed. However, no termination or amendment will, without the consent of the individual to whom any option has been granted, affect or impair the rights of such individual. Under Section 422(b)(2) of the Code, no incentive stock option may be granted under the 2025 Plan more than ten years from the date the 2025 Plan was amended and restated or the date such amendment and restatement was approved by our stockholders, whichever is earlier.

Change in Control

In the event of a merger or Change in Control, each outstanding Award will be treated as the Administrator determines without a Participant’s consent, including, without limitation, that either (i) Awards will be assumed, or substantially equivalent Awards will be substituted, by the acquiring or succeeding corporation (or an affiliate thereof) with appropriate adjustments as to the number and kind of shares and prices; (ii) any outstanding Awards that are subject to performance objectives shall be converted to service-vesting awards by the resulting entity, as if “target” performance had been achieved as of the date of the Change of Control, and shall continue to vest based on the Participant’s Continuous Service during the remaining performance period or other period of required service; or (iii) outstanding Awards will vest and become exercisable, realizable, or payable, or restrictions applicable to an Award for the full duration of their term and outstanding Awards that are subject to performance objectives shall be converted to service-vesting awards by the resulting entity, as if “target” performance had been achieved as of the date of the Change of Control; or (iv) to the extent the Administrator determines, terminate upon or immediately prior to the effectiveness of such merger of Change in Control in exchange for payment in cash.

The 2025 Plan generally defines a change of control to include: (i) the acquisition of more than 50% of the Company’s voting securities, (ii) the replacement of a majority of the incumbent members of the board of directors in a 24-month period, (iii) a merger or consolidation, unless the Company’s stockholders own more than 50% of voting securities of the resulting corporation, or (iv) sale of all or substantially of the Company’s assets.

U.S. Federal Income Tax Consequences

The following is a summary of certain U.S. federal income tax consequences of awards made under the 2025 Plan, based upon the laws in effect on the date hereof. The discussion is general in nature and does not take into account a number of considerations that may apply in light of the circumstances of a particular participant under the 2025 Plan. The income tax consequences under applicable foreign, state and local tax laws may not be the same as under U.S. federal income tax laws.

19

Options

Non-Qualified Stock Options

A participant will not recognize taxable income at the time of grant of a non-qualified stock option. A participant will recognize compensation taxable as ordinary income (and subject to income tax withholding for employees) upon exercise of a non-qualified stock option equal to the excess of the fair market value of the shares purchased over their exercise price.

Incentive Stock Options

A participant will not recognize taxable income at the time of grant of an incentive stock option. A participant will not recognize taxable income (except for purposes of the alternative minimum tax) upon exercise of an incentive stock option. If the shares acquired by exercise of an incentive stock option are held for the longer of two years from the date the option was granted and more than one year from the date the shares were transferred, any gain or loss arising from a subsequent disposition of such shares will be taxed as long-term capital gain or loss. If, however, such shares are disposed of within either of such two- or one-year periods, then in the year of such disposition the participant will recognize compensation taxable as ordinary income equal to the excess of the lesser of the amount realized upon such disposition and the fair market value of such shares on the date of exercise over the exercise price.

Restricted Stock

A participant will not recognize taxable income at the time of grant of restricted shares, unless the participant makes an election under Section 83(b) of the Internal Revenue Code to be taxed at such time. If such election is made, the participant will recognize compensation taxable as ordinary income (and subject to income tax withholding for employees) at the time of the grant equal to the excess of the fair market value of the shares at such time over the amount, if any, paid for the restricted shares. If such election is not made, the participant will recognize compensation taxable as ordinary income (and subject to income tax withholding for employees) at the time the restrictions lapse in an amount equal to the excess of the fair market value of the shares at such time over the amount, if any, paid for the restricted shares.

Restricted Stock Units

A participant will not recognize taxable income at the time of grant of a restricted share unit award. A participant will recognize compensation taxable as ordinary income (and subject to income tax withholding for employees) at the time of settlement of the award equal to the fair market value of any shares delivered and the amount of cash paid upon settlement of the award.

SARs

A participant will not recognize taxable income at the time of grant of a SAR. Upon exercise, a participant will recognize compensation taxable as ordinary income (and subject to income tax withholding for employees) equal to the fair market value of any shares delivered and the amount of cash paid upon exercise of the SAR

Stock Bonus Awards

Generally, participants will recognize taxable income at the time of settlement of other share-based awards, with the amount of income recognized generally being equal to the amount of cash and the fair market value of any shares delivered under the award.

Section 162(m)

When a participant recognizes ordinary compensation income as a result of an award granted under the 2025 Plan, the Company may be permitted to claim a federal income tax deduction for such compensation, subject to various limitations that may apply under applicable law. As a result of those limitations, there can be no assurance that any compensation awarded or paid under the 2025 Plan will be deductible, in whole or in part. For example, Section 162(m) of the Internal Revenue Code generally disallows the deduction of compensation in excess of $1 million per year payable to certain “covered employees.” As a result, all or a portion of the compensation paid to one of our covered employees pursuant to the 2025 Plan may be non-deductible pursuant to Section 162(m).

Further, to the extent that compensation provided under the 2025 Plan may be deemed to be contingent upon a change of control, a portion of such compensation may be non-deductible by the Company under Section 280G of the Internal Revenue Code and may be subject to a 20% excise tax imposed on the recipient of the compensation.

20

Section 409A

Section 409A of the Internal Revenue Code imposes additional tax upon the payment of nonqualified deferred compensation unless certain requirements are met. We intend that awards granted under the 2025 Plan will be designed and administered in such a manner that they are either exempt from the application of, or comply with, the requirements of Section 409A. However, the Company does not warrant the tax treatment of any award under Section 409A or otherwise.

This general discussion of U.S. federal income tax consequences is intended for the information of stockholders considering how to vote with respect to this proposal and not as tax guidance to participants in the 2025 Plan. Different tax rules may apply to specific participants and transactions under the 2025 Plan.

New Incentive Plan Benefits

We are unable to determine the dollar value and number of stock awards that may be received by or allocated to (i) any of our named executive officers, (ii) our current executive officers, as a group, (iii) our employees who are not executive officers, as a group, and (iv) our non-executive directors, as a group as a result of the approval of the amendment to the 2025 Plan because at this time we are unable to determine whether any of the current non-executive directors will meet the requirements to receive any automatic grants of options under the 2025 Plan and all other stock awards granted to such persons are granted by the Compensation Committee on a discretionary basis.

Interests of Directors or Officers

None of the Company’s officers or directors has any interest in any of the matters to be acted upon, except to the extent that a director is named as a nominee for election to the board of directors, a director or an officer may be granted equity award under our 2025 Plan, and/or a director or an officer is a shareholder of our common stock.

Israeli Subplan and Tax Matters