UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

| Actelis Networks, Inc. |

| (Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11

Actelis Networks, Inc.

4039 Clipper Court

Fremont, CA 94538

(510) 545-1045

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the stockholders of Actelis Networks, Inc.:

We are pleased to invite you to attend our Annual Meeting of the stockholders (the “Annual Meeting”) of Actelis Networks, Inc., a Delaware corporation (the “Company”), which will be held at virtually at 10:00 a.m. Eastern Standard Time on August 4, 2023, for the following purposes:

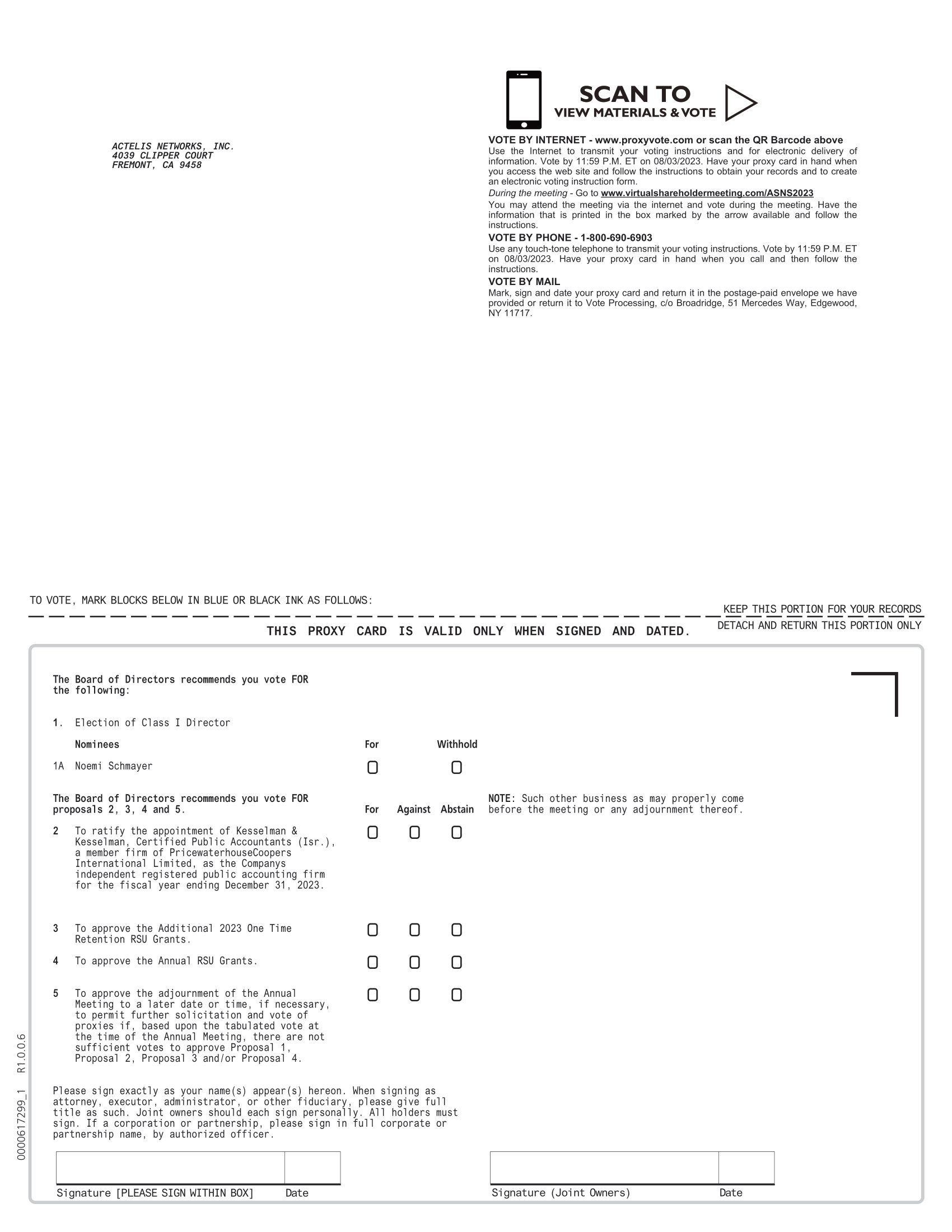

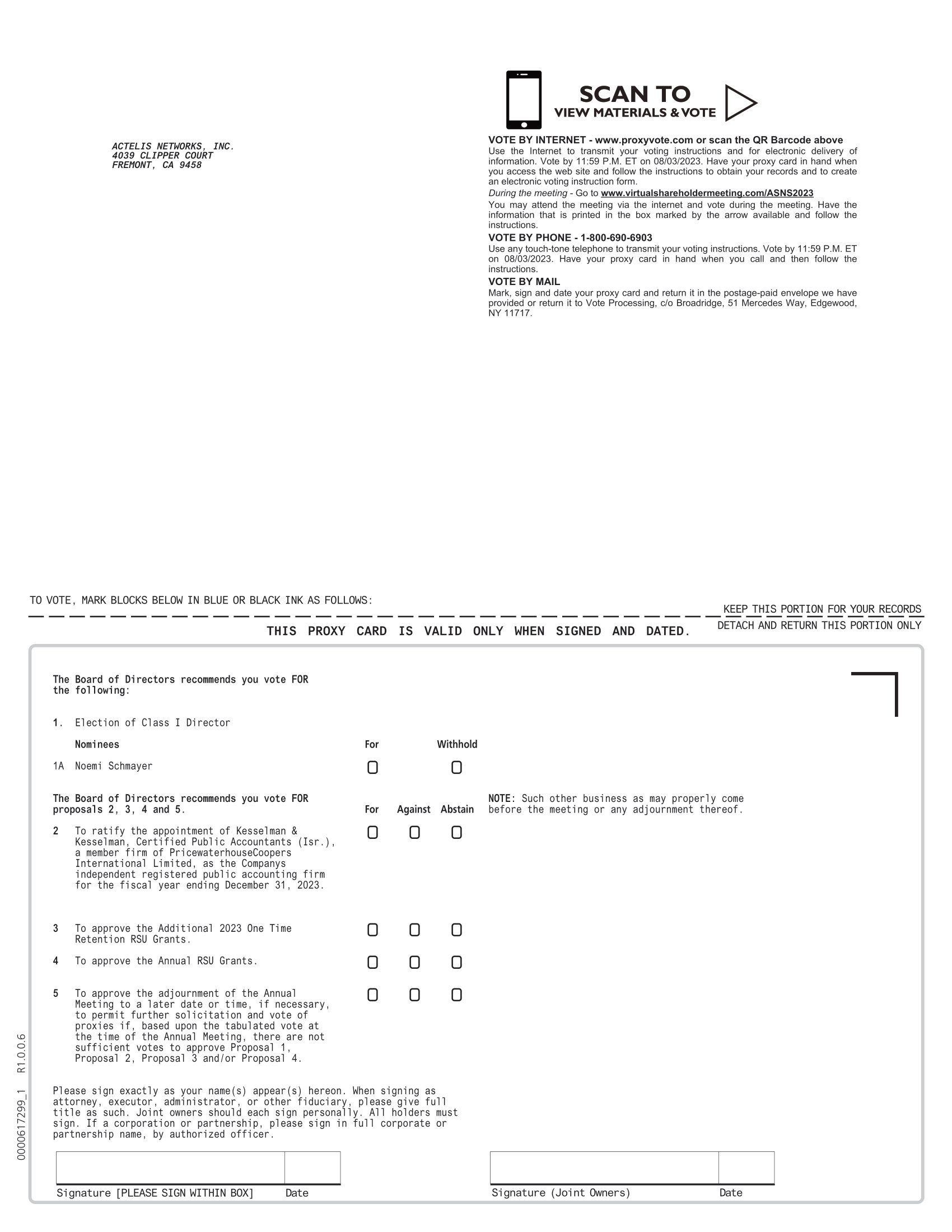

| 1. | To elect one Class I Director to serve for a term of three years until our 2026 Annual Meeting of Stockholders (“Proposal 1”); |

| 2. | To ratify the appointment of Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers International Limited, as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 (“Proposal 2”); |

| 3. | To approve the Additional 2023 RSU Grants (as defined below) (“Proposal 3”); |

| 4. | To approve the Annual RSU Grants (as defined below) (“Proposal 4”); |

| 5 | To approve the adjournment of the Annual Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Annual Meeting, there are not sufficient votes to approve Proposal 1, Proposal 2, Proposal 3 and/or Proposal 4 (“Proposal 5”); and |

| 6. | To conduct any other business as may properly come before the meeting or any adjournment thereof |

The Company’s board of directors (the “Board”) has fixed the close of business on June 8, 2023 as the date (the “Record Date”) for a determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

The Annual Meeting will be held virtually. If you hold your shares in an account at a brokerage firm, bank, dealer or other similar organization and wish to vote at the meeting, you will need to obtain a “legal proxy” from that entity and submit it when you register. On the day of the Annual Meeting, if you have properly registered, you may enter the meeting by clicking on the link provided and entering the password you received via email in your registration confirmations. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically, and submit questions prior to and during the meeting. To vote at the meeting, (a) if you hold your shares through a bank, broker or other nominee, you will need the control number you receive by email after registering, and (b) if you hold your shares in account with our transfer agent, you will need the control number that is shown on your proxy card or e-mail notification of the Annual Meeting.

By Order of the Board,

| /s/ Tuvia Barlev |

Tuvia Barlev

Chairman of the Board

Fremont, California

July 5, 2023

Whether or not you expect to attend in person, we urge you to vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares via the internet, by phone or by signing, dating, and returning the enclosed proxy card will save us the expenses and extra work of additional solicitation. An addressed envelope for which no postage is required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so, as your proxy is revocable at your option. Your vote is important, so please act today.

Table of Contents

i

Actelis Networks, Inc.

4039 Clipper Court

Fremont, CA 94538

(510) 545-1045

ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

This proxy statement (the “Proxy Statement”) is being sent to the holders of shares of common stock, par value $0.0001 per share (“Common Stock”) of Actelis Networks, Inc., a Delaware corporation (the “Company”), in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use at the Annual Meeting of Stockholders of the Company which will be held at 10:00 a.m. Eastern Standard Time on August 4, 2023, virtually at the following link: www.virtualshareholdermeeting.com/ASNS2023 (the “Annual Meeting”).

QUESTIONS AND ANSWERS REGARDING THE ANNUAL MEETING OF STOCKHOLDERS

Who is entitled to vote at the Annual Meeting?

The Board has fixed the close of business on June 8, 2023 as the record date (the “Record Date”) for a determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting. As of the date of this Proxy Statement, there are 1,952,975 shares of Common Stock of the Company outstanding. Each share of the Common Stock represents one vote that may be voted on each matter that may come before the Annual Meeting.

What matters will be voted on at the Annual Meeting?

The proposals that are scheduled to be considered and voted on at the Annual Meeting are as follows:

| 1. | Proposal to elect one Class I Director to serve for a term of three years until our 2026 Annual Meeting of Stockholders (“Director Appointment” or “Proposal 1”); |

| 2. | To ratify the appointment of Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers International Limited, as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 (“Auditor Appointment” or “Proposal 2”); | |

| 3. | To approve the Additional 2023 One Time Retention RSU Grants (as defined below) (“Additional 2023 RSU Grants” or “Proposal 3”); | |

| 4. | To approve the Annual RSU Grants (as defined below) (“Annual RSU Grants” or “Proposal 4”); | |

| 5. | To approve the adjournment of the Annual Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Annual Meeting, there are not sufficient votes to approve Proposal 1, Proposal 2, Proposal 3 and/or Proposal 4 (“Adjournment” or “Proposal 5”); and |

To conduct any other business as may properly come before the meeting or any adjournment thereof.

What are the Board’s voting recommendations?

The Board recommends that you vote “FOR” the Director Appointment, Auditor Appointment, Additional 2023 RSU Grants, Annual RSU Grants and Adjournment.

1

What is the difference between holding shares as a record holder and as a beneficial owner?

If your shares are registered in your name with the Company’s transfer agent, VStock Transfer, LLC, you are the “record holder” of those shares. If you are a record holder, these proxy materials have been provided directly to you by the Company.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials have been forwarded to you by that organization. As the beneficial owner, you have the right to instruct this organization on how to vote your shares.

Who may attend the Annual Meeting?

Record holders and beneficial owners may attend the Annual Meeting. If your shares are held in street name, you will need a “legal proxy” from your brokerage firm, bank, dealer or other similar organization when you register for the Annual Meeting showing your stock ownership as of the Record Date. Please see below for instructions on how to vote at the Annual Meeting if your shares are held in street name.

How do I vote?

If you are a stockholder of record, you may:

| 1. | Vote by internet. The website address for internet voting is on your proxy card. |

| 2. | Vote by phone. The phone number for phone voting is on your proxy card. |

| 3. | Vote by mail. Mark, date, sign and mail promptly the enclosed proxy card. |

| 4. | Vote at the Annual Meeting. Register, attend virtually and vote at the Annual Meeting. |

If you vote by phone or internet, please DO NOT mail your proxy card.

If you are a beneficial owner, you must follow the voting procedures of your nominee included with your proxy materials. If your shares are held by a nominee and you intend to vote at the Annual Meeting, please have a legal proxy from your nominee authorizing you to vote your shares when you register for the Annual Meeting.

What constitutes a quorum?

To carry on the business of the Annual Meeting, we must have a quorum. A quorum is present when one-third of the voting power of the issued and outstanding capital stock of the Company, as of the Record Date, is represented in person or by proxy. Shares owned by the Company are not considered outstanding or considered to be present at the Annual Meeting. Broker non-votes and abstentions are counted as present for the purpose of determining the existence of a quorum.

What happens if the Company is unable to obtain a quorum?

If a quorum is not present to transact business at the Annual Meeting or if we do not receive sufficient votes in favor of the proposals by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit continued solicitation of proxies.

What is a “broker non-vote”?

Broker non-votes occur with respect to shares held in “street name,” in cases where the record owner (for instance, the brokerage firm or bank) does not receive voting instructions from the beneficial owner and the record owner does not have the authority to vote those shares on a proposal.

2

Various national and regional securities exchanges applicable to brokers, banks, and other holders of record determine whether the record owner (for instance, the brokerage firm, or bank) is able to vote on a proposal if the record owner does not receive voting instructions from the beneficial owner. The record owner may vote on proposals that are determined to be routine under these rules and may not vote on proposals that are determined to be non-routine under these rules. If a proposal is determined to be routine, your broker, bank, or other holder of record is permitted to vote on the proposal without receiving voting instructions from you. The Auditor Appointment and Adjournment are routine matters and the record owner may vote your shares on these proposals if it does not get instructions from you.

The Director Appointment, Additional 2023 RSU Grants and Annual RSU Grants Proposal are non-routine and the record owner may not vote your shares on any of these proposals if it does not get instructions from you. If you do not provide voting instructions on these matters, a broker non-vote will occur. Broker non-votes, as well as abstentions, will each be counted towards the presence of a quorum but will not be counted towards the number of votes cast for any proposal.

How many votes are needed for each proposal to pass?

| Proposals | Vote Required | |||

| (1) | Approval of Director Appointment | Affirmative vote of a plurality of the shares of the voting power present. The person receiving the greatest number of votes will be elected as director. | ||

| (2) | Approval of Auditor Appointment | Majority of the voting power present in person or by proxy and entitled to vote on the matter | ||

| (3) | Additional 2023 RSU Grants | Majority of the voting power present in person or by proxy and entitled to vote on the matter | ||

| (4) | Annual RSU Grants Proposal | Majority of the voting power present in person or by proxy and entitled to vote on the matter | ||

| (5) | Approval of Adjournment | Majority of the voting power present in person or by proxy and entitled to vote on the matter | ||

What constitutes outstanding shares entitled to vote?

At the close of business on the Record Date, there were 1,952,764 outstanding and entitled to vote.

Is broker discretionary voting allowed and what is the effect of broker non-votes?

| Broker | ||||||

| Discretionary | Effect of Broker Non- | |||||

| Proposals | Vote Allowed | Votes on the Proposal | ||||

| (1) | Director Appointment | No | None | |||

| (2) | Auditor Appointment | Yes | None | |||

| (3) | Additional 2023 RSU Grants | No | None | |||

| (4) | Annual RSU Grants Proposal | No | None | |||

| (5) | Approve the Adjournment | Yes | None | |||

What is an Abstention?

An abstention is a stockholder’s affirmative choice to decline to vote on a proposal. Under Delaware law, abstentions are counted as shares present and entitled to vote at the Annual Meeting. Generally, unless provided otherwise by applicable law, our amended and restated bylaws provide that an action of our stockholders (other than the election of directors) is approved if a majority of the number of shares of stock entitled to vote thereon and present (either in person or by proxy) vote in favor of such action. Therefore, votes marked as “ABSTAIN” will have the same effect as a vote “AGAINST” the outcome in Proposal 2, 3, 4 and 5. Votes marked as “ABSTAIN” on Proposal 1 will have no effect because directors are elected by plurality voting.

3

What are the voting procedures?

You may vote in favor of each proposal or against each proposal, or in favor of some proposals and against others, or you may abstain from voting on any of these proposals. You should specify your respective choices on the accompanying proxy card or your voting instruction form.

Is my proxy revocable?

You may revoke your proxy and reclaim your right to vote up to and including the day of the Annual Meeting by giving written notice to the Corporate Secretary of the Company, by delivering a proxy card dated after the date of the proxy or by voting in person at the Annual Meeting. All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: Actelis Networks, Inc., 4039 Clipper Court, Fremont, CA 94538, Attention: Corporate Secretary.

Who is paying for the expenses involved in preparing and mailing this proxy statement?

All of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by the Company. In addition to the solicitation by mail, proxies may be solicited by the Company’s officers and regular employees by telephone or in person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in so doing. We may hire an independent proxy solicitation firm.

Could other matters be decided at the Annual Meeting?

Other than the Director Appointment, Auditor Appointment, Additional 2023 RSU Grants, Annual RSU Grants and Adjournment proposals, no other matters will be presented for action by the stockholders at the Annual Meeting.

Do I have dissenters’ (appraisal) rights?

Appraisal rights are not available to the Company’s stockholders with any of the proposals brought before the Annual Meeting.

Interest of Officers and Directors in Matters to Be Acted Upon

All of the directors have an interest in Proposals 3 and 4 and director Noemi Schmayer has an interest in her re-election as a director in Proposal 1. Other than as provided above, none of the officers and directors have any interest in any of the matters to be acted upon at the Annual Meeting.

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSALS 1, 2, 3, 4 AND 5.

4

PROPOSAL 1. ELECTION OF DIRECTOR

Our Board is currently composed of five (5) members, of whom are divided into three classes. As provided in our Certificate of Incorporation, each director is elected to serve for a three-year term and until such director’s successor is elected and has been qualified. The term of our current Class I Director expires at the Annual Meeting.

Information Regarding our Directors

Upon recommendation from the Company’s Nomination and Corporate Governance Committee, the Board has nominated Noemi Schmayer, the current Class I Director, for re-election as the Class I Director whose term will expire at our 2026 Annual Meeting of Stockholders and until her successor is elected and has qualified.

Unless the proxy is marked to indicate that such authorization is expressly withheld, the persons named in the enclosed proxy intend to vote the shares authorized thereby “for” the election of Ms. Schmayer. It is expected that Ms. Schmayer will be able to serve, but if before the election it develops that she is unavailable, the persons named in the accompanying proxy will vote “for” the election of such substitute nominee or nominees as the current Board may recommend.

The director nominee has consented to be named as the nominee in this proxy statement and has agreed to serve as director if elected. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominee named below. If the director nominee of the Company is unable or declines to serve as a director at the Annual Meeting, the proxies will be voted for any nominee designated by the present Board to fill the vacancy. The Board has no reason to believe that the nominee will be unavailable for election. The elected director will hold office until the next Annual Meeting of Stockholders in 2026 or until her earlier death, resignation, or removal, or until their successors are elected and qualified. There are no arrangements or understandings between any of our directors and any other person under which any director was selected to serve as a director of our Company. There are no family relationships among our directors or officers.

The following sets forth the person nominated by the Board for election and certain information concerning such individual:

| Director Nominee | Director Class | Age | Position | Director Since | ||||

| Noemi Schmayer | Class I Director | 55 | Director | May 2022 |

Noemi Schmayer – Ms. Schmayer has served on the Board since May 2022. Ms. Schmayer acted as a Senior Partner and Head of the High-tech and global corporations in one of the five largest law firms in Israel. Since then, Ms. Schmayer has been counseling companies and individuals regarding mergers & acquisitions, investments and strategy, and serves as a director of several board of directors including serving as the external director of Somoto Ltd. (publicly traded on the Tel Aviv Stock Exchange under the name Nostromo Energy Ltd.) and served as legal counsel for Smart Shooter Ltd. Ms. Schmayer is a renowned specialist in corporate law, corporate finance, cross-border transactions, and commercial law. Ms. Schmayer wields particular expertise in M&A, finance transactions, and complexed commercial contracts in High-tech and Biotech. Ms. Schmayer received an LLB in law from Tel Aviv University.

Number and Terms of Office of Officers and Directors

Our Board has five members, three of whom will be deemed “independent” under United States Securities and Exchange Commission (“SEC”) and Nasdaq rules.

Our officers are appointed by the Board and serve at the discretion of the Board, rather than for specific terms of office. Our Board is authorized to appoint persons to the offices set forth in our Certificate of Incorporation as it deems appropriate.

Each of the directors of the Company were elected pursuant to the provisions of the Amended and Restated Stockholders Agreement, dated February 2, 2016 (“Stockholders Agreement”) and our Certificate of Incorporation in effect prior to the Company’s initial public offering in May 2022 (the “IPO”). Tuvia Barlev had a right under the Stockholders Agreement to designate one director. Dr. Niv was elected by the holders of the majority of the Series A Preferred Stock. Joseph Moscovitz, Dr. Naama Halevi-Davidov, and Noemi Schmayer were elected by both the majority of our outstanding common stock and the holders of the majority of the Series A Preferred Stock and Series Preferred B Stock. The Stockholders Agreement was terminated in connection with the IPO and going forward, each of the directors will be appointed by the holders of the majority of our outstanding common stock pursuant to the provisions of the Certificate of Incorporation, with (i) directors in Class I, consisting of Noemi Schmayer, to stand for election at the Annual Meeting to be held in 2023; (ii) directors in Class II, consisting of Joseph Moscovitz and Dr. Naama Halevi-Davidov, to stand for election at the annual meeting of stockholders to be held in 2024; and (iii) directors in Class III, consisting of Israel Niv and Tuvia Barlev, to stand for election at the annual meeting of stockholders to be held in 2025.

5

The Company is governed by the Board. Currently, each member of our Board, other than Tuvia Barlev and Joseph Moscovitz, is an independent director; and all standing committees of our Board are composed entirely of independent directors, in each case under Nasdaq’s independence definition applicable to boards of directors. For a director to be considered independent, our Board must determine that the director has no relationship which, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Members of the Audit Committee also must satisfy a separate SEC independence requirement, which provides that they may not accept directly or indirectly any consulting, advisory or other compensatory fee from us or any of our subsidiaries other than their directors’ compensation. In addition, under SEC rules, an Audit Committee member who is an affiliate of the issuer (other than through service as a director) cannot be deemed to be independent. In determining the independence of members of the Compensation Committee, Nasdaq listing standards require our Board to consider certain factors, including, but not limited to: (1) the source of compensation of the director, including any consulting, advisory or other compensatory fee paid by us to the director, and (2) whether the director is affiliated with us, one of our subsidiaries or an affiliate of one of our subsidiaries. Under our Compensation Committee Charter, members of the Compensation Committee also must qualify as “outside directors” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Code, and as “non-employee directors” for purposes of Rule 16b-3 under the Exchange Act. The independent members of the Board are Israel Niv, Dr. Naama Halevi-Davidov, and Noemi Schmayer.

Committees of the Board of Directors

Our Board has an audit committee, a compensation committee and a nominating and corporate governance committee, each with its own charter that has been approved by the board. The anticipated composition and responsibilities of each committee are described below. Members will serve on these committees until their resignation or until otherwise determined by our Board. Upon our listing on The Nasdaq Capital Market, each committee’s charter will be available under the Corporate Governance section of our website at www.actelis.com. During the calendar year of 2022, our Board met six times. The reference to our website address does not constitute incorporation by reference of the information contained at or available through our website, and you should not consider it to be a part of this Schedule 14A.

Audit Committee

The members of our audit committee are Israel Niv, Dr. Naama Halevi-Davidov, and Noemi Schmayer, with Dr. Naama Halevi-Davidov serving as Chairperson. The composition of our audit committee meets the requirements for independence under current Nasdaq listing standards and SEC rules and regulations. Each member of our audit committee meets the financial literacy requirements of Nasdaq listing standards. In addition, our Board has determined that Dr. Naama-Halevi Davidov is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act of 1933. The audit committee operates under a written charter that satisfies the applicable standards of the SEC and Nasdaq. During the calendar year of 2022, the Audit Committee met three times. The audit committee, among other things:

| ● | reviews our consolidated financial statements and our critical accounting policies and practices; |

| ● | selects a qualified firm to serve as the independent registered public accounting firm to audit our consolidated financial statements; |

| ● | helps to ensure the independence and performance of the independent registered public accounting firm; |

6

| ● | discusses the scope and results of the audit with the independent registered public accounting firm and review, with management and the independent registered public accounting firm, our interim and year-end results of operations; |

| ● | pre-approves all audit and all permissible non-audit services to be performed by the independent registered public accounting firm; |

| ● | oversees the performance of our internal audit function when established; |

| ● | reviews the adequacy of our internal controls; |

| ● | develops procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| ● | reviews our policies on risk assessment and risk management; and |

| ● | reviews related party transactions. |

Compensation Committee

The members of our compensation committee are Dr. Naama Halevi-Davidov, Israel Niv, and Noemi Schmayer, with Israel Niv serving as Chairperson. The composition of our compensation committee meets the requirements for independence under Nasdaq Capital Market listing standards and SEC rules and regulations. Each member of the compensation committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act. The purpose of our compensation committee is to discharge the responsibilities of our Board relating to compensation of our executive officers. The compensation committee operates under a written charter that satisfies the applicable standards of the SEC and Nasdaq. During the calendar year of 2022, the Compensation Committee met three times. The compensation committee, among other things:

| ● | reviews, approves and determines, or make recommendations to our Board regarding, the compensation of our executive officers; |

| ● | administers our stock and equity incentive plans; |

| ● | helps to ensure the independence and performance of the independent registered public accounting firm; |

| ● | reviews and approves, or make recommendations to our Board regarding, incentive compensation and equity plans; and |

| ● | establishes and reviews general policies relating to compensation and benefits of our employees. |

Nominating and Corporate Governance Committee

The members of our nominating and corporate governance committee are Noemi Schmayer, Dr. Naama Halevi-Davidov, and Israel Niv, with Noemi Schmayer serving as Chairperson. The composition of our nominating and corporate governance committee meets the requirements for independence under Nasdaq listing standards and SEC rules and regulations. The nominating and corporate governance committee operates under a written charter that satisfies the applicable standards of the SEC and Nasdaq. During the calendar year of 2022, our Nomination and Corporate Governance Committee did not meet. The nominating and corporate governance committee, among other things:

| ● | identifies, evaluates and selects, or make recommendations to our Board regarding, nominees for election to our Board and its committees; |

7

| ● | evaluates the performance of our Board and of individual directors; |

| ● | considers and make recommendations to our Board regarding the composition of our Board and its committees; |

| ● | reviews developments in corporate governance practices; |

| ● | oversees environmental, social and governance (ESG) matters; |

| ● | evaluates the adequacy of our corporate governance practices and reporting; and |

| ● | develops and make recommendations to our Board regarding corporate governance guidelines and matters. |

Compensation Committee Interlocks and Insider Participation

None of our executive officers currently serves, and in the past year has not served, as a member of the compensation committee of any entity that has one or more executive officers serving on our Board.

Oversight of Risk Management

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including economic risks, financial risks, legal and regulatory risks and others, such as the impact of competition. Management is responsible for the day-to-day management of the risks that we face, while our Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board is responsible for satisfying itself that the risk management processes designed and implemented by management are adequate and functioning as designed. Our Board assesses major risks facing our Company and options for their mitigation in order to promote our stockholders’ interests in the long-term health of our Company and our overall success and financial strength. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for us. The involvement of our full Board in the risk oversight process allows our Board to assess management’s appetite for risk and also determine what constitutes an appropriate level of risk for our Company. Our Board regularly includes agenda items at its meetings relating to its risk oversight role and meets with various members of management on a range of topics, including corporate governance and regulatory obligations, operations and significant transactions, risk management, insurance, pending and threatened litigation and significant commercial disputes.

While our Board is ultimately responsible for risk oversight, various committees of our Board oversee risk management in their respective areas and regularly report on their activities to our entire Board. In particular, the Audit Committee has the primary responsibility for the oversight of financial risks facing our Company. The Audit Committee’s charter provides that it will discuss our major financial risk exposures and the steps we have taken to monitor and control such exposures. Our Board has also delegated primary responsibility for the oversight of all executive compensation and our employee benefit programs to the Compensation Committee. The Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with our business strategy.

We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing our Company and that our Board’s leadership structure provides appropriate checks and balances against undue risk taking.

8

Code of Business Conduct and Ethics

Our Board has adopted a code of ethical conduct that applies to our principal executive officer, principal financial officer and senior financial management. This code of ethical conduct is embodied within our Code of Business Conduct and Ethics, which applies to all persons associated with our Company, including our directors, officers and employees (including our principal executive officer, principal financial officer, principal accounting officer and controller). In order to satisfy our disclosure requirements under Item 5.05 of Form 8-K, we will disclose amendments to, or waivers of, certain provisions of our Code of Business Conduct and Ethics relating to our chief executive officer, chief financial officer, chief accounting officer, controller or persons performing similar functions on our website promptly following the adoption of any such amendment or waiver. The Code of Business Conduct and Ethics provides that any waivers of, or changes to, the code that apply to the Company’s executive officers or directors may be made only by the Audit Committee. In addition, the Code of Business Conduct and Ethics includes updated procedures for non-executive officer employees to seek waivers of the code.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, executive officers, and persons who own more than 10% of our Common Stock to file initial reports of ownership and changes in ownership of our Common Stock with the SEC. These individuals are required by the regulations of the SEC to furnish us with copies of all Section 16(a) forms they file. Based solely on a review of the copies of the forms furnished to us none of our directors, executive officers, and persons who own more than 10% of our Common Stock failed to comply with Section 16(a) filing requirements.

Family Relationships

There are no family relationships among our directors and/or executive officers.

Board Diversity

While we do not have a formal policy on diversity, our Board considers diversity to include the skill set, background, reputation, type and length of business experience of our Board members as well as a particular nominee’s contributions to that mix. Our Board believes that diversity promotes a variety of ideas, judgments and considerations to the benefit of our Company and stockholders. Although there are many other factors, the Board primarily focuses on public company board experience, knowledge of the communications industry, or background in finance or technology, and experience operating growing businesses.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEE FOR ELECTION AS DIRECTOR.

9

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has appointed Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers International Limited (“PwC”) as our independent registered accounting firm for the fiscal year ending December 31, 2023. We are not required to seek stockholder approval for the appointment of our independent registered public accounting firm, however, the Audit Committee and the full Board believe it is sound corporate practice to seek such approval. If the appointment is not ratified, the Audit Committee will investigate the reasons for stockholder rejection and will re-consider the appointment. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such change would be in the best interests of us and our stockholders.

Representatives of PwC are not expected to be present at the Annual Meeting. However, we will provide contact information for PwC to any stockholders who would like to contact the firm with appropriate questions.

Fees Billed to the Company in fiscal years 2022 and 2021

The following table provides detail about fees for professional services rendered to us by PwC, our independent registered public accounting firm engaged to provide accounting services for the fiscal year ended December 31, 2022 and 2021.

| December 31, 2022 | December 31, 2021 | |||||||

| Audit fees | $ | 270,000 | $ | 373,000 | ||||

| Audit related fees | 7,000 | 7,000 | ||||||

| Tax fees | - | - | ||||||

| All other fees | - | - | ||||||

| Total | $ | 277,000 | $ | 380,000 | ||||

Audit Fees - This category includes the audit of our annual financial statements, review of financial statements included in our quarterly reports on Form 10-Q and services that are normally provided by the independent registered public accounting firm in connection with engagements for those fiscal years. This category also includes advice on audit and accounting matters that arose during, or as a result of, the audit or the review of interim financial statements.

Audit-Related Fees - This category consists of assurance and related services by the independent registered public accounting firm that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under “Audit Fees.” The services for the fees disclosed under this category include consultation regarding our correspondence with the SEC, review of registration statements and other accounting consulting.

Tax Fees - This category consists of professional services rendered for tax compliance and tax advice. The services for the fees disclosed under this category include tax return preparation and technical tax advice.

All Other Fees - This category consists of fees for other miscellaneous items.

Policy on Pre-Approval of Audit and Permissible Non-audit Services of Independent Auditors

Consistent with the SEC policies regarding auditor independence, our Board has responsibility for appointing, setting compensation and overseeing the work of the independent auditor. In recognition of this responsibility, our Board has established a policy to pre-approve all audit and permissible non-audit services provided by the independent auditor.

Prior to engagement of the independent auditor for the next year’s audit, management will submit an aggregate of services expected to be rendered during that year for each of the following four categories of services to the Board for approval.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE APPROVAL OF AUDITOR.

10

PROPOSAL 3. CHANGES TO NON-EMPLOYEE DIRECTOR COMPENSATION FOR 2023

In connection with the IPO, the Board approved the following grants of Restricted Stock Units (“RSUs”): (a) an amount of RSUs worth $100,000 as of the time of grant to each of Dr. Naama Halevi-Davidov, Israel Niv, Noemi Schmayer and Joseph Moscovitz (the “Non-Employee Directors”) of which shall fully vest over 36 months, subject to each member’s continued service on the Board, as compensation for serving on the Board (the “Director Stock Grants”); (b) an amount of RSUs worth $100,000 as of the time of grant to Yoav Efron, of which shall fully vest over 36 months, subject to Mr. Efron’s continued service to the Company, as compensation for serving as our Chief Financial Officer (the “CFO Grant”); and (c) amount of RSUs worth $500,000 as of the time of grant to Tuvia Barlev, of which shall fully vest over 36 months, subject to Mr. Barlev’s continued service to the Company, as compensation for serving as our Chief Executive Officer and Chairman (the “CEO Grant”, and together with the Director Grants and CFO Grants, the “IPO Grants”). As a result of the decrease of the price of the Common Stock since the IPO, our Board believes that the total dollar value of the IPO Grants received by each of the Non-Employee Directors, Mr. Barlev and Mr. Efron were not in accordance with the original expectations of the Board nor commensurate with the value of the Non-Employee Directors’, Mr. Barlev’s nor Mr. Efron’s services to the Company. Accordingly, to compensate for the financial shortfall of value from the IPO Grants, on March 22, 2023, Compensation Committee approved, and thereafter, on May 2, 2023, the entire Board approved the issuance of an additional 5,500 RSUs to each Non-Employee Director and to Mr. Efron, and an additional 27,500 RSUs to Mr. Barlev (collectively, the “Additional 2023 RSU Grants”), subject to their availability under the Plan (as defined below).

The Additional 2023 RSU Grants constitute related party transactions under Delaware General Corporations Law §144 of the Delaware General Corporations Law (“DGCL Section 144) because they are between the Corporation and officers and director that have a financial interest in such transaction. Accordingly, as required under DGCL Section 144, we are seeking shareholder approval for the issuance of the Additional 2023 RSU Grants.

Vote Required

The affirmative vote of a majority of the voting power present or represented by proxy is required to approve the Additional 2023 RSU Grant Proposal. Abstentions represent the voting power present under the Company’s amended and restated bylaws, and accordingly will have the same effect as a vote “AGAINST” the outcome of this Proposal 3.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ADDITIONAL 2023 RSU GRANT PROPOSAL.

11

PROPOSAL 4. CHANGES TO ANNUAL NON-EMPLOYEE DIRECTOR COMPENSATION

In connection with the IPO, on March 22, 2023, Compensation Committee of the Board approved, and thereafter, on May 2, 2023, the entire Board approved and ratified the annual issuance of RSUs worth $100,000 at their time of their grant to each of our members of the Board, Dr. Naama Halevi-Davidov, Israel Niv, Noemi Schmayer and Joseph Moscovitz (the “Annual RSU Grants”). The Annual RSU Grants shall fully vest over 36 months, subject to each member’s continued service on the Board, as compensation for serving on the Board. Each Annual RSU Grant will be subject to their availability under the Plan, and thereafter annually ratified by Board approval.

The Annual RSU Grants constitute transactions under DGCL Section 144 because they are transactions between the Corporation and each of the directors of the Corporation that have a financial interest in such transaction. Accordingly, as required under DGCL Section 144, we are seeking shareholder approval for the Annual RSU Grants.

Vote Required

The affirmative vote of a majority of the voting power present or represented by proxy is required to approve the Annual RSU Grant Proposal. Abstentions represent the voting power present under the Company’s amended and restated bylaws, and accordingly will have the same effect as a vote “AGAINST” the outcome of this Proposal 4.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ANNUAL RSU GRANT PROPOSAL.

12

PROPOSAL 5. APPROVAL OF THE ADJOURNMENT

General

The Company is asking stockholders to approve, if necessary, adjournment of the Annual Meeting to solicit additional proxies in favor of the Director Appointment, the Auditor Appointment, the Additional 2023 RSU Grants, and/or the Annual RSU Grants. Any adjournment of the Annual Meeting for the purpose of soliciting additional proxies will allow stockholders who have already sent in their proxies to revoke them at any time prior to the time that the proxies are used.

Vote Required

The affirmative vote of a majority of the voting power present or represented by proxy is required to approve the Adjournment proposal. Abstentions represent the voting power present under the Company’s amended and restated bylaws, and accordingly will have the same effect as a vote “AGAINST” the outcome of this Proposal 5.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ADJOURNMENT.

13

EXECUTIVE AND DIRECTOR COMPENSATION

The following table shows the total compensation awarded to, earned by, or paid to (1) the individual who served as our principal executive officer during fiscal year 2022 and 2021; and (2) our next two most highly compensated executive officers who earned more than $100,000 during fiscal year 2022 and were serving as executive officers as of December 31, 2022. We refer to these individuals in this Schedule 14A as our named executive officers.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Nonequity incentive plan compensation ($) | Nonqualified deferred compensation earnings ($) | All other compensation ($) | Total ($) | |||||||||||||||||||||||||||

| Tuvia Barlev, | 2022 | 250,000 | 125,00 | 500,000 | - | - | - | 11,603 | 886,603 | |||||||||||||||||||||||||||

| Chief Executive Officer and Chairman | 2021 | 181,188 | - | - | - | - | - | 25,000 | 206,188 | |||||||||||||||||||||||||||

| Yoav Efron, | 2022 | 172,614 | 85,000 | 100,000 | - | 26,934 | 384,548 | |||||||||||||||||||||||||||||

| Chief Financial Officer | 2021 | 135,128 | - | - | 29,600 | 7,029 | 171,757 | |||||||||||||||||||||||||||||

| Jan Ruderman | 2022 | 150,000 | - | 32,640 | 11,956 | 93,142 | - | 774 | 288,512 | |||||||||||||||||||||||||||

| Chief Revenue Office — Americas | 2021 | 12,500 | 65 | 12,565 | ||||||||||||||||||||||||||||||||

Outstanding Equity Awards at Fiscal Year-End

The following table provides certain information concerning any common share purchase options, stock awards or equity incentive plan awards held by the executive officers named above at the fiscal year ended December 31, 2022. All amounts are reflective of the Company’s 1-for-10 reverse stock split of the shares of Common Stock, effective April 19, 2023 (the “Reverse Stock Split”).

| Option Awards | Stock Awards | |||||||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares of Stock That Have Not Vested (#) | Market Value of Shares of Stock That Have Not Vested ($) | ||||||||||||||||||

| Tuvia Barlev, | ||||||||||||||||||||||||

|

Chief Executive Officer and Chairman | - | - | - | - | 12,5000 | (1) | $ | 500,000 | ||||||||||||||||

| Yoav Efron, | 10,700 | (2) | - | $ | 0.1058 | 02/08/2028 | - | - | ||||||||||||||||

| Chief Financial Officer | 816 | 1,359 | (3) | $ | 1.3616 | 05/27/2031 | - | - | ||||||||||||||||

| - | - | - | - | 2,5,00 | (4) | $ | 100,000 | |||||||||||||||||

| Jan Ruderman | 544 | (5) | 1,631 | $ | 4 | 09/15/2032 | - | - | ||||||||||||||||

| Chief Revenue Office — Americas | - | - | - | - | 6,8 00 | (6) | $ | 32,640 | ||||||||||||||||

| (1) | The RSUs vests annually in three equal tranches, with the first tranche vesting on May 17, 2023, the second tranche vesting on May 17, 2024, and the last tranche vesting on May 17, 2025. |

| (2) | This option grant was vested in full on February 7, 2022. |

| (3) | 25% of this options vested on May 27, 2022, with the remaining 75% vesting monthly thereafter. |

| (4) | The RSUs vests annually in three equal tranches, with the first tranche vesting on May 17, 2023, the second tranche vesting on May 17, 2024, and the last tranche vesting on May 17, 2025 |

| (5) | The first quarter of the options vested on December 21, 2022, with the remaining three-fourths of the options vesting over the next 36 months on each monthly anniversary date of the vesting date. |

| (6) | The RSUs vests annually in three equal tranches, with the first tranche vesting on September 29, 2023, the second tranche vesting on September 29, 2024, and the last tranche vesting on September 29, 2025. |

14

Benefit Plans

We maintain a defined contribution employee retirement plan, or 401(k) plan, for our full-time employees. Our named executive officers are eligible to participate in the 401(k) plan on the same basis as our other full-time employees, if they are considered an employee and not a consultant. The 401(k) plan is intended to qualify as a tax-qualified plan under Section 401(k) of the Internal Revenue Code. The 401(k) plan provides that each participant may make pre-tax deferrals from his or her compensation up to the statutory limit, which is $20,500 for calendar year 2022, and other testing limits. Participants that are 50 years or older can also make “catch-up” contributions, which in calendar year 2020 may be up to an additional $6,500 above the statutory limit. Participant contributions are held and invested, pursuant to the participant’s instructions, by the plan’s trustee.

We have no pension, or profit-sharing programs for the benefit of directors, officers or other employees, but our officers and directors may recommend adoption of one or more such programs in the future. We do not sponsor any qualified or non-qualified pension benefit plans, nor do we maintain any non-qualified defined contribution or deferred compensation plans.

Employment Agreements

We have entered into written employment agreements with our executive officers. All of these agreements contain customary provisions regarding noncompetition, confidentiality of information and assignment of inventions. However, the enforceability of the noncompetition provisions may be limited under applicable law.

Chief Executive Officer

Employment Agreement with Mr. Tuvia Barlev

On February 15, 2015, we entered into an at-will employment agreement with Mr. Tuvia Barlev, which remains in effect as of the date of this Schedule 14A.

In May 2022, the Company approved an increase to Mr. Barlev’s salary, effective upon completion of the IPO, to $300,000 with performance bonuses of an additional $260,000. In addition, Mr. Barlev received a bonus of $125,000 following the IPO and will annually receive $500,000 of RSUs under the Company’s 2015 Plan.

Mr. Barlev’s employment agreement provides that that he will be entitled to severance if we terminate his employment without “Cause” (as defined in the employment agreement), if he terminates his employment for “Good Reason” (as defined in the employment agreement), or following his death or permanent disability. In any event in which Mr. Barlev is entitled to severance pursuant to these provisions, we shall continue to pay Mr. Barlev his then-in-effect base salary and provide benefit continuation at our expense for a period of six months from the date of termination of employment. Any severance payable to Mr. Barlev shall be payable in equal instalments in the same manner and in our regular payroll cycle as other salaried executive employees are paid.

Consultant Agreement with Barlev Enterprises Inc.

In February 2015, we entered into a consulting agreement with Barlev Enterprises Inc., a company owned by Mr. Tuvia Barlev, our Chief Executive Officer, and his wife, Nurit Barlev, or the Barlev Consulting Agreement. Pursuant to the Barlev Consulting Agreement, Barlev Enterprises Inc. provides services to us as an independent contractor, and receives a monthly retainer of $2,083 for these services. The Barlev Consulting Agreement contains provisions regarding noncompetition, non-solicitation, confidentiality of information and assignment of inventions. The enforceability of the noncompetition covenants is subject to certain limitations. The Barlev Consulting Agreement will continue to be in full force and effect unless otherwise terminated in accordance with its terms. The Barlev Consulting Agreement may be terminated by either party, with or without cause, at any time upon six (6) months advance written notice to the other party. This agreement has terminated following the IPO.

15

Promissory Note with Tuvia Barlev

On February 20, 2015, we made a loan to our Chief Executive Officer, Mr. Tulia Barlev, in the principal amount of $106,290, which loan was evidenced by a secured, non-negotiable promissory note, or the Barlev Note. In April 2022, we entered into a Securities Purchase and Loan Repayment Agreement with Mr. Barlev, pursuant to which Mr. Barlev sold to the Company 27,699 shares for a purchase price equal to $4.55 per share for an aggregate purchase consideration of $126,023, or the Purchase Consideration. In lieu of paying Mr. Barlev the Purchase Consideration for the shares in cash, the Purchase Consideration was used to repay in full the outstanding loan amount and accrued interest owed to the Company by Mr. Barlev, and the Barlev Note was terminated.

Chief Financial Officer

Employment Agreements with Mr. Yoav Efron

In December 2017, we entered into an at will employment agreement with our Chief Financial Officer, Mr. Yoav Efron, and he entered into another, separate, at will employment agreement with our subsidiary. Both of these agreements remain in effect as of the date of this Schedule 14A.

In May 2022, the Company approved an increase to Mr. Efron’s salary, effective upon completion of the IPO, to $187,000 through both employment agreements (which the subsidiary agreement is effected by the currency exchange rates) with performance bonuses of an additional $50,000. In addition, Mr. Efron received a one-time $85,000 bonus upon completion of the IPO and will annually receive $100,000 of RSUs.

Mr. Efron employment agreements provide that that he will be entitled to severance if we terminate his employment without “Cause” (as defined in the employment agreements), if he terminates his employment for “Good Reason” (as defined in the employment agreements), we shall continue to pay Mr. Efron his then-in-effect base salary and provide benefit continuation at our expense for a period of six months from the date of termination of employment following an acquisition of us. Any severance payable to Mr. Efron shall be payable in equal instalments in the same manner and in our regular payroll cycle as other salaried executive employees are paid.

Jan Ruderman

On November 12, 2021, we entered into an at-will employment agreement with Mr. Jan Ruderman. Effective March 24, 2023, Mr. Ruderman departed from his position with the Company.

Mr. Ruderman received a base salary of $150,000 per year. Mr. Ruderman is also eligible to earn an annual sales incentive compensation at a target of $150,000 subject to sales performance and achievement. For the first six months of employment. Mr. Ruderman was guaranteed 80% of such annual sales incentive compensation to be trued up December 31, 2022, subject to the discretion of the CEO. Mr. Ruderman is eligible to receive options to purchase 65,217 shares, subject to approval of the board of directors.

16

Director Compensation

Our Board adopted a non-employee director compensation policy pursuant to which each of our directors who is not an employee or consultant of our company will be eligible to receive an annual cash retainer of $10,000 for his or her service on our board of directors and an annual cash retainer of $2,000 for his or her service on a committee of our board of directors, with the chairperson of each committee receiving an additional $3,000 annually. Additionally, following the IPO, as compensation for serving on the Board, Dr. Naama Halevi-Davidov, Israel Niv, Noemi Schmayer and Joseph Moscovitz were each granted 25,000 RSUs, of which shall fully vest over 36 months, subject to each member’s continued service on the Board.

Our directors are and will continue to be reimbursed by us for any out-of-pocket expenses incurred in connection with activities conducted on our behalf. The compensation of Mr. Barlev as a named executive officer is set forth in the section above; he does not receive any additional compensation for his service as the Chairman of the Board.

For the year ended 2022, our non-employee directors were compensated as follows in the table below:

| Name | Year | Fees Earned or Paid in Cash ($) | Option Awards ($) | All Other Compensation ($) | Total ($) | |||||||||||||||

| Israel Niv | 2022 | $ | 11,816 | - | $ | 48,750 | $ | 60,566 | ||||||||||||

| Dr. Naama Halevi-Davidov(1)(2) | 2022 | 11,816 | - | 48,750 | $ | 60,566 | ||||||||||||||

| Joseph Moscovitz | 2022 | $ | 10,614 | - | $ | 48,750 | $ | 59,364 | ||||||||||||

| Noemi Schmayer | 2022 | $ | 9,959 | - | $ | 48,750 | $ | 58,709 | ||||||||||||

Director and Officer Liability Insurance

We have purchased following the IPO our director and officer liability insurance that provides financial protection for our directors and officers in the event that they are sued in connection with the performance of their services and also provides employment practices liability coverage, which insures for harassment and discrimination suits

17

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Except as specifically noted, the following table sets forth information with respect to the beneficial ownership of our Common Stock as of July 5, 2023 of:

| ● | each of our directors and executive officers; and | |

| ● | each person known to us to beneficially own 5% of our Common Stock on an as-converted basis. |

The calculations in the table are based on 1,952,975 common shares issued and outstanding as of June 26, 2023. All amounts are reflective of the Reverse Stock Split.

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, we have included shares that the person has the right to acquire within 60 days, including through the exercise of any option, warrant or other right or the conversion of any other security. These shares, however, are not included in the computation of the percentage ownership of any other person.

Unless otherwise indicated, the address for each beneficial owner listed in the table below is c/o Actelis Networks, Inc., 4039 Clipper Court, Fremont, CA 94538.

| Name of Beneficial Owner (1) | No. of Shares Beneficially Owned | % of Class | ||||||

| Tuvia Barlev (2) | 165,706 | 8.48 | % | |||||

| Yoav Efron (3) | 13,035 | * | ||||||

| Eyal Aharon (4) | 3,967 | * | ||||||

| Yaron Altit (5) | 10,700 | * | ||||||

| Michal Winkler-Solomon (6) | 4,042 | * | ||||||

| Hemi Kabir (7) | 4,731 | * | ||||||

| Israel Niv (8) | 67,640 | 3.46 | % | |||||

| Elad Domanovitz (9) | 5,230 | * | ||||||

| Noemi Schmayer (10) | 834 | - | ||||||

| Joseph Moscovitz (11) | 834 | - | ||||||

| Dr. Naama Halevi-Davidov (12) | 834 | - | ||||||

| All executive officers and directors as a group (11 persons) | 277,553 | 14.21 | % | |||||

| 5% Stockholders | ||||||||

| Armistace Capital Master Fund, Ltd. | 193,345 | 9.99 | % | |||||

| Isard Dunietz (10) | 114,787 | 5.88 | % | |||||

| * | Less than 1% |

| (1) | Unless otherwise noted, the business address of the following entities or individuals is 4039 Clipper Court, Fremont, CA 94538. |

| (2) | Consists of (i) 161,539 shares of common stock held by Mr. Barlev (ii) 4,167 shares of common stock issuable upon the exercise of options issued to Mr. Barlev which options are exercisable within 60 days from June 26, 2023. |

| (3) | Consists of (i) 323 shares of common stock held by Mr. Efron (ii) 12,712 shares of common stock issuable upon the exercise of options issued to Mr. Efron which options are exercisable within 60 days from June 26, 2023. |

| (4) | Includes 3,967 shares of common stock issuable upon the exercise of options issued to Mr. Aharon which options are exercisable within 60 days from June 26, 2023. |

| (5) | Includes 10,700 shares of common stock issuable upon the exercise of options issued to Mr. Altit which options are exercisable within 60 days from June 26, 2023. |

18

| (6) | Includes 4,042 shares of common stock issuable upon the exercise of options issued to Ms. Winkler Solomon which options are exercisable within 60 days from the June 26, 2023. |

| (7) | Includes 4,731 shares of common stock issuable upon the exercise of options issued to Mr. Kabir which options are exercisable within 60 days from June 26, 2023. |

| (8) | Consists of (i) 45,856 shares of common stock held by The Niv Family Trust, for which the Reporting Person and his spouse serve as trustees; (ii) 13,939 shares of common stock held by Sharon Hava Niv 2015 Family Trust for which Mr. Niv and his spouse serve as trustee; and (iii) 7,845 shares of common stock issuable upon the exercise of options issued to Mr. Niv which options are exercisable within 60 days from June 26, 2023. |

| (9) | Includes 5,230 shares of common stock issuable upon the exercise of options issued to Mr. Domanovitz which options are exercisable within 60 days from June 26, 2023. |

| (10) | Includes 834 shares of common stock issuable upon the exercise of options issued to Ms. Schmayer which options are exercisable within 60 days from June 26, 2023. |

| (11) | Includes 834 shares of common stock issuable upon the exercise of options issued to Mr. Moscovitz which options are exercisable within 60 days from June 26, 2023. |

| (12) | Includes 834 shares of common stock issuable upon the exercise of options issued to Dr. Halevi-Davidov which options are exercisable within 60 days from June 26, 2023. |

| (13) | The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”), and may be deemed to be indirectly beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Investor; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. Armistice Capital and Steven Boyd disclaim beneficial ownership of the securities except to the extent of their respective pecuniary interests therein. The business address of the Master Fund is c/o Armistice Capital, LLC, 510 Madison Ave, 7th Floor, New York, NY 10022. |

| (14) | Mr. Dunietz’s address is 638 La Selle Place, Highland Park IL 60035. |

Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth information as of December 31, 2022 with respect to our compensation plans under which equity securities may be issued.

| Plan Category | Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights | Weighted- Average Exercise Price of Outstanding Options, Warrants and Rights | Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders: | ||||||||||||

| 2015 Equity Incentive Plan (1) | 155,659 | $ | 0.1476 | 115,259 | ||||||||

| Equity compensation plans not approved by security holders | - | - | - | |||||||||

| Total | 155,659 | $ | 0.1476 | 115,259 | ||||||||

| (1) | The weighted average exercise price relates to the options only. RSUs were excluded as they have no exercise price. |

19

2015 Equity Incentive Plan

The 2015 Equity Incentive Plan, or the Plan, was adopted by our Board, on May 10, 2015. The Plan provides for the grant of equity-based incentive awards to our employees, directors, and consultants in order to incentivize them to increase their efforts on behalf of our Company and to promote the success of our business.

Authorized Shares. As of the date of this Schedule 14A, there are 115,259 options to purchase shares of common stock reserved and available for grant under the Plan. Common stock subject to options granted under the Plan that expire or become unexercisable without having been exercised in full will become available again for future grant or sale under the Plan.

Administration. The Board, or a duly authorized committee of the Board, administers the Plan, or the Administrator. Under the Plan, the Administrator has the authority, subject to applicable law, to interpret the terms of the Plan and any award agreements or awards granted thereunder, designate recipients of awards, determine and amend the terms of awards, including the exercise price of an option award, the fair market value of a share, the time and vesting schedule applicable to an award or the method of payment for an award, accelerate or amend the vesting schedule applicable to an award, prescribe the forms of agreement for use under the Plan and take all other actions and make all other determinations necessary for the administration of the 2015 Plan.

The administrator also has the authority to approve the conversion, substitution, cancellation or suspension under and in accordance with the Plan of any or all awards, and the authority to modify outstanding awards unless otherwise provided by the terms of the Plan.

The administrator may adopt special appendices and/or guidelines and provisions for persons who are residing in or employed in, or subject to, the taxes of, any domestic or foreign jurisdictions, to comply with applicable laws, regulations, or accounting, listing or other rules with respect to such domestic or foreign jurisdictions.

Eligibility. The Plan provides for granting awards under various tax regimes, including, without limitation, in compliance with Section 102 of the Ordinance and Section 3(i) of the Ordinance and for awards granted to our United States employees or service providers, including those who are deemed to be residents of the United States for tax purposes, Section 422 of the Code and Section 409A of the Code.

Grants. All awards granted pursuant to the Plan will be evidenced by an award agreement. Award agreements need not be in the same form and may differ in the terms and conditions included therein. The award agreement will set forth the terms and conditions of the award, including the type of award, number of shares subject to such award, vesting schedule and conditions, the exercise price, if applicable, the date of expiration of the award, any special terms applying to such award (if any), including the terms of any country-specific or other applicable appendix, as determined by our board of directors.

Awards. The Plan provides for the grant of stock options, Nonstatutory Stock Options, Stock Appreciation Rights, Restricted Stock and Restricted Stock Units.

With respect to options granted under the Plan, unless otherwise determined by the administrator, and subject to the conditions of the Plan, options vest and become exercisable, if applicable, under the following schedule: 25% of the shares covered by the option on the first anniversary of the vesting commencement date determined by the administrator (and in the absence of such determination, the date on which such option was granted) and 6.25% of the shares covered by the option at the end of each subsequent three-month period thereafter over the course of the following three years; provided that the grantee remains continuously as an employee or provides services to our company and our affiliates throughout such vesting dates.

Each option will expire ten years from the date of the grant thereof, unless such shorter term of expiration is otherwise designated by the administrator or required by applicable law.

Options under the Plan may be exercised by providing our company with a notice of exercise and full payment of the exercise price for such shares underlying the option, if applicable, in such form and method as may be determined by the administrator and permitted by applicable law. An option may not be exercised for a fraction of a share. If the Company’s shares are listed for trading on any securities exchange, and if the administrator so determines, all or part of the exercise price and any withholding taxes may be paid by the delivery of an irrevocable direction to a securities broker approved by our company to sell shares and to deliver all or part of the sales proceeds to our company or the trustee, or, the delivery of an irrevocable direction to pledge shares to a securities broker or lender approved by our company, as security for a loan, and to deliver all or part of the loan proceeds to our company, or such other method of payment acceptable to our company as determined by the administrator.

20

Transferability. Other than by will, the laws of descent and distribution or as otherwise provided under the Plan, the awards and shares granted under the 2015 Plan are not assignable or transferable, unless determined otherwise by the Administrator in which case such Award may only be transferred as permitted by Rule 701 of the Securities Act of 1933.

Termination of Relationship. In the event of termination of a grantee’s employment or service with our company, all vested and exercisable options held by such grantee as of the date of termination may be exercised within ninety days after such date of termination, unless otherwise determined by the administrator, but in no event later than the date of expiration of the option as set forth in the award agreement. After such ninety-day period, all such unexercised options will terminate, and the shares covered by such options shall again be available for issuance under the Plan.

In the event of termination of a grantee’s employment or service with our company or any of our affiliates due to such grantee’s death or permanent disability, all vested and exercisable options held by such grantee as of the date of termination may be exercised by the grantee or the grantee’s legal guardian, estate or by a person who acquired the right to exercise the options by bequest or inheritance, as applicable, within 12 months after such date of termination, unless otherwise provided by the administrator, but in no event later than the date of expiration of the option as set forth in the award agreement. Any options which are unvested as of the date of such termination or which are vested but not then exercised within the 12-month period following such date, will terminate and the shares covered by such options shall again be available for issuance under the Plan.

All restricted shares still subject to restriction under the applicable restriction period as set by the administrator in the applicable award agreement, lapsed will revert to the Company and again will become available for grant under the Plan.

Rights as a stockholder. Subject to terms of the Plan, a grantee shall have no rights as a stockholder of our company with respect to any shares covered by an award until the grantee shall have exercised the award and paid the exercise price therefor, if applicable, and becomes the record holder of the subject shares.

Transactions. Shares subject to an award, as well as the price per share covered by each outstanding award, shall be proportionately adjusted for any increase or decrease in the number of issued shares resulting from a share split, reverse share split, combination or reclassification of the shares, or any other increase or decrease in the number of issued shares effected without receipt of consideration by our company, provided, however, that the Administrator will make such adjustments to an Award required by Section 25102(o) of the California Corporations Code to the extent the Company is relying upon the exemption afforded thereby with respect to the Award.

In the event of a merger or Change in Control, each outstanding Award will be treated as the Administrator determines without a Participant’s consent, including, without limitation, that either (i) Awards will be assumed, or substantially equivalent Awards will be substituted, by the acquiring or succeeding corporation (or an affiliate thereof) with appropriate adjustments as to the number and kind of shares and prices; (ii) upon written notice to a Participant, that the Participant’s Awards will terminate upon or immediately prior to the consummation of such merger or Change in Control (subject to the provisions of the paragraph above); (iii) outstanding Awards will vest and become exercisable, realizable, or payable, or restrictions applicable to an Award will lapse, in whole or in part prior to or upon consummation of such merger or Change in Control, and, to the extent the Administrator determines, terminate upon or immediately prior to the effectiveness of such merger of Change in Control; (iv) (A) the termination of an Award in exchange for an amount of cash and/or property, if any, equal to the amount that would have been attained upon the exercise of such Award or realization of the Participant’s rights as of the date of the occurrence of the transaction (and, for the avoidance of doubt, if as of the date of the occurrence of the transaction the Administrator determines in good faith that no amount would have been attained upon the exercise of such Award or realization of the Participant’s rights, then such Award may be terminated by the Company without payment), or (B) the replacement of such Award with other rights or property selected by the Administrator in its sole discretion; or (v) any combination of the foregoing or other alternative not listed hereinabove. In taking any of the actions permitted under this subsection, the Administrator will not be obligated to treat all Awards, all Awards held by a Participant, or all Awards of the same type, similarly. In the event of liquidation or winding up of our company, the administrator will notify each Participant as soon as practicable prior to the effective date of such proposed transaction. To the extent it has not been previously exercised, an Award will terminate immediately prior to the consummation of such proposed action.

21

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The following includes a summary of transactions since January 1, 2021 to which we have been a party in which the amount involved exceeded $120,000 or one percent of the average of our total assets at year-end for the last two completed fiscal years, and in which any of our directors, executive officers or, to our knowledge, beneficial owners of more than 5% of our capital stock or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest, other than equity and other compensation, termination, change in control and other arrangements, which are described under “Executive and Director Compensation.”

Services Agreement with Ram Vromen

On December 27, 2021, we entered into a service agreement with Dr. Ram Vromen, our former director, or the Vromen Services Agreement. Under the terms of the Vromen Services Agreement, Dr. Vromen provides services to us as an independent contractor. The services include advising us and aiding in fundraising, assisting with presentations and providing follow-up, negotiating deals, legal assistance. We agreed to pay the outstanding amount for unpaid services rendered by Dr. Vromen during the period between February 15, 2015, and ending on December 31, 2019, of $197,500 plus VAT, or the Outstanding Fees. Pursuant to the Vromen Services Agreement, Dr. Vromen will also be entitled to additional fees in the amount of $150,000, plus VAT as follows: Dr. Vromen will receive (1) $100,000 upon the earlier to occur of (i) the closing of a financing round by us of at least $2.0 million and (ii) achievement of at least $3.0 million in EBITDA as reported by us, which fee was paid to Dr. Vromen in January 2022 following the closing of our private placement, and (2) $50,000 upon the earlier to occur of (i) the closing of a financing round by us of at least $4.0 million and (ii) achievement of at least $3.0 million in EBITDA as reported by us. In the event that we reach the second of the milestones set forth above and Dr. Vromen is entitled to receive such additional fees, then we will pay to Dr. Vromen all of the Outstanding Fees, together with the payment of such additional fees, provided that we may pay any and all of the Outstanding Fees in several installments over a period not to exceed twenty-four (24) months from achievement of the applicable milestone.

Related Party Transaction Policy

We have adopted in our Code of Ethics a formal, written policy that our executive officers, directors (including director nominees), holders of more than 5% of any class of our voting securities and any member of the immediate family of or any entities affiliated with any of the foregoing persons, are not permitted to enter into a related party transaction with us without the prior approval or, in the case of pending or ongoing related party transactions, ratification of our audit committee. For purposes of our policy, a related party transaction is a transaction, arrangement or relationship where we were, are or will be involved and in which a related party had, has or will have a direct or indirect material interest.

Certain transactions with related parties, however, are excluded from the definition of a related party transaction including, but not limited to:

| ● | transactions involving the purchase or sale of products or services in the ordinary course of business, not exceeding $20,000; |

| ● | transactions where a related party’s interest derives solely from his or her service as a director of another entity that is a party to the transaction; |

| ● | transactions where a related party’s interest derives solely from his or her ownership of less than 10% of the equity interest in another entity that is a party to the transaction; and |

| ● | transactions where a related party’s interest derives solely from his or her ownership of a class of our equity securities and all holders of that class received the same benefit on a pro rata basis. |

22

No member of the Audit Committee may participate in any review, consideration or approval of any related party transaction where such member or any of his or her immediate family members is the related party. In approving or rejecting the proposed agreement, our Audit Committee shall consider the relevant facts and circumstances available and deemed relevant by the Audit Committee, including, but not limited to:

| ● | the benefits and perceived benefits to us; |

| ● | the materiality and character of the related party’s direct and indirect interest; |