Exhibit 99.1

Applying the Science of Networking Enabling Cybersecure, Rapid Networking for All IoT “Things” and Locations For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please see full disc los ures.

Disclaimer This Presentation is not an Offer or a Representation This Presentation does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or o the r specific product, or a solicitation of any vote or approval, nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such o ffe r, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The information contained herein does no t p urport to be all - inclusive and Actelis nor any of its subsidiaries, stockholders, affiliates, representatives, control persons, partners, members, managers, directors, offi cer s, employees, advisers or agents make any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. You should consult with your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying solely upon the information contained herein to make any investment decision. The recipient shall no t r ely upon any statement, representation or warranty made by any other person, firm or corporation in making any investment decision. To the fullest extent permitted by law , in no circumstances will the Company or any of its subsidiaries, stockholders, affiliates, representatives, control persons, partners, members, managers, director s, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentat ion , its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith . The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or fi nan cial needs. Nothing in this Presentation should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or th at any of the contemplated results of such forward - looking statements will be achieved. Financial Information and Use of Non - GAAP Financial Measures. The financial information contained in this Presentation has been taken from or prepared based on our historical financial st ate ments for the periods presented. This presentation includes certain non - GAAP financial measures. These non - GAAP measures are an addition, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to their nearest GAAP equivalent or any other performance measures derived in accordance with GAAP. We believe that these non - GAAP measures of financial results provide useful supplemental inform ation to investors about Actelis. Our management uses forward - looking non - GAAP measures to evaluate our projected financials and operating performance. However, there are a number of limitations related to the use of these non - GAAP measures and their nearest GAAP equivalents. In addition, other companies may calculate non - GAAP measures differently, or may use other measures to calculate their financial performance, and therefore, our non - GAAP measures may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward - looking non - GAAP financial measures are provided, they are presented on a no n - GAAP basis without reconciliations of such forward looking non - GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are ne cessary for such reconciliations. Past performance is not indicative of future results. There is no guarantee that any specific objective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. See disclosures at the beginning. 2

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Risk Factors Our business and our ability to execute our business strategy are subject to a number of risks as more fully described in the se ction titled “Risk Factors” of the preliminary prospectus filed with the SEC. These risks include, among others: • We have a history of net losses, may incur substantial net losses in the future, and may not achieve or sustain profitability or growth in future periods . If we cannot achieve and sustain profitability, our business, financial condition, and operating results will be adversely affected . • We have had negative cash flow and, given our projected funding needs, our ability to generate positive cash flow is uncertain . • Our financial statements contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all . • Even after consummation of the offering as contemplated, we may need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute our stockholders’ ownership interests . • Our indebtedness could adversely affect our ability to raise additional capital to fund operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting our financial obligations . • To support our business growth, in the past years we increased our focus on serving certain IoT verticals, while continuing to serve our existing Telco customers . This change in our strategy may make it more difficult to evaluate our business growth and future prospects, and may increase the risk that we will not be successful in our plans . • We may have ineffective sales and marketing efforts . • We are dependent on the supply of electronic and mechanical components and our business would be harmed if we do not receive sufficient supply of such components in number and performance to meet our production requirements and product specifications in a timely and cost - effective manner . • We are dependent on key suppliers . • Demand for our products and solutions may not grow or may decline . • Our gross margins may not increase or may deteriorate . • Changes in the price and availability of our raw materials and shipping could be detrimental to our profitability . • Expanding our operations and marketing efforts to meet expected growth may impact profitability if actual growth is less than expected . • If our internal Company cyber - security measures are breached or fail and unauthorized access is obtained to our IT environment, we may incur significant losses of data, which we may not be able to recover and may experience a delay in our ability to conduct our day - to - day business . 3

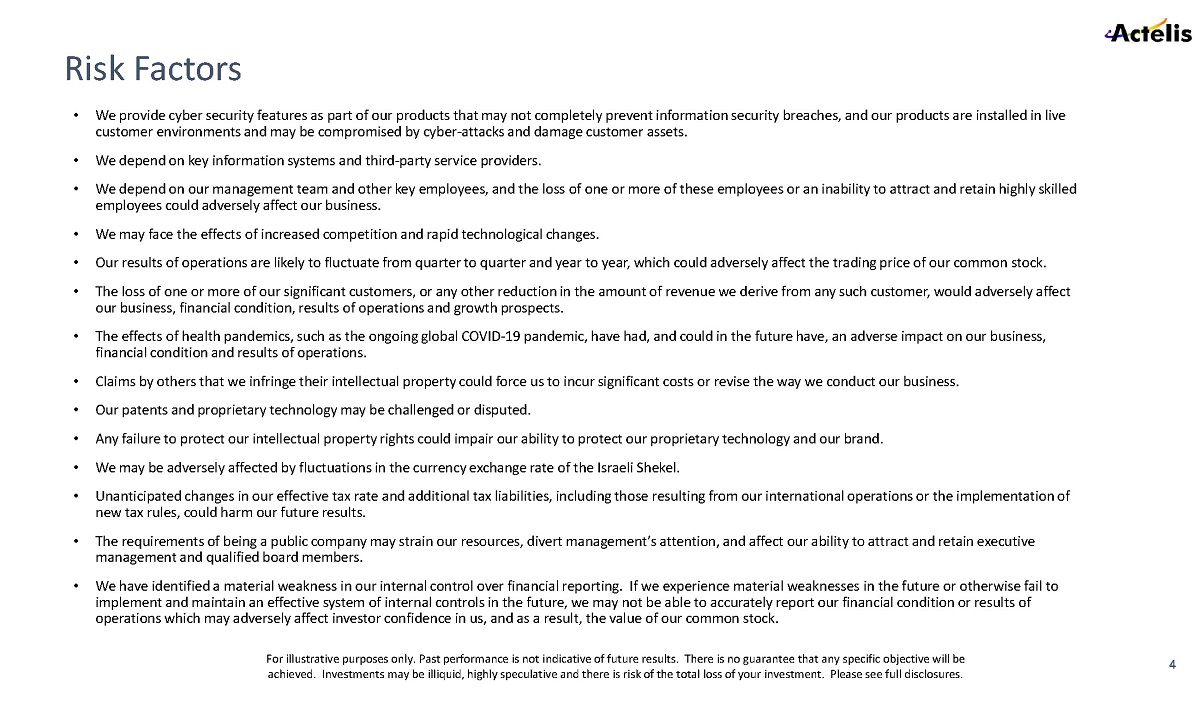

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Risk Factors • We provide cyber security features as part of our products that may not completely prevent information security breaches, and ou r products are installed in live customer environments and may be compromised by cyber - attacks and damage customer assets. • We depend on key information systems and third - party service providers. • We depend on our management team and other key employees, and the loss of one or more of these employees or an inability to a ttr act and retain highly skilled employees could adversely affect our business. • We may face the effects of increased competition and rapid technological changes. • Our results of operations are likely to fluctuate from quarter to quarter and year to year, which could adversely affect the tra ding price of our common stock. • The loss of one or more of our significant customers, or any other reduction in the amount of revenue we derive from any such cu stomer, would adversely affect our business, financial condition, results of operations and growth prospects. • The effects of health pandemics, such as the ongoing global COVID - 19 pandemic, have had, and could in the future have, an adverse impact on our business, financial condition and results of operations. • Claims by others that we infringe their intellectual property could force us to incur significant costs or revise the way we con duct our business. • Our patents and proprietary technology may be challenged or disputed. • Any failure to protect our intellectual property rights could impair our ability to protect our proprietary technology and ou r b rand. • We may be adversely affected by fluctuations in the currency exchange rate of the Israeli Shekel. • Unanticipated changes in our effective tax rate and additional tax liabilities, including those resulting from our internatio nal operations or the implementation of new tax rules, could harm our future results. • The requirements of being a public company may strain our resources, divert management ’ s attention, and affect our ability to attract and retain executive management and qualified board members. • We have identified a material weakness in our internal control over financial reporting. If we experience material weaknesse s i n the future or otherwise fail to implement and maintain an effective system of internal controls in the future, we may not be able to accurately report our fi nan cial condition or results of operations which may adversely affect investor confidence in us, and as a result, the value of our common stock. 4

FORWARD LOOKING STATEMENTS This Presentation contains forward - looking statements . In addition, from time to time, we or our representatives may make forward - looking statements orally or in writing . We base these forward - looking statements on our expectations and projections about future events, which we derive from the information currently available to us . Such forward - looking statements relate to future events or our future performance, including : our financial performance and projections ; our growth in revenue and earnings ; and our business prospects and opportunities . You can identify forward - looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “hopes” or the negative of these or similar terms . Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under the heading “Risk Factors” and elsewhere in the final prospectus, dated May 16 , 2022 that we have filed with the U . S . Securities and Exchange Commission in connection with our initial public offering . Forward - looking statements are only predictions . The forward - looking events discussed in this Presentation and other statements made from time to time by us or our representatives, may not occur, and actual events and results may differ materially and are subject to risks, uncertainties and assumptions about us . We are not obligated to publicly update or revise any forward - looking statement, whether as a result of uncertainties and assumptions, the forward - looking events discussed in this document and other statements made from time to time by us or our representatives might not occur . Past performance is not indicative of future results . There is no guarantee that any specific outcome will be achieved . Investments may be speculative, illiquid and there is a total risk of loss . Past performance is not indicative of future results. There is no guarantee that any specific objective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. See disclosures at the beginning. 5

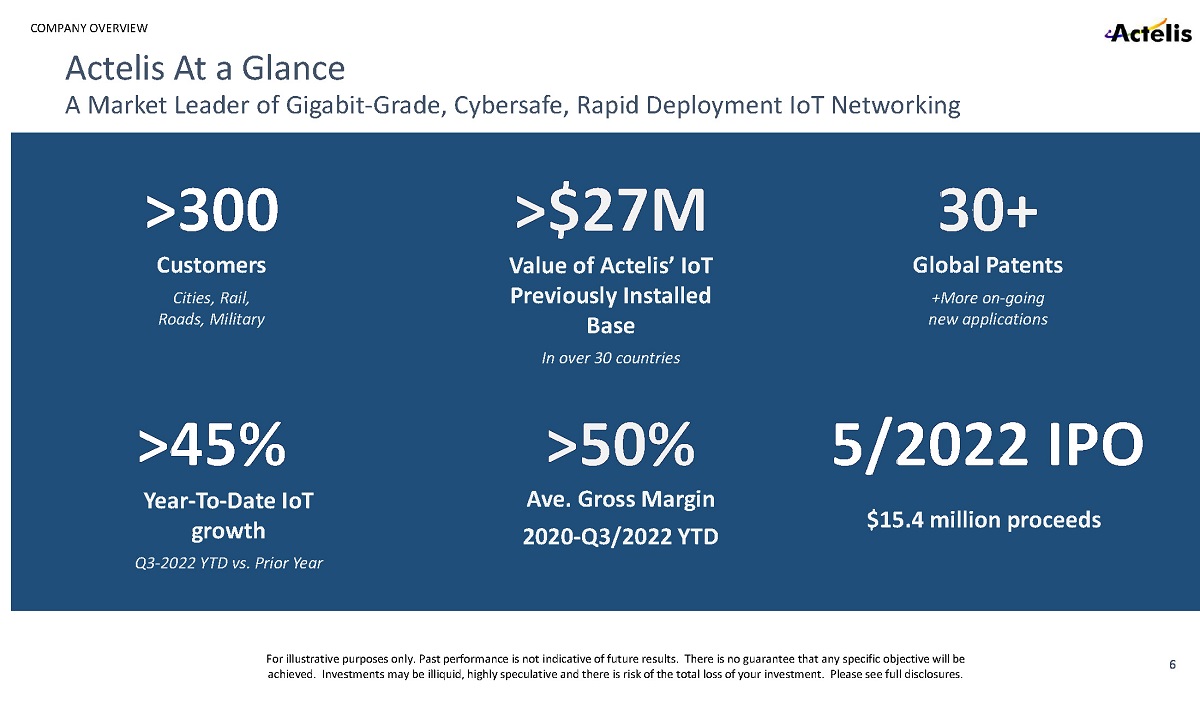

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Customers Cities, Rail, Roads, Military Value of Actelis ’ IoT Previously Installed Base In over 30 countries Global Patents +More on - going new applications Year - To - Date IoT growth Q 3 - 2022 YTD vs. Prior Year Ave. Gross Margin 2020 - Q3/2022 YTD $15.4 million proceeds 6 Actelis At a Glance A Marke t Leader of Gigabit - Grade, Cybersafe, Rapid Deployment IoT Networking

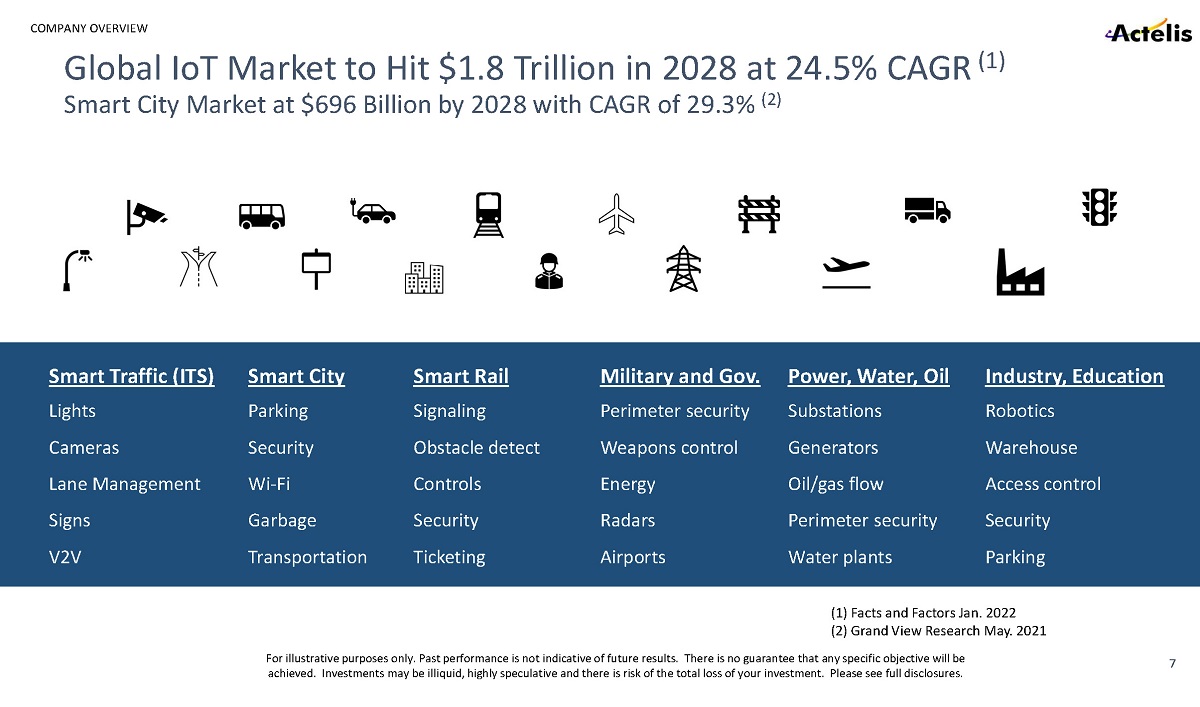

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. (1) Facts and Factors Jan. 2022 (2) Grand View Research May. 2021 Smart Traffic (ITS) Smart City Smart Rail Military and Gov. Power, Water, Oil Industry, Education Lights Parking Signaling Perimeter security Substations Robotics Cameras Security Obstacle detect Weapons control Generators Warehouse Lane Management Wi - Fi Controls Energy Oil/gas flow Access control Signs Garbage Security Radars Perimeter security Security V2V Transportation Ticketing Airports Water plants Parking 7 Global IoT Market to Hit $1.8 Trillion in 2028 at 24.5% CAGR (1) Smart City Market at $696 Billion by 2028 with CAGR of 29.3% (2)

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. IoT Connectivity Modernization Needs Growing Exponentially • Billions of devices currently connected with copper cables Historically low speed, low reliability, not secure • New Fiber Optic cables are being installed Reliable, fast, but expensive and slow to deploy • Wireless is getting faster Historically very low speed, lowest reliability and security Major efforts to Securely Connect Tens of Millions of Locations at High - Speed 8

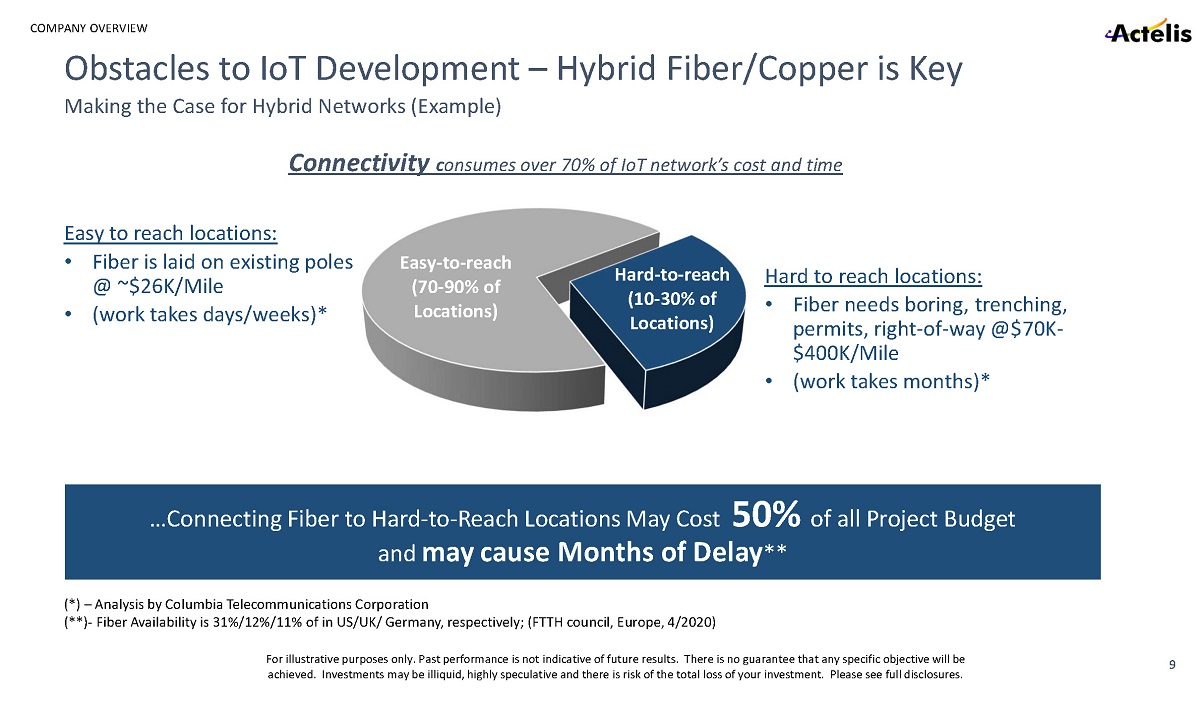

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Easy - to - reach (70 - 90% of Locations) Hard - to - reach ( 10 - 30 % of Locations) …Connecting Fiber to Hard - to - Reach Locations May Cost 50% of all Project Budget and may cause Months of Delay ** (*) – Analysis by Columbia Telecommunications Corporation (**) - Fiber Availability is 31%/12%/11% of in US/UK/ Germany, respectively; (FTTH council, Europe, 4/2020) Easy to reach locations: • Fiber is laid on existing poles @ ~$26K/Mile • (work takes days/weeks)* Hard to reach locations: • Fiber needs boring, trenching, permits, right - of - way @$70K - $400K/Mile • (work takes months)* Obstacles to IoT Development – Hybrid Fiber/Copper is Key 9 Making the Case for Hybrid Networks (Example) Connectivity c onsumes over 70 % of IoT network ’ s cost and time

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. 10 Extending Safe, Gigabit - Grade Connectivity over Fiber + Enhance Existing Wires Hybrid Architecture Makes Existing Network Part of the Digital Future Fiber is preferred for performance and reliability, but: • Can be very slow to deploy in many locations • May not be possible economically in many hard - to - reach locations Existing coax/wires connect billions of locations/devices and are instantly available at no cost, but: • Historically suffer from low speed and low reliability • Are unprotected from hacking and cyber attacks • Actelis ’ technology enhances wires securely to Gigabit - Grade Actelis’ Hybrid Fiber - Copper Networking Solutions are Combining the Best of Both: Providing Cyber - Safe, Gi g abit - Grade connectivity combining Fiber and enhanced existing wires Eliminating deployment obstacles in challenging locations Helping IoT projects converge on time and budget 1 1

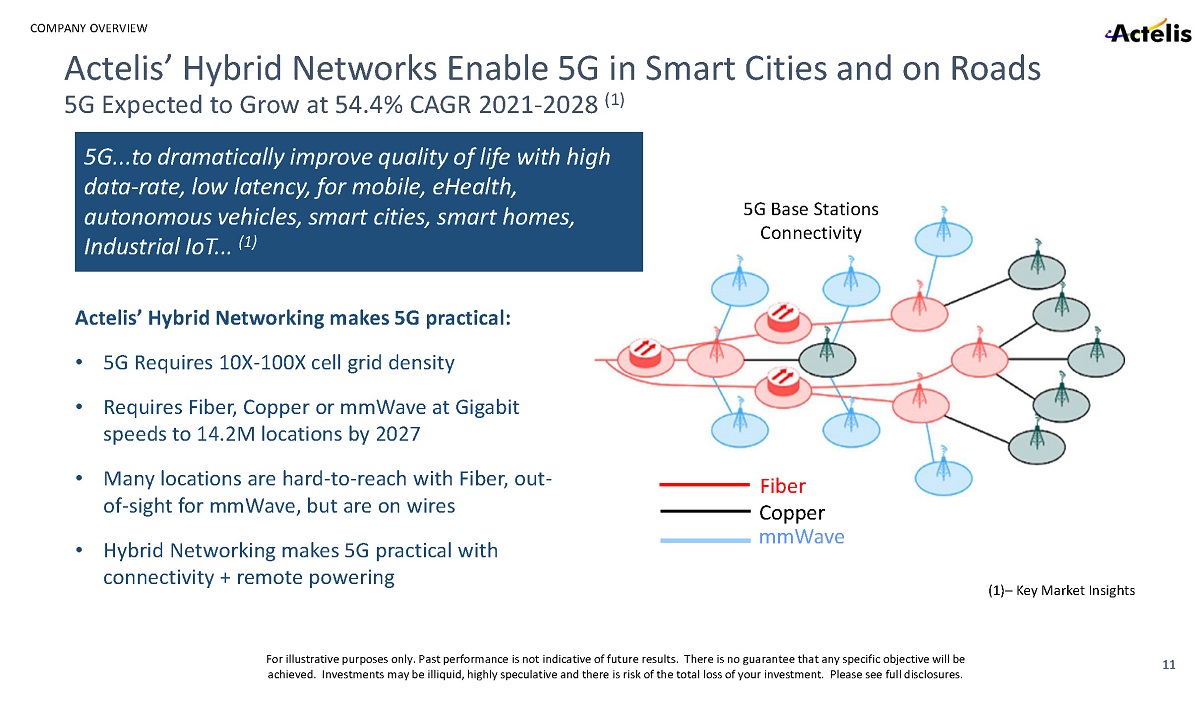

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Actelis’ Hybrid Networking makes 5G practical: • 5G Requires 10X - 100X cell grid density • Requires Fiber, Copper or mmWave at Gigabit speeds to 14.2M locations by 2027 • Many locations are hard - to - reach with Fiber, out - of - sight for mmWave , but are on wires • Hybrid Networking makes 5G practical with connectivity + remote powering Fiber Copper mmWave 5G Base Stations Connectivity 11 Actelis ’ Hybrid Networks Enable 5G in Smart Cities and on Roads 5G Expected to Grow at 54.4% CAGR 2021 - 2028 (1) (1) – Key Market Insights 5G...to dramatically improve quality of life with high data - rate, low latency, for mobile, eHealth, autonomous vehicles, smart cities, smart homes, Industrial IoT... (1)

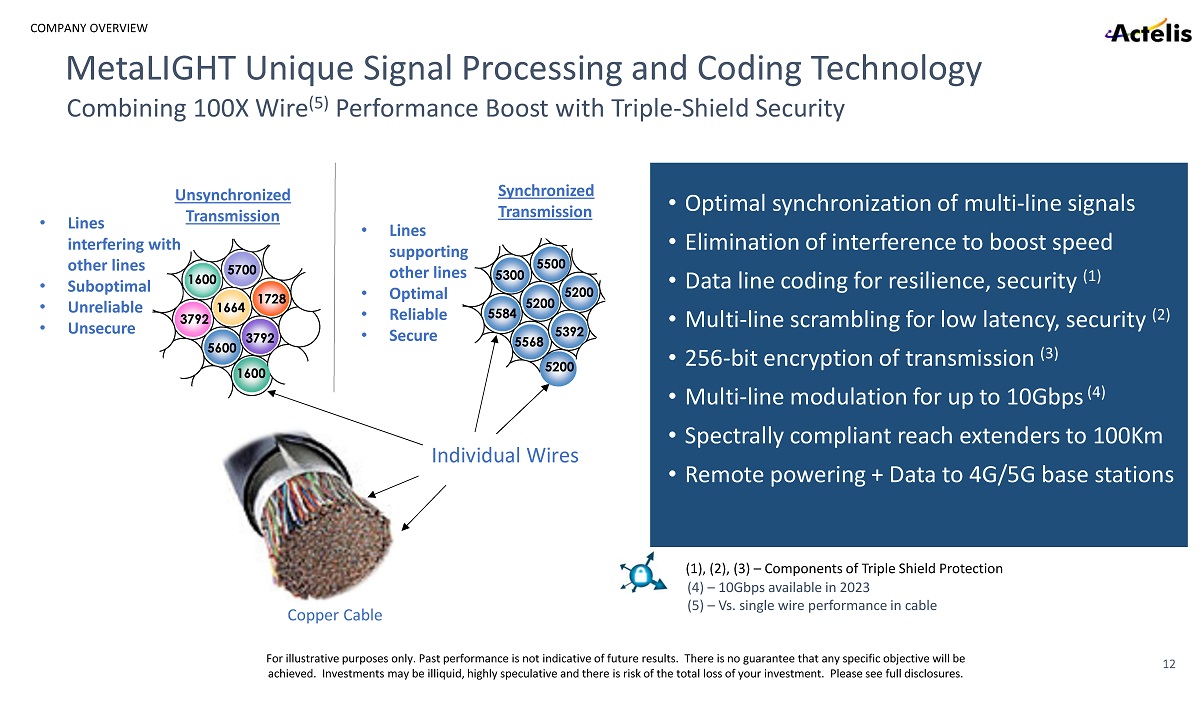

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. MetaLIGHT Unique Signal Processing and Coding Technology • Optimal synchronization of multi - line signals • Elimination of interference to boost speed • Data line coding for resilience, security (1) • Multi - line scrambling for low latency, security (2) • 256 - bit encryption of transmission (3) • Multi - line modulation for up to 10Gbps (4) • Spectrally compliant reach extenders to 100Km • Remote powering + Data to 4G/5G base stations (1), (2), (3) – Components of Triple Shield Protection 1728 1600 1664 5600 5700 3792 3792 1600 5568 5200 5300 5500 5584 5200 5392 5200 Unsynchronized Transmission • Lines supporting other lines • Optimal • Reliable • Secure Copper Cable • Lines interfering with other lines • Suboptimal • Unreliable • Unsecure Synchronized Transmission Individual Wires (4) – 10Gbps available in 2023 (5) – Vs. single wire performance in cable 12 Combining 100X Wire (5) Performance Boost with Triple - Shield Security

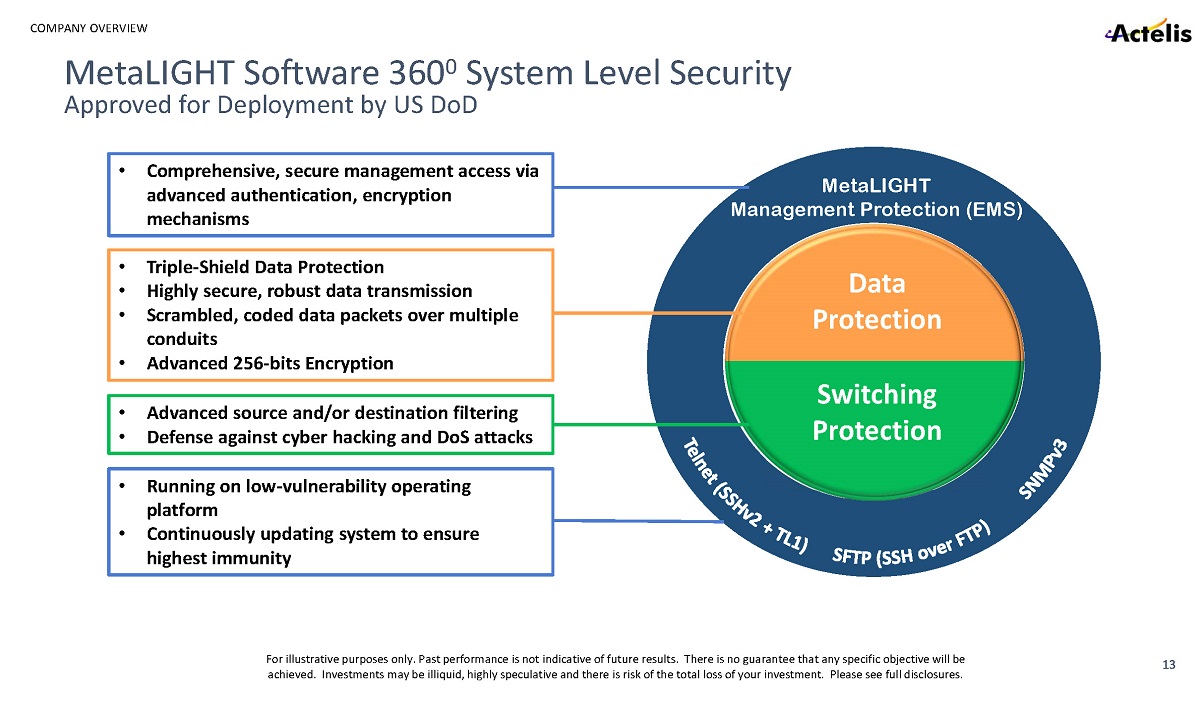

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. 13 MetaLIGHT Software 360 0 System Level Security Approved for Deployment by US DoD Data Protection Switching Protection MetaLIGHT Management Protection (EMS) • Comprehensive, secure management access via advanced authentication, encryption mechanisms • Advanced source and/or destination filtering • Defense against cyber hacking and DoS attacks • Triple - Shield Data Protection • Highly secure, robust data transmission • Scrambled, coded data packets over multiple conduits • Advanced 256 - bits Encryption • Running on low - vulnerability operating platform • Continuously updating system to ensure highest immunity

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Libraries Schools City Buildings Regional Medical Centers Colleges / Universities Remote Parking Lots Guard Stations Perimeter Security Railways Powerlines and Substations Gas, Oil, Water Pipelines Wi - Fi MetaLIGHT Series 14 Actelis’ MetaLIGHT Building Blocks Enable Seamless Hybrid Networks

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Stanford University City of Frankfurt Energy Austria Japanese Army SMART TRANSPORTATION SMART GRID SMART CITY SMART CAMPUS Gov, MILITARY & POLICE Canadian rail Swiss rail Belgian Police East Midland BB Consortium UK 15 Customers that Already Trust Actelis ’ Solutions

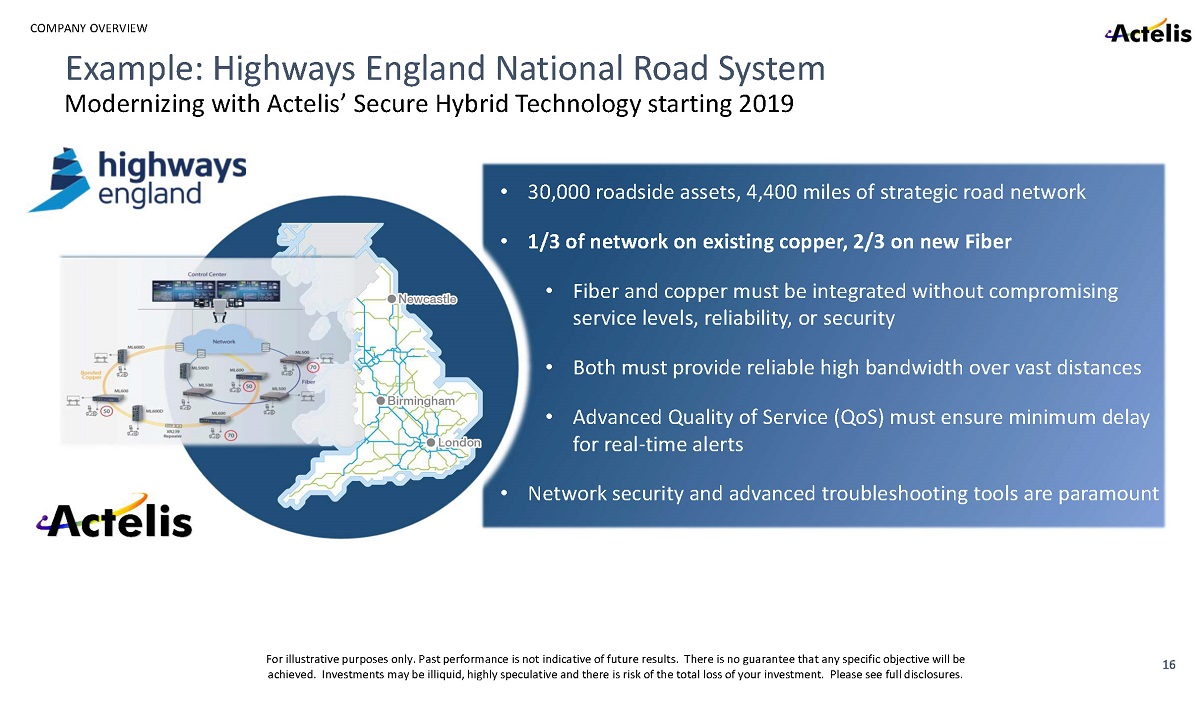

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. • 30,000 roadside assets, 4,400 miles of strategic road network • 1 / 3 of network on existing copper, 2 / 3 on new Fiber • Fiber and copper must be integrated without compromising service levels, reliability, or security • Both must provide reliable high bandwidth over vast distances • Advanced Quality of Service (QoS) must ensure minimum delay for real - time alerts • Network security and advanced troubleshooting tools are paramount 16 Modernizing with Actelis ’ Secure Hybrid Technology starting 2019 Example: Highways England National Road System

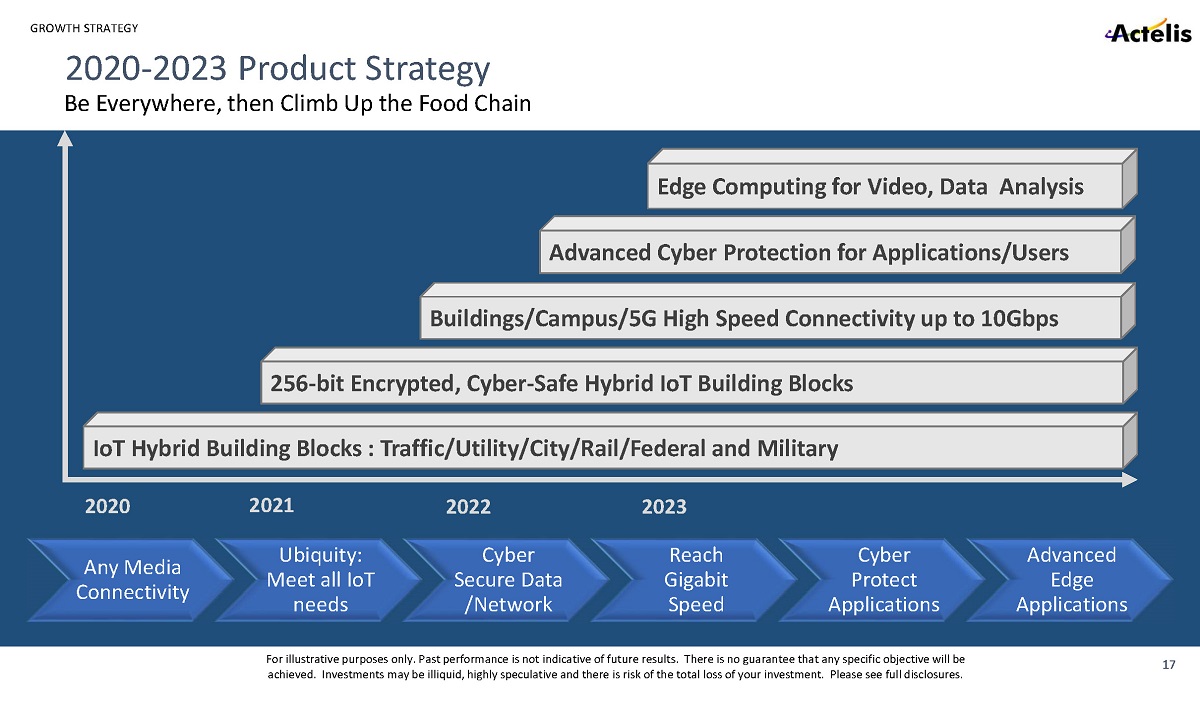

GROWTH STRATEGY For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. IoT Hybrid Building Blocks : Traffic/Utility/City/Rail/Federal and Military Edge Computing for Video, Data Analysis Advanced Cyber Protection for Applications/Users ϮϬϮϭ ϮϬϮϮ ϮϬϮϯ 256 - bit Encrypted, Cyber - Safe Hybrid IoT Building Blocks Buildings/Campus/ 5 G High Speed Connectivity up to 10 Gbps ϮϬϮ 0 Any Media Connectivity Ubiquity: Meet all IoT needs Cyber Secure Data /Network Reach Gigabit Speed Cyber Protect Applications Advanced Edge Applications 17 Be Everywhere, then Climb Up the Food Chain 2020 - 2023 Product Strategy

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. COMPETITIVE OVERVIEW 18 Leading Unique Real - Life Hybrid Offering Time/cost per bit Low High Low High Security Real Life Hybrid Networks Actelis ’ solutions offer significant competitive advantages in performance and security layers in both Fiber and copper. When combined into real - life hybrid copper - fiber networks, they offer higher security, faster deployment and lower cost. Our Real - Life Solutions Offer Significant Competitive Advantages

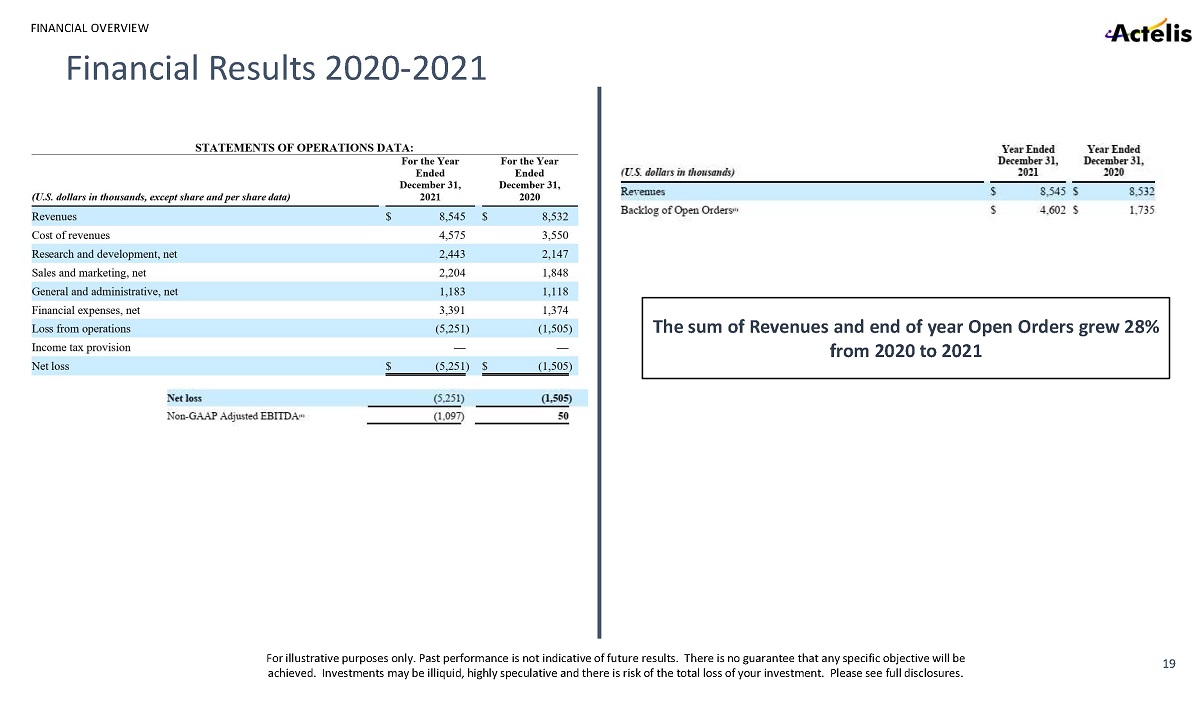

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. FINANCIAL OVERVIEW 19 Financial Results 2020 - 2021 The sum of Revenues and end of year Open Orders grew 28 % from 2020 to 2021

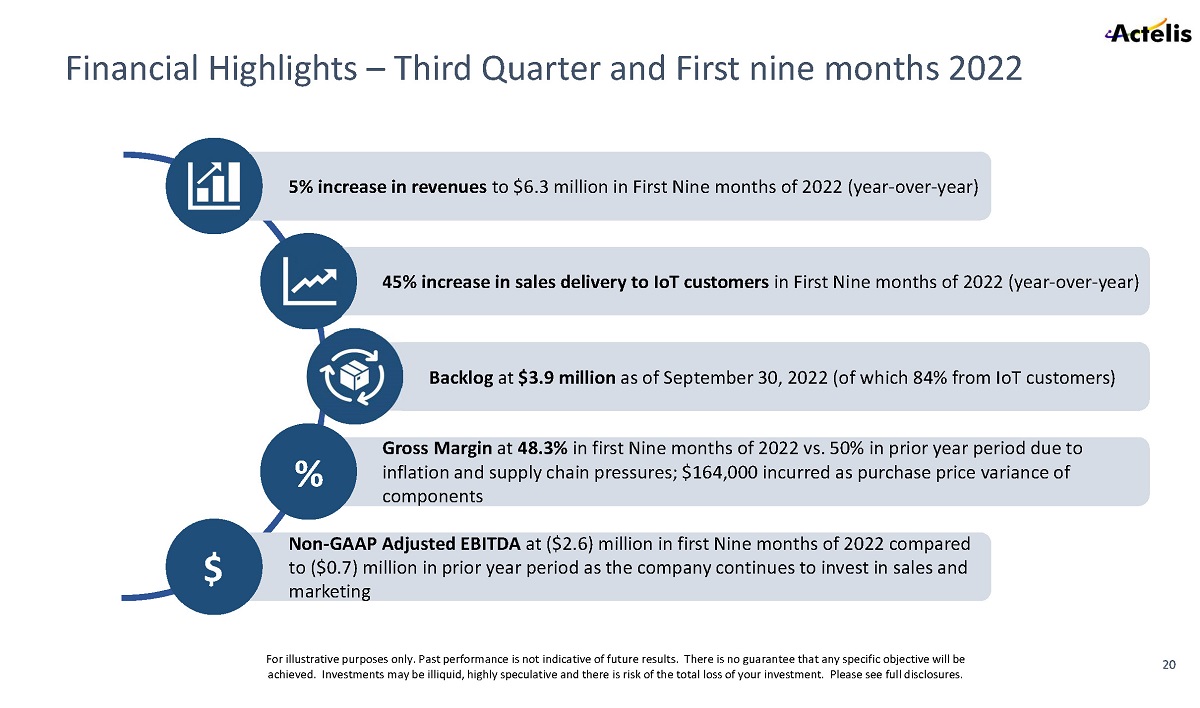

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Financial Highlights – Third Quarter and First nine months 2022 20 5 % i ncrease in revenues to $ 6.3 million in First Nine months of 2022 (year - over - year) 45 % increase in sales delivery to IoT customers in First Nine months of 2022 (year - over - year) Non - GAAP Adjusted EBITDA at ( $ 2.6 ) million in first Nine months of 2022 compared to ($ 0.7 ) million in prior year period as the company continues to invest in sales and marketing $ Gross Margin at 48.3% in first Nine months of 2022 vs. 50% in prior year period due to inflation and supply chain pressures; $164,000 incurred as purchase price variance of components % Backlog at $ 3.9 million as of September 30 , 2022 (of which 84 % from IoT customers)

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. FINANCIAL OVERVIEW 21 Financial Results Third Quarter and First Nine months of 2022 Third Quarter First Nine months (U.S. Dollars in thousands except for Gross Margin) 2022 2021 2022 2021 Revenues 1,348 1,422 6,297 5,995 Gross Margin 40% 37% 48% 50% Adjusted EBITDA (1,698) (768) (2,586) (707) 84% of Backlog of customer Open Orders comes from IoT customers Third Quarter First Nine months (U.S. Dollars in thousands) 2022 2021 2022 2021 Backlog of open Orders (1) 3,917 5,153 3,917 5,153 (1) Presented as of September 30 for each year.

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. FINANCIAL OVERVIEW Balance Sheet as of September 30, 2022 June 30, 2022 December 31, 2021 (U . S . Dollars in thousands) Total Assets 16,325 4,684 Total Liabilities 10,762 18,695 Redeemable Convertible Preferred Stock - 5,585 Shareholder’s Equity (Capital Deficiency) 5,563 (19,596) Balance Sheet – transformed as a result of completed IPO 22 • IPO proceeds (net of IPO costs) increased Assets and Shareholders’ Equity. • A one - time conversion of notes, warrants and preferred stock into Common Stock decreased Liabilities and Convertible Preferred Stock, and increased Shareholder’s Equity. Impact of IPO on Balance Sheet December 31, 2021 to June 30, 2022

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Matt Glover Senior Managing Director Gateway Investor Relations matt@gatewayir.com (949) 574 - 3860 Yoav Efron CFO Actelis Networks, Inc. yoave@actelis.com (908) 242 6463 Ralf Esper Director Gateway Investor Relations ralf@gatewayir.com (949) 574 - 3860 23 Contact Information