As filed with the United States Securities and Exchange Commission on May 10, 2022.

Registration No. 333-264321

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

Amendment No. 4

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

______________

Actelis Networks, Inc.

(Exact Name of Registrant as Specified in Its Charter)

______________

|

Delaware |

3669 |

52-2160309 |

||

|

(State or Other Jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

Actelis Networks, Inc.

47800 Westinghouse Drive

Fremont, CA 94539

(510) 545-1045

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

_______________________

Tuvia Barlev

Chief Executive Officer and Chairman of the Board of Directors

Actelis Networks, Inc.

47800 Westinghouse Drive

Fremont, CA 94539

(510) 545-1045

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

_______________________

Copies to:

|

Oded Kadosh, Esq. |

Gary Emmanuel, Esq. |

Louis A. Bevilacqua, Esq. |

_______________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|||||

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|||||

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION DATED MAY 10, 2022 |

Actelis Networks, Inc.

3,000,000 Shares of Common Stock

This is a firm commitment initial public offering of shares of common stock of Actelis Networks, Inc. We are offering shares of our common stock. We anticipate that the initial public offering price of our shares will be between $4 and $6 per share. For purposes of this prospectus, the assumed initial public offering price per share is $5.00, the mid-point of the anticipated price range. The actual number of shares we will offer will be determined based on the actual public offering price.

Prior to this offering, there has been no public market for our common stock. We have applied to list our shares of common stock on the Nasdaq Capital Market under the symbol “ASNS.” No assurance can be given that our application will be approved and if our application is not approved, this offering cannot be completed. The obligation of the underwriter to purchase the shares of common stock is conditioned upon our receiving approval to list the shares of common stock on Nasdaq.

We are an “emerging growth company” and a “smaller reporting company,” each as defined under the federal securities laws and, as such, have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings. See the section titled “Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

Upon the closing of this offering, all of our non-voting common stock will be redeemed for their par value. The term “common stock” in this prospectus does not include non-voting common stock.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page 12 of this prospectus for a discussion of factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Per Share |

Total(4) |

|||||

|

Initial public offering price(1) |

$ |

$ |

||||

|

Underwriting discounts and commissions(2) |

$ |

$ |

||||

|

Proceeds, before expenses, to us(3) |

$ |

$ |

||||

____________

(1) Initial public offering price per share is assumed as $5 per share, which is the midpoint of the range set forth on the cover page of this prospectus.

(2) We have agreed to pay Boustead Securities, LLC, the underwriter named in this prospectus, or the Underwriter, a discount equal to (i) 7% of the gross proceeds of the offering. We have agreed to sell to the Underwriter, on the applicable closing date of this offering, warrants in an amount equal to 7% of the aggregate number of shares of common stock sold by us in this offering, or the Underwriter’s Warrants. For a description of other terms of the Underwriter’s Warrants and a description of the other compensation to be received by the Underwriter, see “Underwriting” beginning on page 96.

(3) Excludes fees and expenses payable to the Underwriter. The total amount of Underwriter’s expenses related to this offering is set forth in the section entitled “Underwriting.”

(4) Assumes that the Underwriter does not exercise any portion of their over-allotment option.

We expect our total cash expenses for this offering (including cash expenses payable to the Underwriter for its out-of-pocket expenses) to be approximately $805,052, exclusive of the above discounts. In addition, we will pay additional items of value in connection with this offering that are viewed by the Financial Industry Regulatory Authority, or FINRA, as underwriting compensation. These payments will further reduce proceeds available to us before expenses. See “Underwriting” beginning on page 96.

This offering is being conducted on a firm commitment basis. The Underwriter is obligated to take and pay for all of the shares of common stock if any such shares of common stock are taken. We have granted the Underwriter an option for a period of 45 days after the closing of this offering to purchase up to 15% of the total number of our shares of common stock to be offered by us pursuant to this offering, solely for the purpose of covering over-allotments, at the initial public offering price less the underwriting discounts and commissions. If the Underwriter exercises its option in full, the total underwriting discounts and commissions payable will be $1,207,500 based on an assumed offering price of $5 per share, and the total gross proceeds to us, before underwriting discounts and commissions expenses, will be $17,250,000. If we complete this offering, net proceeds will be delivered to us on the applicable closing date.

The Underwriter expects to deliver the shares of our common stock against payment therefor on or about , 2022, subject to customary closing conditions.

Boustead Securities, LLC

The date of this prospectus is , 2022

|

Page |

||

|

1 |

||

|

9 |

||

|

11 |

||

|

12 |

||

|

34 |

||

|

36 |

||

|

37 |

||

|

38 |

||

|

40 |

||

|

42 |

||

|

53 |

||

|

68 |

||

|

75 |

||

|

80 |

||

|

82 |

||

|

84 |

||

|

89 |

||

|

Material U.S. Federal Income Tax Considerations for Non-U.S. Holders |

91 |

|

|

96 |

||

|

100 |

||

|

100 |

||

|

100 |

||

|

F-1 |

This prospectus constitutes a part of a registration statement on Form S-1 (or, together with all amendments and exhibits thereto, the Registration Statement) filed by us with the Securities and Exchange Commission, or the SEC, under the Securities Act of 1933, as amended, or the Securities Act. As permitted by the rules and regulations of the SEC, this prospectus omits certain information contained in the Registration Statement, and reference is made to the Registration Statement and related exhibits for further information with respect to Actelis Networks Inc. and the securities offered hereby. With regard to any statements contained herein concerning the provisions of any document filed as an exhibit to the Registration Statement or otherwise filed with the SEC, in each instance reference is made to the copy of such document so filed. Each such statement is qualified in its entirety by such reference.

You should rely only on the information contained in this prospectus or in any related free-writing prospectus. We and the underwriter have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by us or on our behalf or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any information that others may give you.

This prospectus is an offer to sell only the common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these shares of common stock in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this prospectus is current only as of the date of the front cover of the prospectus. Our business, financial condition, operating results and prospects may have changed since that date.

Persons who come into possession of this prospectus and any applicable free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction. See “Underwriting” for additional information on these restrictions.

i

Until and including , 2022 (the 25th day after the date of this prospectus), all dealers effecting transactions in our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside of the United States: Neither we nor the underwriter have taken any action to permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

For purposes of this Registration Statement, “Company”, “we” or “our” refers to Actelis Networks, Inc. and its subsidiary, Actelis Networks Israel, Ltd., or Actelis Israel, unless otherwise required by the context.

EXPLANATORY NOTE

Our charter authorizes us to issue up to 42,803,774 shares consisting of 30,000,000 shares of common stock with a par value of US$0.0001 per share, 2,803,774 shares of non-voting common stock with a par value of US$0.0001 per share and 10,000,000 shares of preferred stock with a par value of US$0.0001 per share.

Upon the closing of this offering, all of our non-voting common stock will be redeemed for their par value.

The term “common stock” in this prospectus does not include non-voting common stock.

INDUSTRY AND MARKET DATA

This prospectus includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information. Although we are responsible for all of the disclosures contained in this prospectus, including such statistical, market and industry data, we have not independently verified any of the data from third-party sources, nor have we ascertained the underlying economic assumptions relied upon therein. In addition, while we believe the market opportunity information included in this prospectus is generally reliable and is based on reasonable assumptions, such data involves risks and uncertainties, including those discussed under the heading “Risk Factors.”

PRESENTATION OF FINANCIAL INFORMATION

Our financial statements were prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP. We present our consolidated financial statements in U.S. dollars.

Our fiscal year ends on December 31 of each year. Our most recent fiscal year ended on December 31, 2021.

Certain figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

TRADEMARKS AND TRADENAMES

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

This prospectus includes trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included in this prospectus are the property of their respective owners.

ii

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read this entire prospectus and should consider, among other things, the matters set forth under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto appearing elsewhere in this prospectus before making your investment decision. This prospectus contains forward-looking statements and information relating to Actelis Networks. See “Cautionary Note Regarding Forward-Looking Statements” on page 34.

Company Overview

Actelis is a networking solutions company with a mission to enable fast, secure, cost-effective and easily implemented communication for Internet of Things, or IoT, projects, deployed over wide areas such as cities, campuses, airports, military bases, roads and rail.

Our networking solutions use a combination of newly deployed fiber infrastructure and existing copper and coaxial lines to create a highly cost-effective, secure and quick-to-deploy network.

Our patent protected hybrid fiber-copper networking solutions deliver excellent communication over fiber to locations that may be easy to reach with new fiber. However, for locations that are difficult to reach with fiber, we can upgrade existing copper lines, to deliver cyber-hardened, high-speed connectivity without needing to replace the existing copper infrastructure with new fiber. We believe that such hybrid fiber-copper networking solution has distinct advantages in most real-life installations, providing significant budget savings and accelerating deployment of modern IoT networks. We believe that our solutions can provide connectivity over fiber or copper up to multi-Gigabit communication, while supporting Gigabit-Grade reliability and quality.

When high-speed, long reach, high reliability and secure connectivity is required, network operators usually resort to using wireline communication over physical communication lines rather than wireless communication that is more limited in performance, reliability and security. However, wireline communication infrastructure is costly, and often accounts for more than 50% of total cost of ownership (ToC) and time to deploy wide-area IoT projects.

Typically, providing new fiber connectivity to hard-to-reach locations is costly and time-consuming, often requiring permits for boring, trenching, and right-of-way. Connecting such hard-to-reach locations, may cause significant delays and budget overruns in IoT projects. Our solutions aim to solve these challenges.

By alleviating difficult challenges in connectivity, we believe that Actelis’ solutions are making a significant difference: effectively accelerating deployment of IoT projects, and making IoT projects more affordable and predictable to plan and budget.

Our solutions also offer end-to-end network security to protect critical IoT data, utilizing a powerful combination of coding and encryption technologies, applied as required on both new and existing infrastructure within the hybrid-fiber-copper network. Our solutions have been tested for performance and security by the U.S. Department of Defense, or the U.S. DoD, laboratories, and approved for deployment with U.S. Federal Government and U.S. defense forces, as part of APL (Approved Product List) in 2019.

As of December 31, 2021, we had more than 300 customers. We experienced an average annual sales growth in our IoT business of more than 20% each year from 2018 through 2021 in booking of orders from customers in the IoT market.

Since our inception, our business was focused on serving telecommunication service providers, also known as Telcos, providing connectivity for enterprises and residential customers. Our products and solutions have been deployed with more than 100 telecommunication service providers worldwide, in enterprise, residential and mobile base station connectivity applications. In recent years, as we have further developed our technology and rolled out additional products, we turned our focus on serving the wide-area IoT markets. Our operations are focused on our fast-growing IoT business, while maintaining our commitment to our existing Telco customers.

We currently derive a significant portion of our revenue from our existing Telco customers. For the years ended December 31, 2021 and December 31, 2020, our Telco customers in the aggregate accounted for approximately 48% and 55% of our revenues, respectively.

We currently derive a significant portion of our revenue from a limited number of our customers. For the years ended December 31, 2021 and December 31, 2020, our top ten customers in the aggregate accounted for approximately 78% and 70% of our revenues.

1

Our auditors’ opinion in each of our audited financial statements for the years ended December 31, 2021, and December 31, 2020, contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. As of December 31, 2021, and 2020, we had an accumulated deficit of $22.4 and $17.2 million, respectively. In recent years, we have suffered recurring losses from operations, have negative working capital and cash outflows from operating activities, and therefore we are dependent upon external sources for financing our operations.

We currently have one outstanding loan with Migdalor Business Investments Fund, or Migdalor, in the original principal amount of approximately $6 million which is secured by all our assets, which remains outstanding as of December 31, 2021. If we cannot generate sufficient cash flow from operations to service our debt, we may need to further refinance our debt, dispose of assets or issue equity to obtain necessary funds. We expect to continue repaying the principal and interest of the Migdalor Loan from our operating cash flow.

Our Technology

To address many of the most difficult wide-area IoT and Telecom connectivity challenges, we utilize the hidden potential in existing legacy copper/coax wires that already connect billions of locations and devices globally (often at low speed, suffering from interruptions and presenting poor information security) — delivering mostly voice, or low speed control signals). However, these lines are readily available at no additional deployment cost and can reach, as we believe, most locations. Using our patented signal-processing technology and system architecture, we can “upgrade” these lines, by deriving Gigabit Grade performance from them, and integrate them with new fiber installations, where available, to create a complete hybrid-fiber-copper network, enabling fast, reliable, and safe Gigabit-Grade connectivity.

Our technology is both powerful and compact, and is built as a relatively small set of feature-rich network elements, that serve as building block in many IoT verticals. These elements include switches, concentrators, reach extenders, data encryption elements, power sources and a smart networking software that allows for remote management and monitoring down to the single element and line performance, configuration management making complex network topologies easy to deploy, analyze, debug and remote SW download to help with remote handling of large and small networks.

Our solutions can also provide remote power over the same existing copper lines to power up network elements and IoT components connected to them (like cameras and meters). Connecting power lines to millions of IoT locations can be costly and very time consuming (similar to data connectivity). By offering the ability to combine power delivery over the same copper lines used for high-speed data, we believe our solutions are solving yet another important challenge in connecting hard-to-reach locations. We believe that combining communication and power over the same existing lines is particularly important to help connect many fifth generation, or 5G, small cells and Wifi base stations, as high cost of connectivity and power is often slowing their deployment.

Rapid Deployment and Lower Cost of Critical Connectivity for IoT

We aim to become the global leading provider of cyber-secure, cost-effective and quick-to-deploy hybrid networking for all wide-area IoT applications. Our products work over all types of wireline media on the global data network, whether owned or operated by telecom service providers or a private network operated by enterprises or government organizations. Our products are structured as building blocks for many IoT applications, and are feature-rich: This allows for one Actelis box to often replace multiple other platforms available in the market, allowing for space-saving installation, energy conservation (which we believe results in a greener network), and making network planning easier for our customers. We aim at having our products installed and help accelerate deployment of wire-area IoT projects and applications everywhere.

For example, in one of the projects where our solutions are deployed, we found that 70% of locations are easy-to-reach with new fiber optic installation. Connectivity for these locations may, as we believe, average $26,000 per mile for new fiber laid on poles, and can take between days to weeks to connect. However, the remaining 30% of locations may be hard-to-reach with new fiber optics, may require boring or trenching to reach IoT sensors or camera locations, possibly connecting over obstacles, roads, long distances, and may also require obtaining the right of way for extensive civil works. This part of the deployment, as we believe, may cost up to $400,000 per mile, may sometimes go distances of many miles, and may take many months to complete. Connecting such locations can dramatically increase project budget and cause major delays. Our hybrid networking technology includes fiber-based network elements connecting the easy-to-reach locations over new fiber, as well as copper or hybrid fiber-copper network elements that are capable of upgrading the existing copper infrastructure, such that Gigabit-Grade connectivity may be provided over this existing

2

copper infrastructure, immediately utilizing such readily available lines at no additional cost or time to deploy. Both parts of the network are then combined into a seamless fabric of a hybrid fiber-copper network, under one management software that provides smooth, largely automated operation and end-to-end security.

In another project, we provided hybrid networking connectivity with remote powering to 3G and 4G base stations. Looking forward, we believe that a dense grid of 5G small cells would be required to enable global 5G coverage, which, may be key to IoT deployment in many smart city projects and other dense areas. We believe that connecting these 5G small cells to the network cost effectively and rapidly, in both hard-to-reach and easy-to-reach locations, as well as powering them cost-effectively is key to successful and timely deployment for such network.

We expect to release in 2023 a high-speed, cyber-hardened, multi-Gigabit, hybrid fiber-copper solution with optional remote powering aimed to help with 5G small cell deployment, especially in smart city IoT applications, where 5G is most critical. We expect that such solution will add a large sub-vertical market to our growth.

Cyber Security

IoT networks are vulnerable to cyber-attacks. They often carry data related to critical processes and applications, such as provision of energy, water, gas and transportation services to large populations; we believe that this data requires enhanced security within the network.

Our products include cyber safety features that we are constantly developing and particularly include network traffic encryption and coding. We have developed and implemented a multi-layered “Triple Shield” technology that includes (i) information coding for resilience and security (over copper); (ii) multi-line information scrambling for increased resilience and added security (over copper); and (iii) an additional 256-bit hardware-based real-time encryption of data running over fiber or copper — creating end-to-end protection for the entire hybrid network. Our network management software is also cyber-hardened and helps protect the system. Our systems have been selected for deployment in sensitive applications with U.S. DoD and other governments and military organizations, airports, utility companies, oil and gas companies, smart cities, rail and traffic applications globally.

Market Verticals We Address

We execute our vision through a multi-channel, global approach that combines our expertise, with the expertise of our trusted business partners, system integrators, distributors, and consultants.

We run a vertical based marketing plan where we dedicate efforts and resources to each vertical. The IoT verticals that we have focused on include: (1) intelligent transportation systems (ITS); (2) rail; (3) federal and military; (4) airports; (5) energy and water; (6) smart city; (7) education campuses; (8) industrial campuses; and (9) airports. Our products are utilized within networks that have been deployed, for example by The City of Los Angeles, Highways England, Federal Aviation Administration, the US military, including Air Force and Navy Stanford University, and many others. Our customers benefit from rapidly and cost-effectively enabling their critical IoT functions such as traffic cameras and smart signaling, security cameras, smart parking meters and ticketing, rail signaling and control, electrical substation management and protection, military operations, and many more.

To date, we have been most successful in selling to customers in the intelligent transportation systems, rail, federal and military, and airports markets, primarily in the US, Canada, Europe, and Japan. While we have not yet sold to industrial campuses, we have sold to energy and water, smart city and education campuses. We intend to grow our IoT sales by growing all verticals and our pipeline of sales opportunities includes customers in each of the eight verticals listed above.

State of IoT Connectivity Market

IoT infrastructure connectivity demand is growing rapidly. We believe there is an urgent need to connect tens of millions of locations, with a fast and secure connection. A huge challenge for IoT projects is that implementing connectivity between different IoT points in a network can consume the majority of a project’s cost and time to implement, and that unpredictable challenges in deploying connectivity may compromise IoT project plans.

According to a report by Facts and Factors (January 2022) Global Internet of Things (IoT) market is expected to grow to $ 1.8 billion by 2028, at a Compounded Average Growth Rate (CAGR) of 24.5%.

3

According to a report by Grand View Research (May 2021), the smart city market alone is expected to grow to $696 billion by 2028 at a Compounded Average Growth Rate (CAGR) of 29.3%. We believe that the number of IoT applications requiring our fast, smart, and secure connectivity is immense and provides us with a great market opportunity to grow our business. From smart transportation systems (smart cameras, smart lights and signals, V2V — Vehicle to Vehicle communication) and smart security (cameras and radars), to smart parking, smart rail, power station monitoring, and industrial and warehouse automation, we believe that we are uniquely positioned to address all of these applications in a versatile and flexible manner.

We believe that 5G mobile technology will play a major role in the implementation and scaling of IoT networks. According to research published by ABI Research in January 2021, 5G technology is expected to grow at a CAGR of 41.2% between 2021 and 2027 with a major part of that growth coming from servicing IoT networks.

According to Key Market Insights, the global small cell 5G network market size was valued at $740.8 million in 2020. The market is expected to grow from $859.4 million in 2021 to approximately $1.8 billion in 2028, reflecting a CAGR of 54.4% between 2021-2028.

5G base stations and small cells need to be deployed in a dense grid of millions of locations and need to be connected to gigabit speed communication and power. We are addressing these needs for the rapid connectivity and power, aiming at enabling faster and more cost-effective deployment of 5G in IoT applications.

Our Solutions

Actelis has invested nearly $100 million over the years to develop its patented, multi-layered “Triple Shield” technology, which can serve all connectivity markets. Our technology includes signal processing SW that is implementing optimization of multi-line signal coordination; the elimination of interference to boost connectivity performance; the optimization of coding for resilience and security; multi-line data scrambling for low latency, increased resilience, and added security; our solutions also offer implementation of 256-bit encryption of transmission for data running over fiber or copper for network-wide protection of data. Our technology is packaged into a small set of compact, hardened, feature-rich network elements (such as switches, concentrators and reach extenders) — the MetaLIGHT product family — that are used as building blocks addressing the needs of most wide-area IoT verticals and applications, in a space-and energy-saving fashion. The ability to drive remote powering and synchronization signals to network ends over the same (copper) transmission lines provides additional significant cost-and-time benefits to network operators. We estimate that, as of December 31, 2021, we achieved over $24 million in our IoT installed base. We define our IoT installed base based on the shipments to our customers in the IoT market from January 1, 2012 through December 31, 2021.

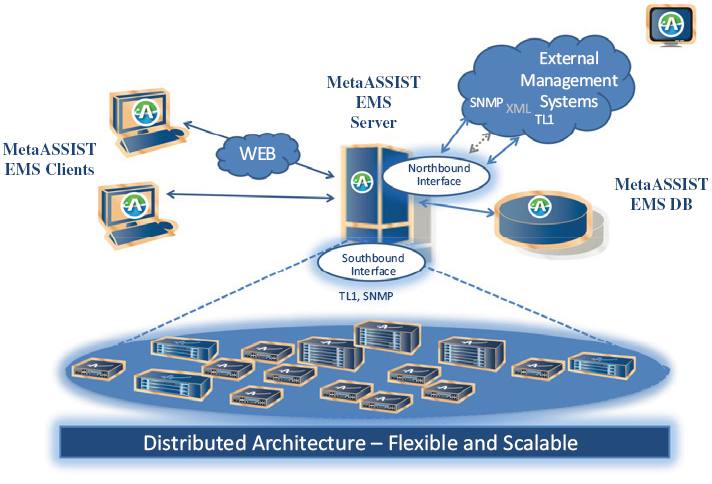

Our offering includes our network management software, providing built-in automation to help configure, manage, monitor, safeguard, install and maintain complex, hybrid networks of thousands of elements remotely.

We aim to continue developing our technology to include more system-wide security and further hybridity across all types of infrastructure and further include cutting-edge computing capabilities to serve all connectivity needs for our IoT customers, in an effective and easily deployable way, while maintaining our commitment to serve our existing Telco customers.

We believe that our strong reputation as a provider of high-quality solutions, and the trust we gain from being recognized as a solid solution provider by prominent customers (such as the U.S. DoD) help us execute our strategy.

Competitive Advantage

We believe our solutions are advantageous in enabling IoT and telecom hybrid networks that optimize the usage of infrastructure across new fiber as well as existing copper lines, both at Gigabit-Grade connectivity. Our security portfolio is growing, and our plan is to make our solution the leading cyber-secure hybrid networking system. We believe that the following are some specific competitive advantages that jointly make our solutions very competitive:

• High performance hybrid-fiber-copper communication system

• Speeds from 10Mbps to 10Gbps

• Reach up to 100Km

• Cyber-protection capabilities at data level, physical medium level, and system level

4

• Robust design for gigabit-grade, resilient communication over fiber or copper

• Dense, feature-rich design to replace multiple alternative elements in the market, and allow for installation that is compact, cost-effective, and energy efficient

• Ability to drive power to remote locations over same infrastructure (copper only)

• Automated software tools for installation and remote management to reduce cost of installation and ongoing operations of complex networks

We believe that the combination of these advantages provide our customers with a highly cost-effective solution to quickly obtain IoT connectivity anywhere in their network.

Growth Strategy

The key elements of our growth strategy include:

• Utilizing our existing customers and partners globally, as well as our brand name and product differentiation to expand deployment into virtually all IoT verticals globally.

• Growing our network of partners in three continents, aiming to become the vendor of choice for cyber- hardened networking, enabling IoT connectivity globally.

• Introducing broader cyber-protection capabilities at IoT network level, offering protection software and services for IoT devices and users.

• Introducing hybrid fiber-copper-power solutions for effective connectivity and power to enable 5G growth in IoT.

• Adding wireless MMwave technology to fiber-copper connectivity, to be able to offer all three options of IoT connectivity.

• Introducing edge computing capabilities into the MetaLIGHT building blocks, enabling smart applications and recurring SW business models for our customers.

JOBS Act and the Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, or the JOBS Act. As an “emerging growth company,” we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include, but are not limited to:

• requiring only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s discussion and analysis of financial condition and results of operations” in our Securities Act of 1933, as amended, or the Securities Act, filings;

• reduced disclosure about our executive compensation arrangements;

• no non-binding advisory votes on executive compensation or golden parachute arrangements; and

• exemption from compliance with the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes Oxley Act of 2002, or SOX.

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an “emerging growth company.” We will continue to remain an “emerging growth company” until the earliest of the following: (i) the last day of the fiscal year following the fifth anniversary of the date of the completion of this offering; (ii) the last day of the fiscal year in which our total annual gross revenue is equal to or more than $1.07 billion; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission, or the SEC.

We are also a “smaller reporting company” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and have elected to take advantage of certain of the scaled disclosures available to smaller reporting companies. To the extent that we continue to qualify as a “smaller reporting company” as such term is defined in Rule 12b-2

5

under the Exchange Act, after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an “emerging growth company” may continue to be available to us as a “smaller reporting company,” including exemption from compliance with the auditor attestation requirements pursuant to SOX and reduced disclosure about our executive compensation arrangements. We will continue to be a “smaller reporting company” until we have $250 million or more in public float (based on our common stock) measured as of the last business day of our most recently completed second fiscal quarter or, in the event we have no public float (based on our common stock) or a public float (based on our common stock) that is less than $700 million, annual revenues of $100 million or more during the most recently completed fiscal year.

We may choose to take advantage of some, but not all, of these exemptions. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained herein may be different from the information you receive from other public companies in which you hold stock. In addition, the JOBS Act provides that an emerging growth company may take advantage of an extended transition period for complying with new or revised accounting standards, delaying the adoption of these accounting standards until they would apply to private companies. We have elected to avail ourselves of the extended transition period for complying with new or revised financial accounting standards. As a result of this accounting standards election, we will not be subject to the same implementation timing for new or revised accounting standards as other public companies that are not emerging growth companies which may make comparison of our financials to those of other public companies more difficult.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties that you should consider before investing in our company. You should carefully consider all of the risks described more fully in the section titled “Risk Factors” in this prospectus beginning on page 12, before deciding to invest in our common stock. If any of these risks actually occurs, our business, financial condition and results of operations would likely be materially adversely affected. These key risks, include, but are not limited to, the following:

Risks Related to Our Business

• We have a history of net losses, may incur substantial net losses in the future, and may not achieve or sustain profitability or growth in future periods. If we cannot achieve and sustain profitability, our business, financial condition, and operating results will be adversely affected.

• We have had negative cash flow and, given our projected funding needs, our ability to generate positive cash flow is uncertain.

• Our financial statements contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all.

• Even after consummation of the offering as contemplated, we may need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute our stockholders’ ownership interests.

• Our indebtedness could adversely affect our ability to raise additional capital to fund operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting our financial obligations.

• To support our business growth, in the past years we increased our focus on serving certain IoT verticals, while continuing to serve our existing Telco customers. This change in our strategy may make it more difficult to evaluate our business growth and future prospects, and may increase the risk that we will not be successful in our plans.

• We may have ineffective sales and marketing efforts.

• We are dependent on the supply of electronic and mechanical components and our business would be harmed if we do not receive sufficient supply of such components in number and performance to meet our production requirements and product specifications in a timely and cost-effective manner.

• We are dependent on key suppliers.

• Demand for our products and solutions may not grow or may decline.

6

• Our gross margins may not increase or may deteriorate.

• Changes in the price and availability of our raw materials and shipping could be detrimental to our profitability.

• Expanding our operations and marketing efforts to meet expected growth may impact profitability if actual growth is less than expected.

• If our internal Company cyber-security measures are breached or fail and unauthorized access is obtained to our IT environment, we may incur significant losses of data, which we may not be able to recover and may experience a delay in our ability to conduct our day-to-day business.

• We provide cyber security features as part of our products that may not completely prevent information security breaches, and our products are installed in live customer environments and may be compromised by cyber-attacks and damage customer assets.

• We depend on key information systems and third-party service providers.

• We depend on our management team and other key employees, and the loss of one or more of these employees or an inability to attract and retain highly skilled employees could adversely affect our business.

• We may face the effects of increased competition and rapid technological changes.

• Our results of operations are likely to fluctuate from quarter to quarter and year to year, which could adversely affect the trading price of our common stock.

• The loss of one or more of our significant customers, or any other reduction in the amount of revenue we derive from any such customer, would adversely affect our business, financial condition, results of operations and growth prospects.

• The effects of health pandemics, such as the ongoing global COVID-19 pandemic, have had, and could in the future have, an adverse impact on our business, financial condition and results of operations.

Risks Related to Protecting Our Technology and Intellectual Property

• Claims by others that we infringe their intellectual property could force us to incur significant costs or revise the way we conduct our business.

• Our patents and proprietary technology may be challenged or disputed.

• Any failure to protect our intellectual property rights could impair our ability to protect our proprietary technology and our brand.

Risks Related to Managing Our Business Operations in Israel

• We may be adversely affected by fluctuations in the currency exchange rate of the Israeli Shekel.

• Unanticipated changes in our effective tax rate and additional tax liabilities, including those resulting from our international operations or the implementation of new tax rules, could harm our future results.

Risks Related to this Offering and Ownership of our Common Stock

• The requirements of being a public company may strain our resources, divert management’s attention, and affect our ability to attract and retain executive management and qualified board members.

• We have identified a material weakness in our internal control over financial reporting. If we experience material weaknesses in the future or otherwise fail to implement and maintain an effective system of internal controls in the future, we may not be able to accurately report our financial condition or results of operations which may adversely affect investor confidence in us, and as a result, the value of our common stock.

• If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, stockholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our common stock.

7

Corporate Information

We were incorporated in Delaware on November 12, 1998. Actelis Israel, our wholly-owned subsidiary, was incorporated in Israel in 1998.

We maintain our principal executive offices at 47800 Westinghouse Drive, Fremont, CA 94539. We also maintain an office in Tel Aviv, Israel where our research and development facilities are located. Our telephone number is (510) 545-1045. Our website address is www.actelis.com. The information contained on our website and available through our website is not incorporated by reference into and should not be considered a part of this prospectus, and the reference to our website in this prospectus is an inactive textual reference only.

8

|

Common stock offered by us |

3,000,000 shares of common stock (or 3,450,000 shares of common stock if the Underwriter exercises its over-allotment option in full). Upon the closing of this offering, all of our non-voting common stock will be redeemed for their par value. The term “common stock” in this prospectus does not include non-voting common stock. |

|

|

Public Offering Price |

We expect the initial public offering price to be between $4 and $6 per share. For purposes of this prospectus, the assumed initial public offering price per share is $5, the mid-point of the anticipated price range. The actual offering price per share will be as determined between the Underwriter and us based on market conditions at the time of pricing and the actual number of shares we will offer will be determined based on the actual public offering price. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price. |

|

|

Common stock outstanding immediately before this offering |

|

|

|

Common stock outstanding immediately after this offering |

|

|

|

Underwriting; Over-Allotment Option |

This offering is being conducted on a firm commitment basis. The Underwriter is obligated to take and pay for all of the shares of common stock if any such shares are taken. We have granted to the Underwriter an option for a period of 45 days from the date of this prospectus to purchase up to 450,000 additional shares (constituting 15% of the total number of shares of common stock to be offered in this offering) of common stock from us at the initial public offering price, less the underwriting discounts and commissions, to cover over-allotments, if any. |

|

|

Underwriter’s Warrants |

We have agreed to issue to the Underwriter (or its permitted assignees) a warrant to purchase up to a total of 210,000 shares of common stock equal to 7% of the aggregate number of the shares sold in this offering at an exercise price equal to 125% of the public offering price of the Stock sold in this offering (or 241,500 shares if the Representative exercises the over-allotment option in full). The Underwriter’s Warrant will be exercisable at any time, and from time to time, in whole or in part, commencing from the closing of the offering and expiring five (5) years from commencement of sales in the offering, will have a cashless exercise provision and will terminate on the fifth anniversary of the effective date of the registration statement of which this prospectus is a part. |

|

|

Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $13.0 million, or approximately $15.1 million if the Underwriter exercises its option to purchase additional shares to cover over-allotments, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the proceeds from this offering for research and development, sales and marketing, general and administrative, capital investments and working capital. See “Use of Proceeds.” |

|

|

Risk factors |

See “Risk Factors” and other information appearing elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding whether to invest in our securities. |

9

|

Lock-up |

Our executive officers, directors and our security holder(s) of five percent (5%) or more have agreed not to offer, sell, agree to sell, directly or indirectly, or otherwise dispose of any shares of our common stock for a Lock-up period of twelve months following the closing of this offering, subject to certain exceptions. For substantially all of our other security holders, the period of Lock-up will be six months. See “Underwriting” for more information. |

|

|

Listing |

We have applied to list our common stock on the Nasdaq Capital Market under the symbol “ASNS.” No assurance can be given that our shares of common stock will be approved for listing on Nasdaq. The approval of our listing on Nasdaq is a condition to the closing of this offering. |

The number of shares of common stock that will be outstanding after this offering is based on 2,050,404 shares common stock outstanding as of December 31, 2021, after giving effect to (i) a reverse share split effected on May 2, 2022 at a ratio of 1-for-46, (ii) the exercise immediately prior to the closing of this offering of 1,300,248 shares of common stock issuable upon conversion of $1.5 million of the aggregate principal amount of the convertible loan agreement that we entered into with our existing investors and certain employees, or the CLA, by the holders thereof (based on an assumed conversion price equal to $5.00, the midpoint of the price range set forth on the cover page of this prospectus); (iii) the conversion immediately prior to the closing of this offering of 7,731,043 shares of convertible preferred stock on a one (1) for one (1) basis into 7,731,043 shares of common stock, (iv) the exercise immediately prior to the closing of this offering of 181,192 shares of common stock issuable pursuant to an option to purchase shares of common stock granted to Migdalor as part of the a loan agreement with Migdalor, or the Migdalor Loan, (based on an assumed conversion price equal to $5.00, the midpoint of the price range set forth on the cover page of this prospectus); (v) the exercise immediately prior to the closing of this offering of (x) 601,708 shares of common stock issuable upon the exercise of warrants issued to Mizrahi-Tefahot Bank, or Mizrahi Bank, at an aggregate value of $750,000 (based on an assumed conversion price equal to $5.00, the midpoint of the price range set forth on the cover page of this prospectus), and (y) 1,666 shares of common stock issuable upon the exercise of a warrant issued to Lauderdale Gmbh & Co. KG, or the Lauderdale Warrant; (vi) the exercise immediately prior to the closing of this offering of 720,001 shares of common stock, resulting from a 6% convertible note issued by us in a private placement from December 2021 through April 2022, or the Private Placement Note (based on an assumed conversion price equal to $5.00, the midpoint of the price range set forth on the cover page of this prospectus), and (vii) the exercise of 15,459 stock options by employees after January 1, 2022, and excludes as of such date:

• 870,002 shares of common stock issuable upon the exercise of outstanding stock options under our 2015 Equity Incentive Plan, at a weighted average exercise price of $0.147 per share;

• 79,348 shares of common stock issuable upon the exercise of options that we intend to award to certain of our employees and officers under our 2015 Equity Incentive Plan following the completion of this offering, with an exercise price equal the offering price in this offering;

• 1,901,314 shares of common stock reserved for future issuance under our 2015 Equity Incentive Plan;

• 73,048 shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $1.02 per share; and

• 210,000 shares of common stock issuable upon the exercise of the Underwriter’s Warrants in connection with this offering.

Unless otherwise indicated, all information in this prospectus assumes or gives effect to:

• an assumed initial public offering price of $5 per share of common stock, which is the midpoint of the price range set forth on the cover page of this prospectus;

• no exercise by the Underwriter of its option to purchase up to 450,000 additional shares of common stock from us to cover over-allotments, if any; and

• a reverse share split effected on May 2, 2022 at a ratio of 1-for-46.

10

SUMMARY CONSOLIDATED FINANCIAL DATA

You should read the following summary consolidated financial data together with our consolidated financial statements and the related notes appearing at the end of this prospectus and the “Cash and Capitalization,” “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus. We have derived these summary consolidated statements of operations data for the years ended December 31, 2021, and December 31, 2020, from our audited consolidated financial statements appearing at the end of this prospectus. Our historical results are not necessarily indicative of results that should be expected in any future period.

STATEMENTS OF OPERATIONS DATA:

|

(U.S. dollars in thousands, except share and per share data) |

For the Year |

For the Year |

||||||

|

Revenues |

$ |

8,545 |

|

$ |

8,532 |

|

||

|

Cost of revenues |

|

4,575 |

|

|

3,550 |

|

||

|

Research and development, net |

|

2,443 |

|

|

2,147 |

|

||

|

Sales and marketing, net |

|

2,204 |

|

|

1,848 |

|

||

|

General and administrative, net |

|

1,183 |

|

|

1,118 |

|

||

|

Financial expenses, net |

|

3,391 |

|

|

1,374 |

|

||

|

Loss from operations |

|

(5,251 |

) |

|

(1,505 |

) |

||

|

Income tax provision |

|

— |

|

|

— |

|

||

|

Net loss |

$ |

(5,251 |

) |

$ |

(1,505 |

) |

||

|

|

|

|

|

|||||

|

Loss per share of common stock attributable to the Company |

|

|

|

|

||||

|

Basic and diluted |

$ |

(2.56 |

) |

$ |

(0.74 |

) |

||

|

Weighted average common stock outstanding |

|

|

|

|

||||

|

Basic and diluted |

|

2,048,788 |

|

|

2,047,313 |

|

||

BALANCE SHEET DATA:

|

(U.S. dollars in thousands) |

As of December 31, |

|||||||

|

2021 |

2020 |

|||||||

|

Current assets |

$ |

4,135 |

|

$ |

3,224 |

|

||

|

Total assets |

|

4,684 |

|

|

3,766 |

|

||

|

Current liabilities |

|

5,951 |

|

|

4,624 |

|

||

|

Long term liabilities |

|

12,744 |

|

|

7,955 |

|

||

|

Redeemable convertible Preferred Shares |

|

5,585 |

|

|

5,585 |

|

||

|

Total capital deficiency |

$ |

(19,596 |

) |

$ |

(14,398 |

) |

||

11

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, before deciding to invest in our common stock. The risks and uncertainties described below may not be the only ones we face. If any of the risks actually occur, our business, results of operations, financial condition and prospects could be harmed. In that event, the trading price of our common stock could decline, and you could lose part or all of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations.

Risks Related to Our Business

We have a history of net losses, may incur substantial net losses in the future, and may not achieve or sustain profitability or growth in future periods. If we cannot achieve and sustain profitability, our business, financial condition, and operating results will be adversely affected.

We have incurred net losses in recent years, and we may not achieve or maintain profitability in the future. We experienced a net loss of $5.2 million and $1.5 million in the years ended December 31, 2021 and 2020, respectively. As a result, we had an accumulated deficit of $22.4 million and $17.2 million as of December 31, 2021 and 2020, respectively. We cannot predict when or whether we will reach or maintain profitability.

We also expect our operating expenses to increase in the future as we continue to invest for our future growth, including expanding our research and development function to drive further development of our platform, expanding our sales and marketing activities, developing the functionality to expand into adjacent markets, and reaching customers in new geographic locations, which will negatively affect our operating results if our total revenues do not increase. In addition to the anticipated costs to grow our business, we also expect to incur significant additional legal, accounting, and other expenses as a newly public company. These efforts and additional expenses may be more costly than we expect, and we cannot guarantee that we will be able to increase our revenues to offset our operating expenses. Any failure to increase our revenues or to manage our costs as we invest in our business would prevent us from achieving or maintaining profitability.

We have had negative cash flow in the past and, given our projected funding needs, our ability to generate positive cash flow is uncertain.

We have had negative cash flow from operating activities of $2.7 million and $0.3 million in the year ended December 31, 2021 and 2020, respectively. We expect to have negative cash flow from operating and investing activities through the foreseeable future as we expect to incur research and development, sales and marketing, and general and administrative expenses and make capital expenditures in our efforts to increase our sales. Our business also will at times require significant amounts of working capital to support our growth of additional platforms. An inability to generate positive cash flow for the near term may adversely affect our ability to raise needed capital for our business on reasonable terms, diminish supplier or customer willingness to enter into transactions with us, and have other adverse effects that may decrease our long-term viability. There can be no assurance that we will achieve positive cash flow in the near future or at all.

Our financial statements contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all.

The auditors’ opinion included in each of our audited financial statements for the years ended December 31, 2021 and December 31 2020, contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. As of December 31, 2021 and 2020, we had an accumulated deficit of $22.4 and $17.2 million, respectively. In recent years, we have incurred recurring losses from operations, have negative working capital and cash outflows from operating activities, and therefore we are dependent upon external sources for financing our operations. We have had negative cash flow from operating activities of $2.7 million and $0.3 million in the year ended December 31, 2021, and 2020. These events and conditions, along with other matters, indicate that a material uncertainty exists that may cast significant doubt on our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty. This going concern opinion could materially limit our ability to raise additional funds through the issuance of equity or debt securities or otherwise. Further financial statements may include an explanatory paragraph with respect to our ability to continue as a going

12

concern. We expect to fund our operations using cash on hand and through operational cash flows. There can be no assurance that we will succeed in generating sufficient revenues from our product sales to continue our operations as a going concern. If funds are not available to us, we may be required to delay, reduce the scope of, or eliminate research or development plans for, or commercialization efforts with respect to our products. This may raise substantial doubts about our ability to continue as a going concern.

Even after consummation of the offering as contemplated, we may need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute our stockholders’ ownership interests.

In order for us to pursue our business objectives, even after consummation of the offering as contemplated, we may need to raise additional capital, which additional capital may not be available on reasonable terms or at all. Any additional capital raised through the sale of equity or equity-backed securities may dilute our shareholders’ ownership percentages and could also result in a decrease in the market value of our equity securities. The terms of any securities issued by us in future capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect on the holders of any of our securities then outstanding. In addition, we may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

Our indebtedness could adversely affect our ability to raise additional capital to fund operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting our financial obligations.

We currently have one outstanding loan with Migdalor Business Investments Fund, or Migdalor, in the original principal amount of approximately $6 million which is secured by all our assets which remains outstanding as of December 31, 2021. If we cannot generate sufficient cash flow from operations to service our debt, we may need to further refinance our debt, dispose of assets or issue equity to obtain necessary funds. We do not know whether we will be able to do any of this on a timely basis, on terms satisfactory to us, or at all. Our indebtedness could have important consequences, including:

• our ability to obtain additional debt or equity financing for working capital, capital expenditures, debt service requirements, acquisitions and general corporate or other purposes may be limited;

• a portion of our cash flows from operations will be dedicated to the payment of principal and interest on the indebtedness and will not be available for other purposes, including operations, capital expenditures and future business opportunities;

• our ability to adjust to changing market conditions may be limited and may place us at a competitive disadvantage compared to less-leveraged competitors, if such exist; and

• we may be vulnerable during a downturn in general economic conditions or in our business, or may be unable to carry on capital spending that is important to our growth.

To support our business growth, in the past years we increased our focus on serving certain IoT verticals, while continuing to serve our existing Telco customers. This change in our strategy may make it more difficult to evaluate our business growth and future prospects, and may increase the risk that we will not be successful in our plans.

Since our inception, our business was focused on serving telecommunication service providers, also known as Telcos, for enterprises and residential customers. Our products and solutions have been deployed with more than 100 telecommunication service providers worldwide, in enterprise, residential and mobile base station connectivity applications. In recent years, as we have further developed our technology and rolled out additional products, we turned our focus on serving the IoT markets. Our operations are focused on our fast-growing IoT business, while maintaining our commitment to our existing Telco customers.

13

We currently derive a significant portion of our revenue from our existing Telco customers. For the years ended December 31, 2021 and December 31, 2020, our Telco customers in the aggregate accounted for approximately 48% and 55% of our revenues, respectively.

Our change in strategy and our efforts to serve the IoT verticals that we have focused on may prove more expensive than we currently anticipate, or may require longer development and deployment times, and we may not succeed in fully penetrating such IoT verticals, or at all.

We may have ineffective sales and marketing efforts.

Our sales and marketing efforts to drive growth may be ineffective as we try to win new deals either directly with end-user customers, or indirectly through business partners, distributors, system integrators or value-add resellers. These ineffective efforts may cause us to miss our planned growth and harm our financial results.

We are dependent on the supply of electronic and mechanical components and our business would be harmed if we do not receive sufficient supply of such components in number and performance to meet our production requirements and product specifications in a timely and cost-effective manner.

We rely on a supply of electronic and mechanical components of our final products to be able to fulfill and deliver customer orders. Such supply has been interrupted from time to time and if such interruption continues, it may cause us to be unable to fulfill and deliver such customer orders on expected delivery lead times. Such long lead times may cause customers to avoid placing orders or reduce future orders. As a result, such interruptions, if they continue, will reduce our ability to grow our business at the pace we expect and may cause us to miss our operating business plans.

In most cases, we do not have guaranteed supply arrangements with our suppliers, and our business relies on placing orders to our suppliers as we receive forecasts or orders from our customers. Because of the variability and uniqueness of customers’ orders, we do not maintain an extensive inventory of materials for manufacturing. Through our procurement and production planning, we seek to minimize the risk of production and service interruptions and/or shortages of key parts by, among other things, monitoring the financial stability of key suppliers, identifying (and often qualifying) possible alternative suppliers, placing longer term orders for components and maintaining appropriate inventories of key components. Although we make reasonable efforts to ensure that components are available from multiple suppliers, certain key components are available only from a single supplier or a limited group of suppliers. Also, key components we obtain from some of our suppliers incorporate the suppliers’ proprietary intellectual property; in those cases, we are more reliant on third parties for high-performance, high-technology components, which reduces the amount of control we have over the availability and protection of the technology and intellectual property that is used in our products. In addition, if certain of our key suppliers experience liquidity issues and are forced to discontinue operations, it could affect their ability to deliver parts and could result in delays for our products. Similarly, our suppliers themselves have increasingly complex supply chains, and delays or disruptions at any stage of their supply chains may prevent us, and have prevented us, from obtaining components in a timely manner and result in delays for our products. Our operating results and business may be adversely impacted if we are unable to obtain components to meet our production requirements and product specifications, or if we are able to do so only on unfavorable terms.

We outsource our product manufacturing and are dependent on our key manufacturers, and on our component and OEM suppliers. We are susceptible to problems, and have encountered problems in the past, in connection with procurement, decreasing quality, reliability, and protectability.

Our devices are assembled by using fully manufactured parts, the manufacturing of which has been fully outsourced, and we have no direct control over the manufacturing processes of our products. We outsource procurement and manufacturing activities to certain key manufacturers and certain component and OEM suppliers.

We also purchase unique components and products from suppliers who are exclusively able to fulfill such supply. We may lose some or all of these relationships, or have a material weakness in negotiating favorable terms, or such unique components have or may be declared end-of-life which may require product design changes. Such circumstances have hurt our profitability in the past, and may hurt our profitability in the future, and negatively affect our ability to deliver our product on time to customers.

14

Our lack of control in our manufacturing process due to the fact that we outsource our product manufacturing may increase quality or reliability risks and could limit our ability to quickly increase or decrease production rates. If necessary, switching production to other or additional subcontractors will entail a material cost and a temporary decrease in our productivity. Our manufacturing process has been disrupted in the past, and may be disrupted in the future, by various factors, including but not limited to shipping delays, bottlenecks resulting from raw materials specific shortages, quality problems or a decrease in quality, manpower shortages by the manufacturers or political unease that would trigger the closure of a facility or financial insolvency.

Furthermore, a supplier may discontinue production of a particular part for any number of reasons, which may require us to purchase a large inventory of such discontinued parts in order to ensure that a continuous supply of such parts remains available to our customers. Such “end-of-life” parts purchases could result in significant expenditures by us in a particular period, and ultimately any unused parts may result in a significant inventory write-off, either of which could have an adverse impact on our financial condition and results of operations for the applicable periods. Refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” for additional information on supply constraints related to the COVID-19 pandemic.

Demand for our products and solutions may not grow or may decline.

We may experience a reduction in customer demand as a result of either of competition from other companies, technological changes required by our target markets, or disruptions of existing and new customer relationships. Such demand reduction will prevent us from realizing our planned growth.

Our gross margins may not increase or may deteriorate.

If our gross margins do not increase as planned or deteriorate, it will be harder for us to achieve profitability, which could substantially impact our business and ability to carry on operations if other financing sources are not secured on satisfactory terms. Our gross margins may deteriorate as a result of either reductions of customers price points, increases in product component and manufacturing costs, or unfavorable changes in the mix between more and less profitable customers and/or products.

Changes in the price and availability of our raw materials and shipping could be detrimental to our profitability.

Chipsets, electronic and mechanical components are significant components of our products. Over the past two years, the prices and availability of electronic and mechanical components have been constantly increasing.

Furthermore, our products are assembled with various contract manufacturers located in Israel and in Taiwan. As a result of the of COVID-19 pandemic, the world is experiencing shortages of electronic components. We have already experienced instances of limited supply of certain raw materials and shipping delays, which resulted in extended lead times, increased shipping costs and higher-than-usual backlogs. If the prices of such components and shipping were to continue to increase, or if shipping delays continue to occur, such price changes and shipping delays could have a negative effect on our gross margin and have a negative effect on revenues and earnings.

We may have previously agreed to set prices with our customers and any changes in supply costs may decrease our margin and directly affect profitability. If prices increase, supply interruptions, shipping delays, or shortages of materials continue to occur, it could have a negative effect on revenues and earnings.

Expanding our operations and marketing efforts to meet expected growth may impact profitability if actual growth is less than expected.

To meet expected growth, we plan to expand operations, including additional hiring, advertising, and promotion. If actual growth is less than expected, it would negatively impact our ability to become profitable, which would require we raise additional capital if required, which may not be available on favorable terms, or at all, which would impact our ability to carry on operations.

15