Company Presentation May 2022 Applying the Science of Networking Enabling Cyber - Hardened, Rapid Networking for All IoT “ Things ” and Locations For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please see full disc los ures. Filed Pursuant to Rule 433 of the Securities Act of 1933 Issuer Free Writing Prospectus dated May 2, 2022 Relating to Preliminary Prospectus dated May 2, 2022 Registration No. 333 - 264321

FORWARD LOOKING STATEMENTS This document contains forward - looking statements . In addition, from time to time, we or our representatives may make forward - looking statements orally or in writing . We base these forward - looking statements on our expectations and projections about future events, which we derive from the information currently available to us . Such forward - looking statements relate to future events or our future performance, including : our financial performance and projections ; our growth in revenue and earnings ; and our business prospects and opportunities . You can identify forward - looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “hopes” or the negative of these or similar terms . Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under the heading “Risk Factors” and elsewhere in the registration statement that we have filed with the U . S . Securities and Exchange Commission . Forward - looking statements are only predictions . The forward - looking events discussed in this document and other statements made from time to time by us or our representatives, may not occur, and actual events and results may differ materially and are subject to risks, uncertainties and assumptions about us . We are not obligated to publicly update or revise any forward - looking statement, whether as a result of uncertainties and assumptions, the forward - looking events discussed in this document and other statements made from time to time by us or our representatives might not occur . Past performance is not indicative of future results . There is now guarantee that any specific outcome will be achieved . Investments may be speculative, illiquid and there is a total risk of loss . Past performance is not indicative of future results. There is no guarantee that any specific objective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. See disclosures at the beginning. 2

Free Writing Prospectus and Other Matters Free Writing Prospectus We have filed a registration statement (including a preliminary prospectus) with the SEC for the offering to which this communication relates. The registration statement has not yet become effective. Before you invest, you should read the preliminary prospectus in that registration statement (including the risk factors described therein) and other documents that we have filed with the SEC for more complete information about us and this offering. You may access these documents for free by visiting EDGAR on the SEC Website at http://www.sec.gov . The preliminary prospectus was filed May 2 , 2022 and is available on the SEC website at http://www.sec.gov . Alternatively, the Company and any underwriter or dealer participating in the offering will arrange to send you the prospectus if you request it by call ing Boustead Securities, LLC at 949.502.4408 or by email at offerings@boustead 1828 .com or standard mail at Boustead Securities, LLC, Attn: Equity Capital Markets, 6 Venture, Suite 395 , Irvine, CA 92618 , USA. Form CRS/Reg BI Disclaimer: Boustead Securities, LLC is registered with the Securities and Exchange Commission (SEC) as a broker - dealer and is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). Brokerage and investment advisory services and fees differ and it is important for you to understand these differences. Free and simple tools are available to research firms and financial professionals at Investor.gov/CRS, which also provides educational materials about broker - dealers, investment advisers, and investing. When we provide you with a recommendation, we have to act in your best interest and not put our interest ahead of yours. At the same time, the way we make money creates a conflict with your interests. Please strive to understand and ask us about these conflicts because they can affect the recommendations we provide you. There are many risks involved with investing. For Boustead Securities customers and clients, please see our Regulation Best Interest Relationship Guide on the Form CRS Reg BI page on our website at https://www.boustead 1828 .com/form - crs - reg - bi. For FlashFunders ’ visitors, you may review the Form CRS of Boustead Securities under the Form CRS section. Please also carefully review and verify the accuracy of the information you provide us on account applications, subscription documents and others. © 2021 Past performance is not indicative of future results. There is no guarantee that any specific objective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. See disclosures at the beginning. 3

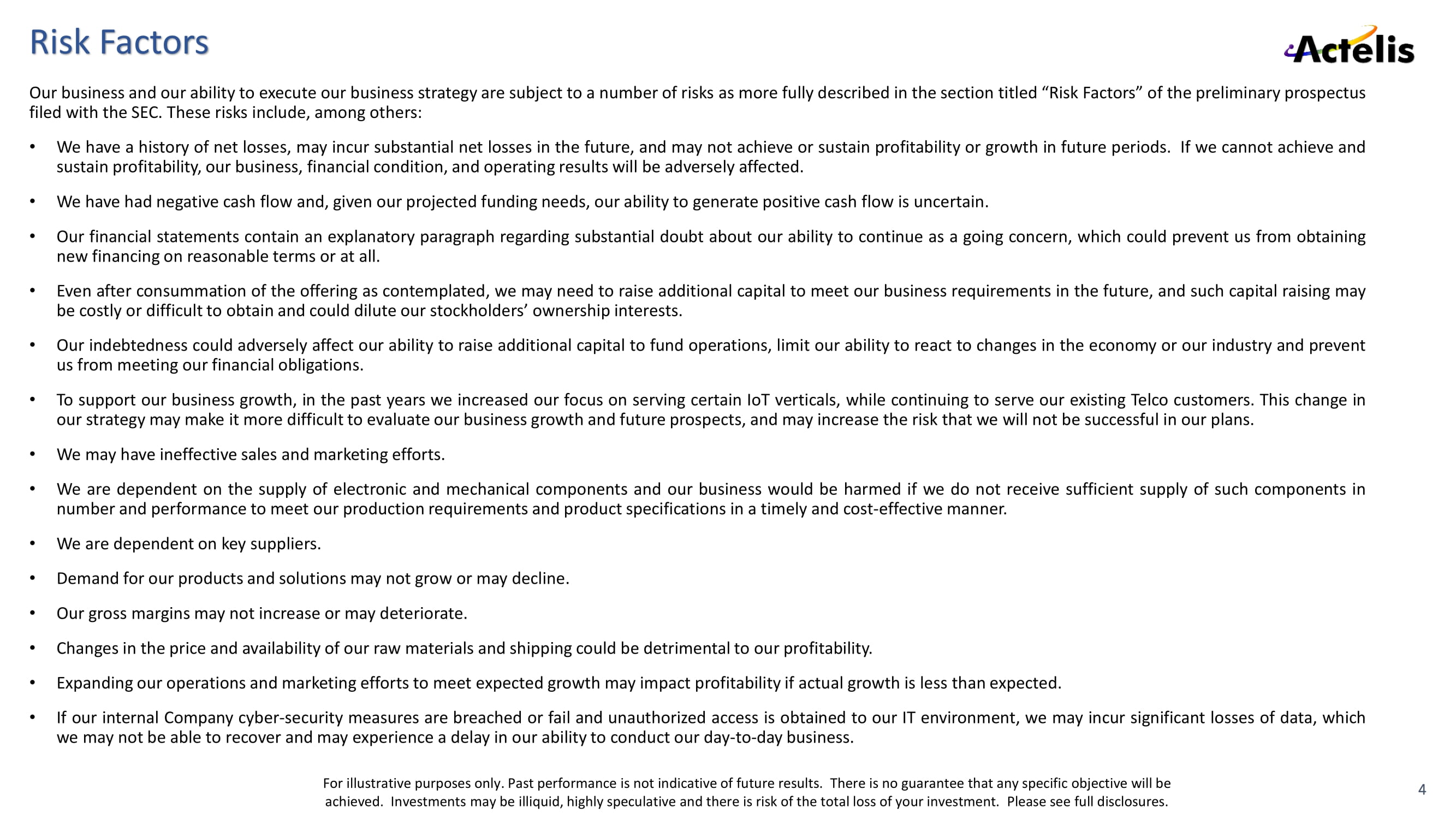

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Risk Factors Our business and our ability to execute our business strategy are subject to a number of risks as more fully described in the se ction titled “Risk Factors” of the preliminary prospectus filed with the SEC. These risks include, among others: • We have a history of net losses, may incur substantial net losses in the future, and may not achieve or sustain profitability or growth in future periods . If we cannot achieve and sustain profitability, our business, financial condition, and operating results will be adversely affected . • We have had negative cash flow and, given our projected funding needs, our ability to generate positive cash flow is uncertain . • Our financial statements contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all . • Even after consummation of the offering as contemplated, we may need to raise additional capital to meet our business requirements in the future, and such capital raising may be costly or difficult to obtain and could dilute our stockholders’ ownership interests . • Our indebtedness could adversely affect our ability to raise additional capital to fund operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting our financial obligations . • To support our business growth, in the past years we increased our focus on serving certain IoT verticals, while continuing to serve our existing Telco customers . This change in our strategy may make it more difficult to evaluate our business growth and future prospects, and may increase the risk that we will not be successful in our plans . • We may have ineffective sales and marketing efforts . • We are dependent on the supply of electronic and mechanical components and our business would be harmed if we do not receive sufficient supply of such components in number and performance to meet our production requirements and product specifications in a timely and cost - effective manner . • We are dependent on key suppliers . • Demand for our products and solutions may not grow or may decline . • Our gross margins may not increase or may deteriorate . • Changes in the price and availability of our raw materials and shipping could be detrimental to our profitability . • Expanding our operations and marketing efforts to meet expected growth may impact profitability if actual growth is less than expected . • If our internal Company cyber - security measures are breached or fail and unauthorized access is obtained to our IT environment, we may incur significant losses of data, which we may not be able to recover and may experience a delay in our ability to conduct our day - to - day business . 4

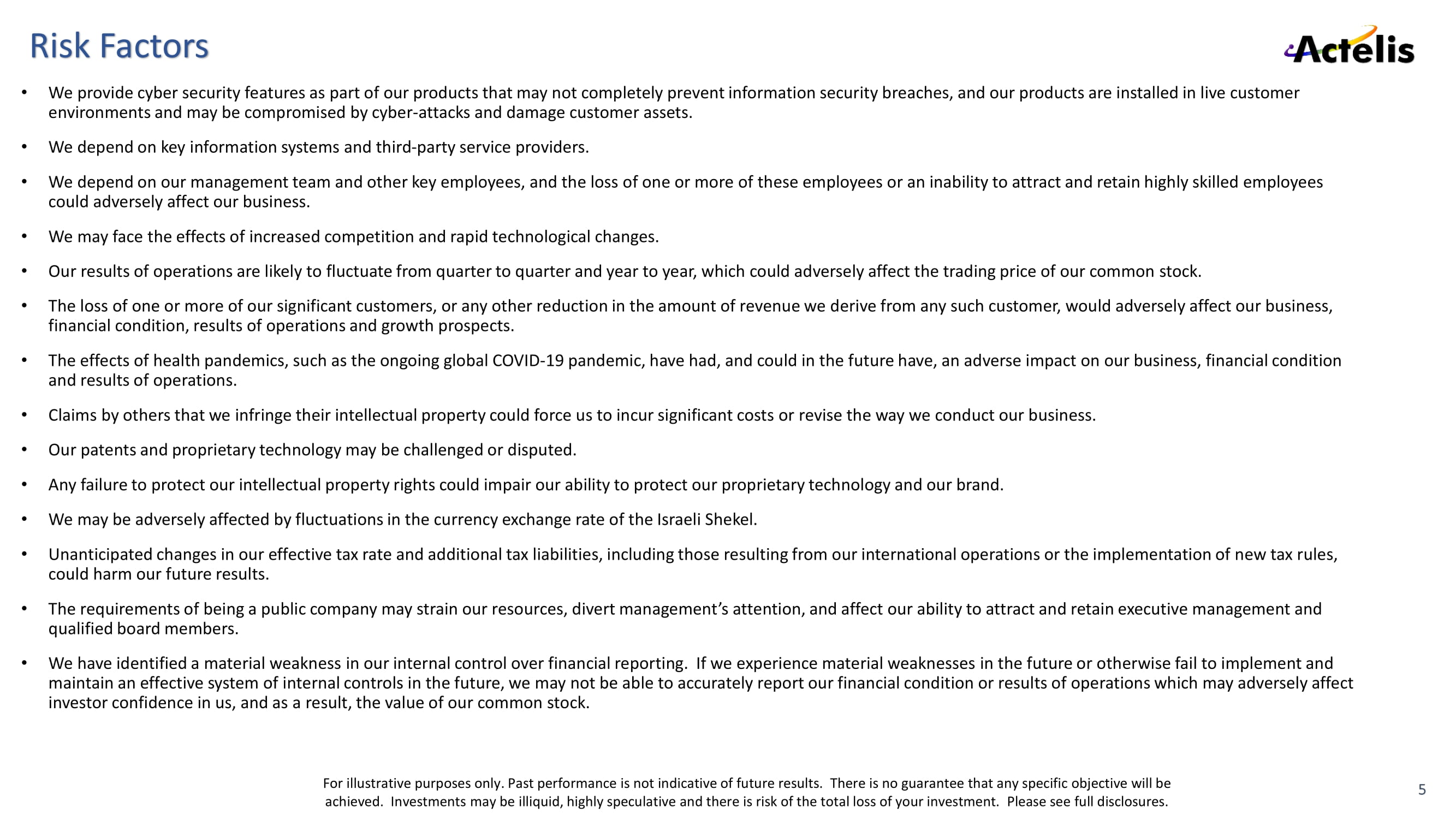

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Risk Factors • We provide cyber security features as part of our products that may not completely prevent information security breaches, and ou r products are installed in live customer environments and may be compromised by cyber - attacks and damage customer assets. • We depend on key information systems and third - party service providers. • We depend on our management team and other key employees, and the loss of one or more of these employees or an inability to a ttr act and retain highly skilled employees could adversely affect our business. • We may face the effects of increased competition and rapid technological changes. • Our results of operations are likely to fluctuate from quarter to quarter and year to year, which could adversely affect the tra ding price of our common stock. • The loss of one or more of our significant customers, or any other reduction in the amount of revenue we derive from any such cu stomer, would adversely affect our business, financial condition, results of operations and growth prospects. • The effects of health pandemics, such as the ongoing global COVID - 19 pandemic, have had, and could in the future have, an adverse impact on our business, financial condition and results of operations. • Claims by others that we infringe their intellectual property could force us to incur significant costs or revise the way we con duct our business. • Our patents and proprietary technology may be challenged or disputed. • Any failure to protect our intellectual property rights could impair our ability to protect our proprietary technology and ou r b rand. • We may be adversely affected by fluctuations in the currency exchange rate of the Israeli Shekel. • Unanticipated changes in our effective tax rate and additional tax liabilities, including those resulting from our internatio nal operations or the implementation of new tax rules, could harm our future results. • The requirements of being a public company may strain our resources, divert management ’ s attention, and affect our ability to attract and retain executive management and qualified board members. • We have identified a material weakness in our internal control over financial reporting. If we experience material weaknesse s i n the future or otherwise fail to implement and maintain an effective system of internal controls in the future, we may not be able to accurately report our financial condit ion or results of operations which may adversely affect investor confidence in us, and as a result, the value of our common stock. 5

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Free Writing Prospectus This presentation highlights basic information about us and the offering . Because it is a summary, it does not contain all of the information that you should consider before investing . This offering may only be made by means of a prospectus . We have filed a registration statement on Form S - 1 (File No . 333 - 264321 ), including a preliminary prospectus, dated April [ 29 ], 2022 (the “ Preliminary Prospectus ” ) with the SEC for the offering to which this communication relates . The registration statement has not yet become effective . Before you invest, you should read that registration statement, the Preliminary Prospectus and the final prospectus (when available) for more complete information about the Company and this offering . You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov . Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Boustead Securities, LLC a t 949.502.4408 or by email at offerings@boustead 1828 .com or standard mail at Boustead Securities, LLC, Attn: Equity Capital Markets, 6 Venture, Suite 395 , Irvine, CA 92618 , USA. This presentation does not constitute an offer or invitation for the sale or purchase or to engage in any other transaction with Actelis or its affiliates . The information in this presentation is not targeted at any residents of any particular country or jurisdiction and not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to local law or regulation . 6

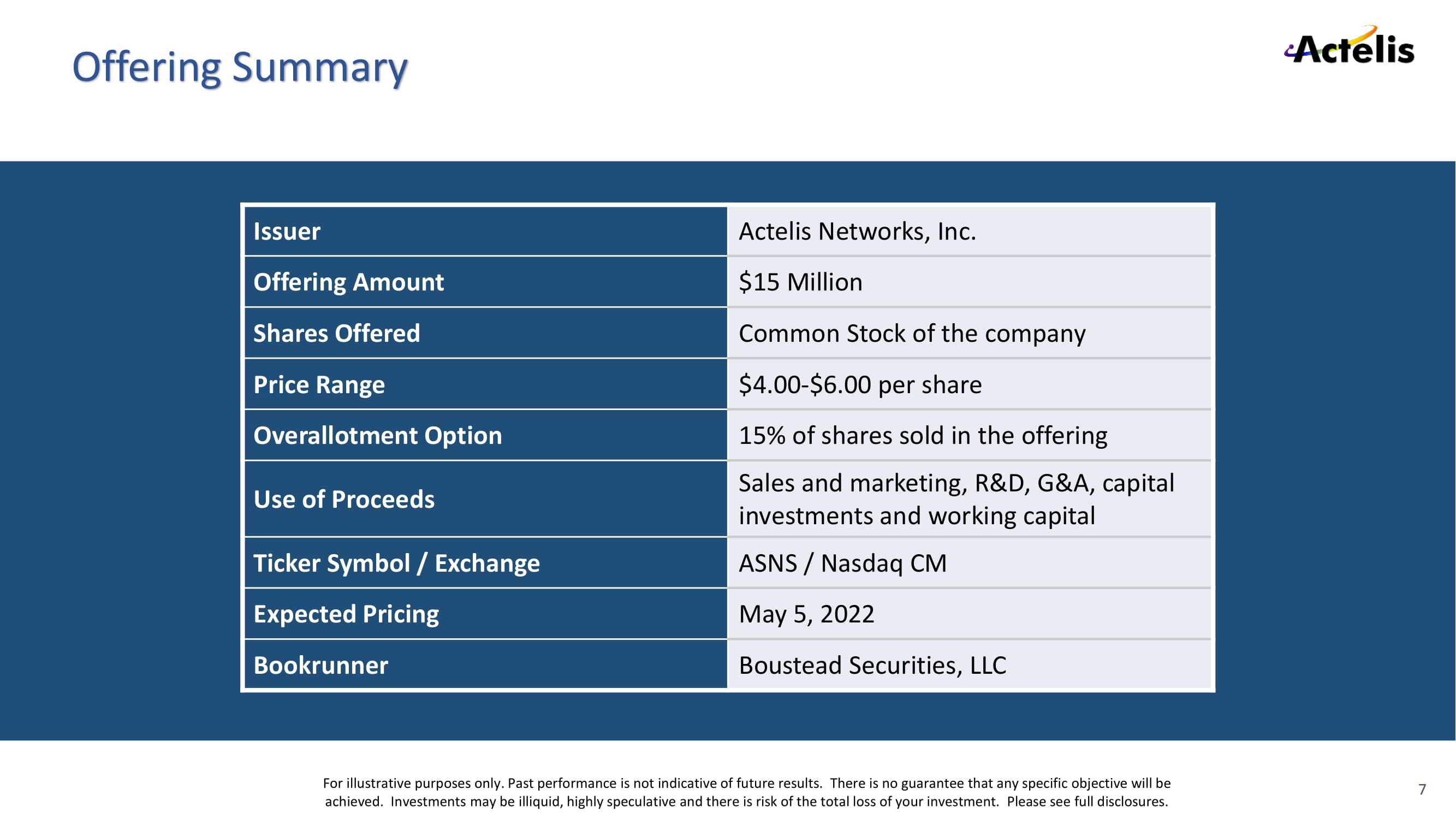

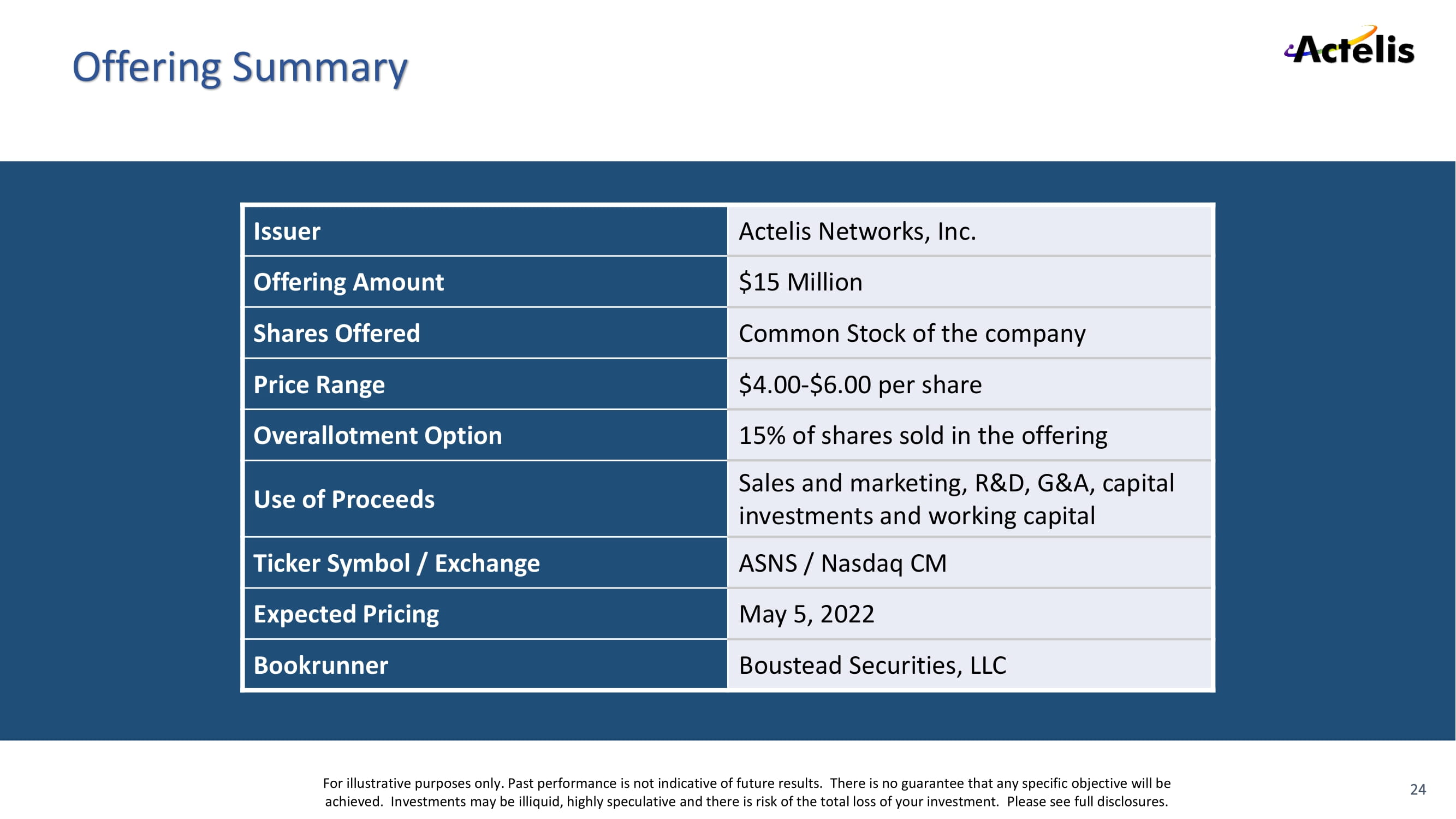

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. 7 Offering Summary Issuer Actelis Networks, Inc. Offering Amount $15 Million Shares Offered Common Stock of the company Price Range $4.00 - $6.00 per share Overallotment Option 15% of shares sold in the offering Use of Proceeds Sales and marketing, R&D, G&A, capital investments and working capital Ticker Symbol / Exchange ASNS / Nasdaq CM Expected Pricing May 5, 2022 Bookrunner Boustead Securities, LLC

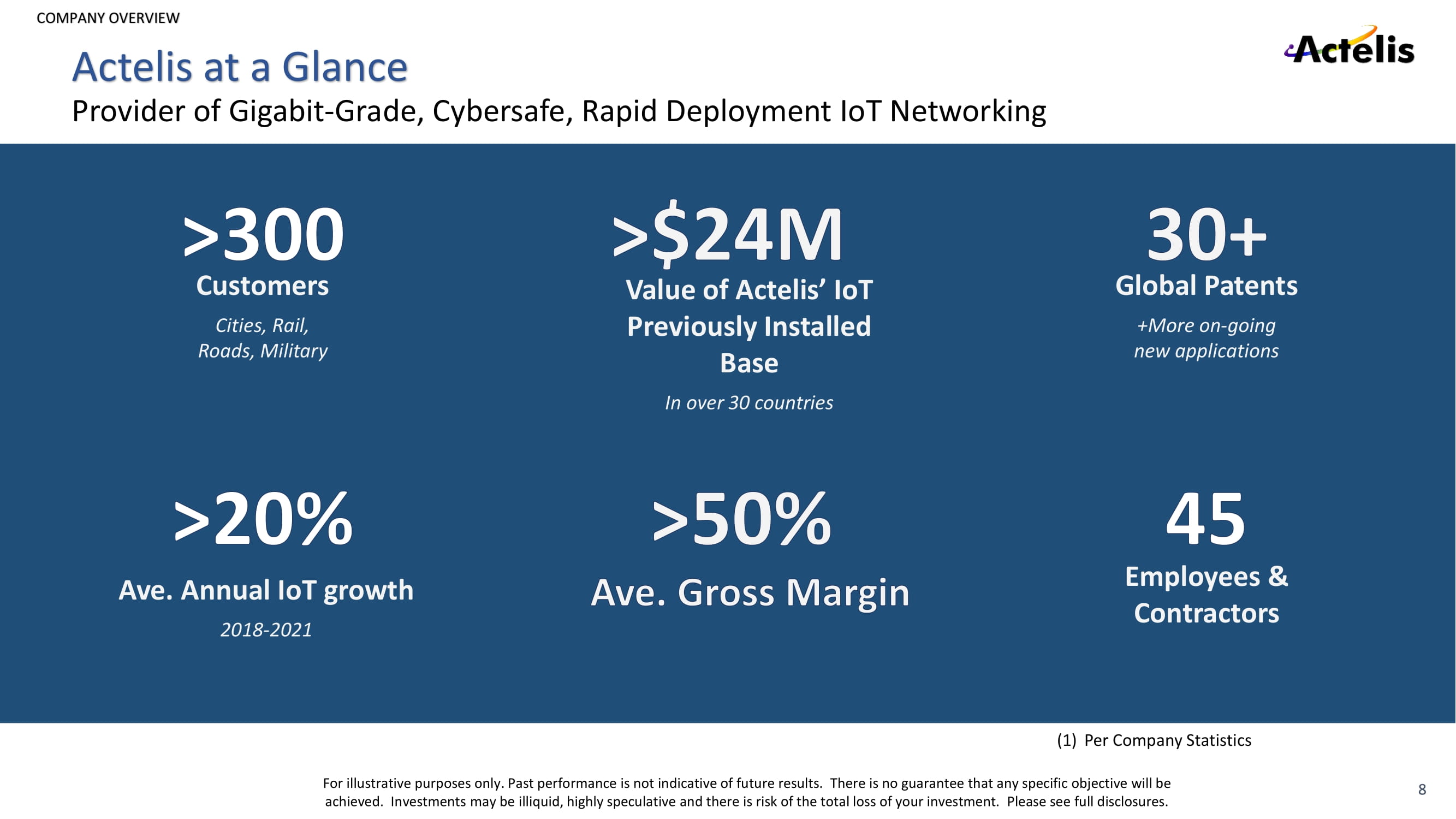

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Customers Cities, Rail, Roads, Military Value of Actelis ’ IoT Previously Installed Base In over 30 countries Global Patents +More on - going new applications Ave. Annual IoT growth 2018 - 2021 Employees & Contractors 8 (1) Per Company Statistics Actelis at a Glance Provider of Gigabit - Grade, Cybersafe, Rapid Deployment IoT Networking

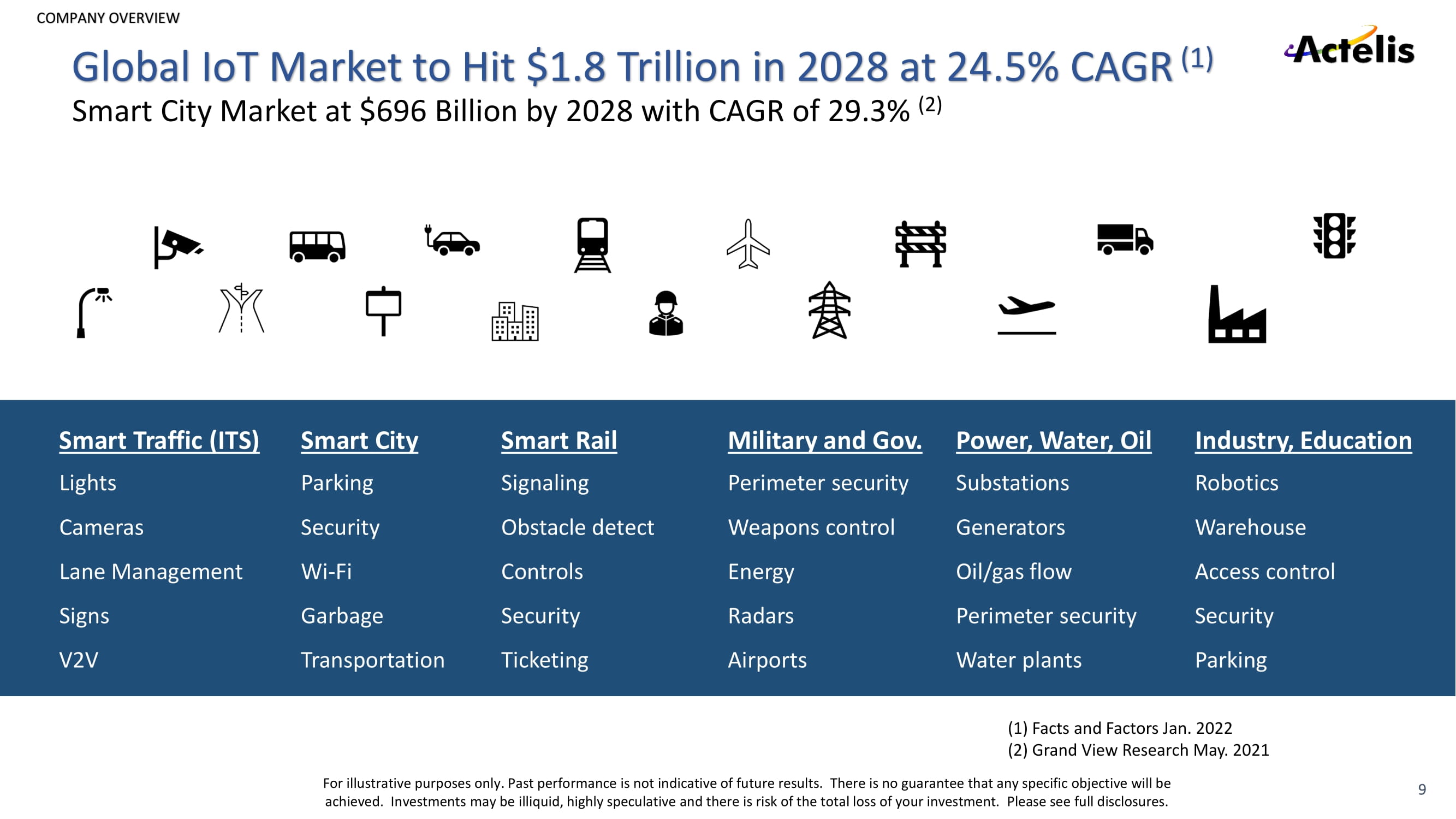

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. ( 1 ) Facts and Factors Jan. 2022 ( 2 ) Grand View Research May. 2021 Smart Traffic (ITS) Smart City Smart Rail Military and Gov. Power, Water, Oil Industry, Education Lights Parking Signaling Perimeter security Substations Robotics Cameras Security Obstacle detect Weapons control Generators Warehouse Lane Management Wi - Fi Controls Energy Oil/gas flow Access control Signs Garbage Security Radars Perimeter security Security V2V Transportation Ticketing Airports Water plants Parking 9 Global IoT Market to Hit $1.8 Trillion in 2028 at 24.5% CAGR (1) Smart City Market at $696 Billion by 2028 with CAGR of 29.3% (2)

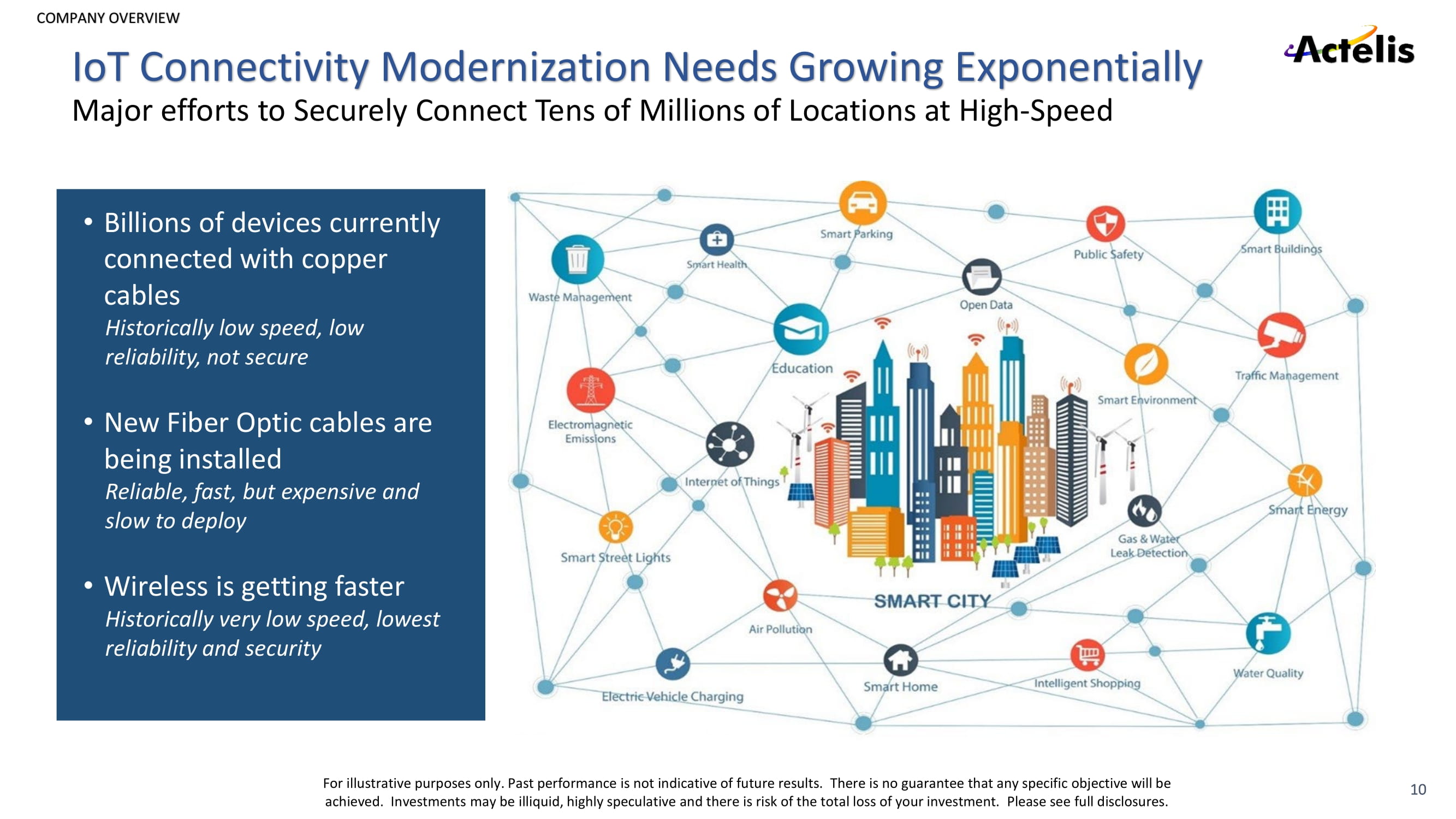

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. IoT Connectivity Modernization Needs Growing Exponentially • Billions of devices currently connected with copper cables Historically low speed, low reliability, not secure • New Fiber Optic cables are being installed Reliable, fast, but expensive and slow to deploy • Wireless is getting faster Historically very low speed, lowest reliability and security Major efforts to Securely Connect Tens of Millions of Locations at High - Speed 10

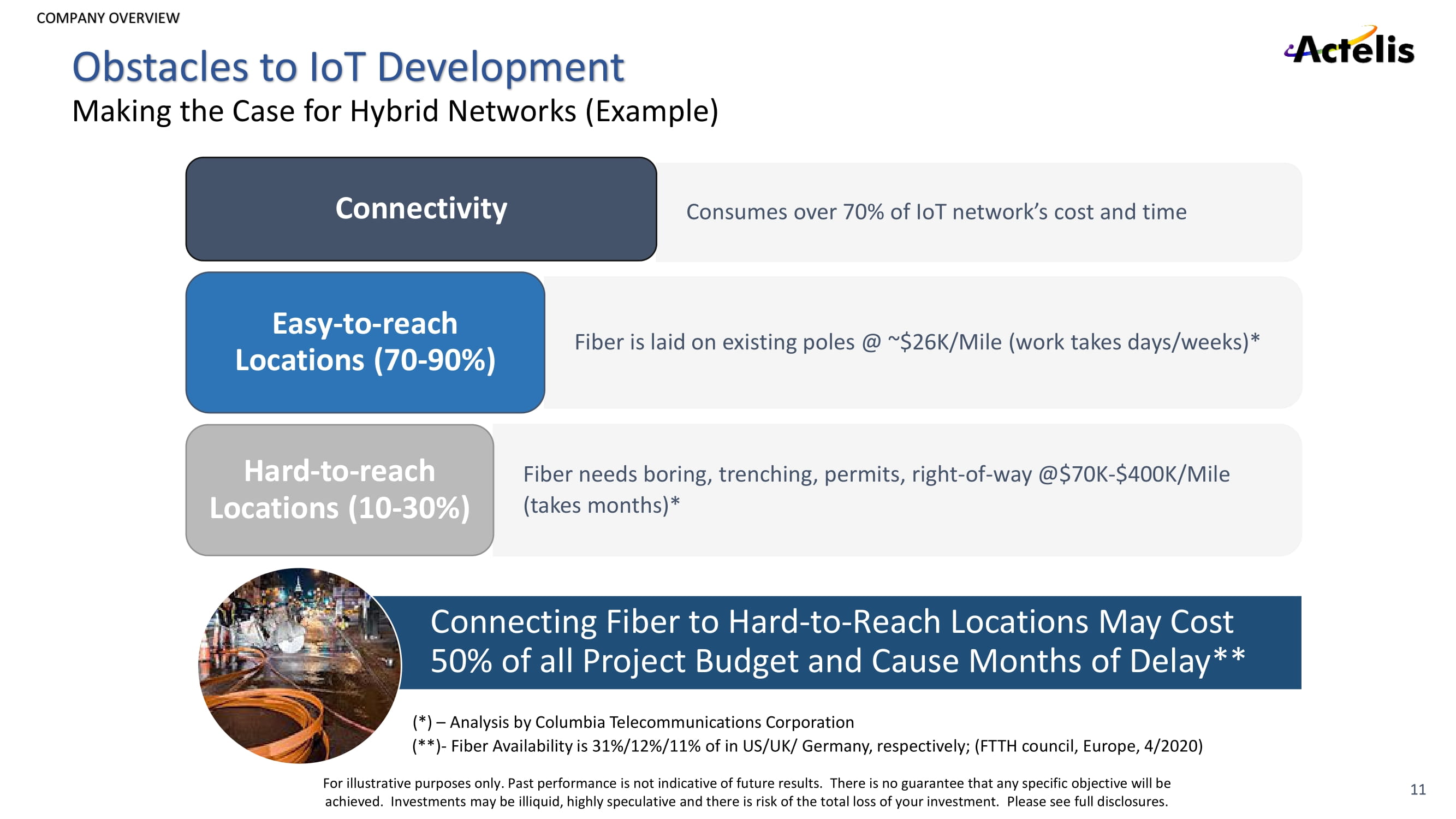

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Obstacles to IoT Development Making the Case for Hybrid Networks (Example) Connecting Fiber to Hard - to - Reach Locations May Cost 50% of all Project Budget and Cause Months of Delay** Consumes over 70 % of IoT network ’ s cost and time Connectivity Fiber is laid on existing poles @ ~$ 26 K/Mile (work takes days/weeks)* Easy - to - reach Locations (70 - 90%) Fiber needs boring, trenching, permits, right - of - way @$ 70 K - $ 400 K/Mile (takes months)* Hard - to - reach Locations (10 - 30%) (*) – Analysis by Columbia Telecommunications Corporation (**) - Fiber Availability is 31%/12%/11% of in US/UK/ Germany, respectively; (FTTH council, Europe, 4/2020) 11

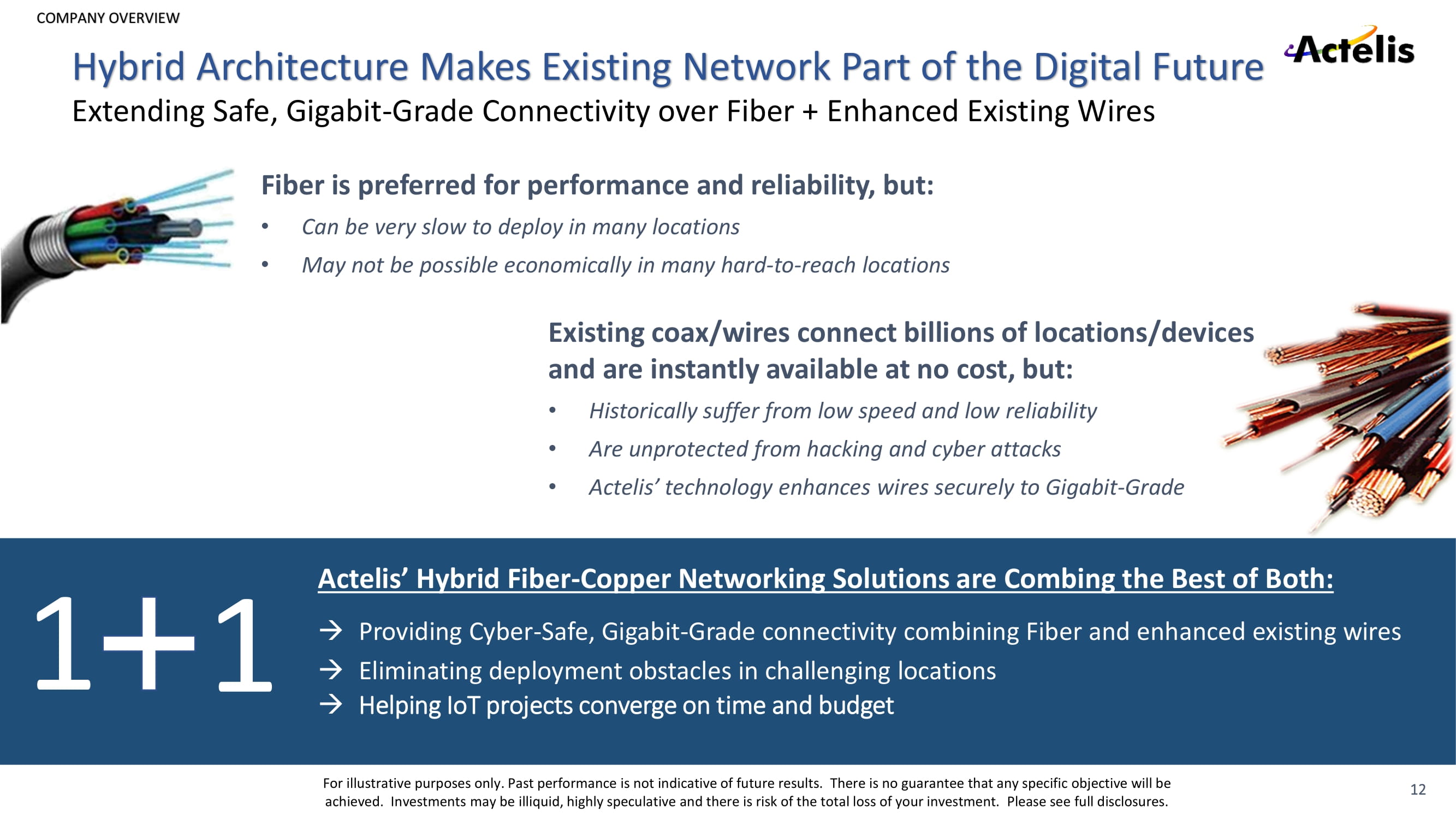

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Fiber is preferred for performance and reliability, but: • Can be very slow to deploy in many locations • May not be possible economically in many hard - to - reach locations Actelis ’ Hybrid Fiber - Copper Networking Solutions are Combing the Best of Both: Providing Cyber - Safe, Gi g abit - Grade connectivity combining Fiber and enhanced existing wires Eliminating deployment obstacles in challenging locations Helping IoT projects converge on time and budget Existing coax/wires connect billions of locations/devices and are instantly available at no cost, but: • Historically suffer from low speed and low reliability • Are unprotected from hacking and cyber attacks • Actelis’ technology enhances wires securely to Gigabit - Grade 12 Extending Safe, Gigabit - Grade Connectivity over Fiber + Enhanced Existing Wires Hybrid Architecture Makes Existing Network Part of the Digital Future 1 1

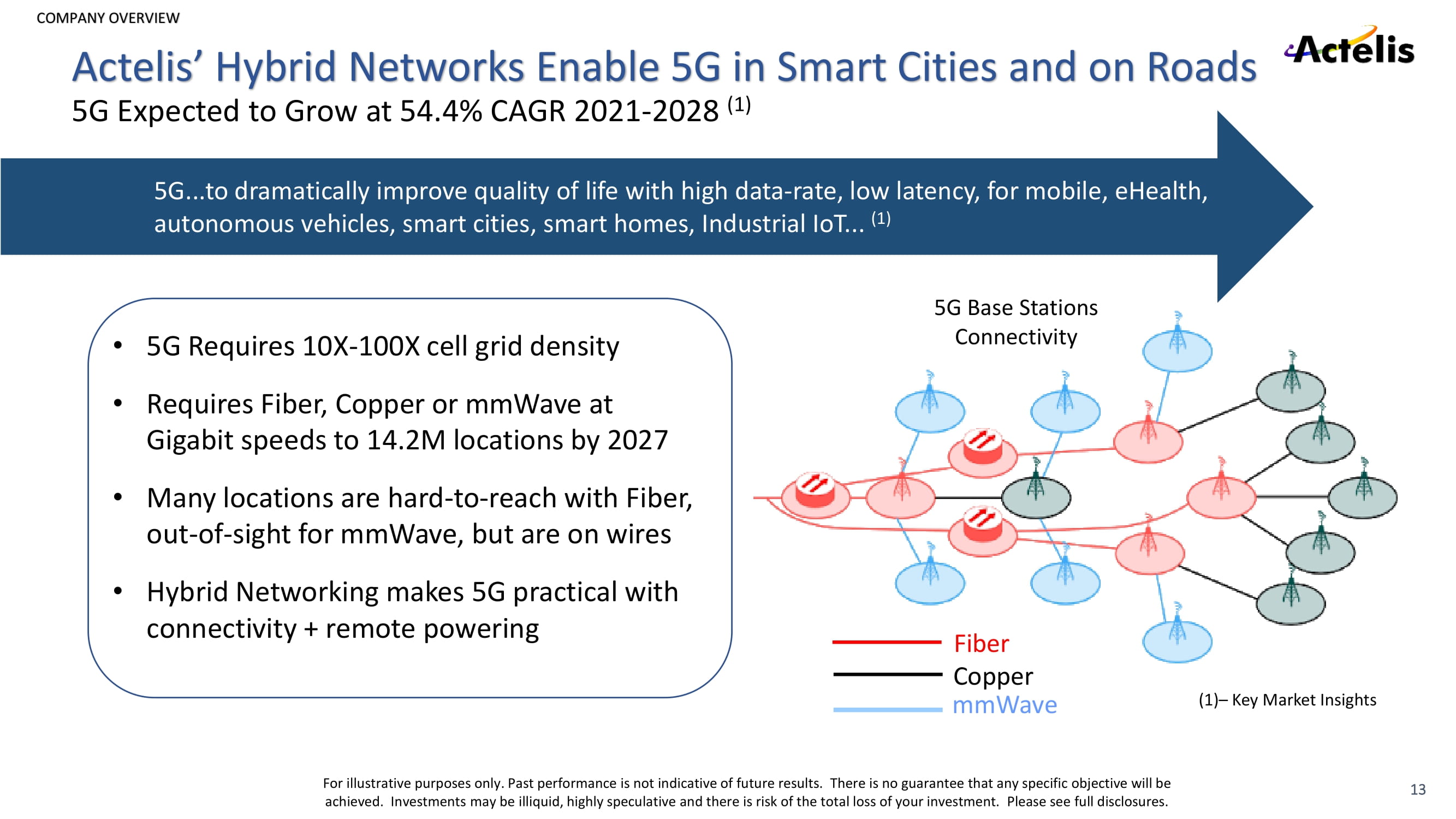

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. • 5G Requires 10X - 100X cell grid density • Requires Fiber, Copper or mmWave at Gigabit speeds to 14.2M locations by 2027 • Many locations are hard - to - reach with Fiber, out - of - sight for mmWave, but are on wires • Hybrid Networking makes 5G practical with connectivity + remote powering (1) – Key Market Insights Fiber Copper mmWave 5G Base Stations Connectivity 13 Actelis’ Hybrid Networks Enable 5G in Smart Cities and on Roads 5G Expected to Grow at 54.4% CAGR 2021 - 2028 (1) 5G...to dramatically improve quality of life with high data - rate, low latency, for mobile, eHealth, autonomous vehicles, smart cities, smart homes, Industrial IoT... (1)

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. MetaLIGHT Unique Signal Processing and Coding Technology • Optimal synchronization of multi - line signals • Elimination of interference to boost speed • Data line coding for resilience, security (1) • Multi - line scrambling for low latency, security (2) • 256 - bit encryption of transmission (3) • Multi - line modulation for up to 10Gbps (4) • Spectrally compliant reach extenders to 100Km • Remote powering + Data to 4G/5G base stations ( 1 ), ( 2 ), ( 3 ) – Components of Triple Shield Protection 1728 1600 1664 5600 5700 3792 3792 1600 5568 5200 5300 5500 5584 5200 5392 5200 Unsynchronized Transmission • Lines supporting other lines • Optimal • Reliable • Secure Copper Cable • Lines interfering with other lines • Suboptimal • Unreliable • Unsecure Synchronized Transmission Individual Wires (4) – 10Gbps available in 2023 (5) – Vs. single wire performance in cable 14 Combining 100X Wire (5) Performance Boost with Triple - Shield Security

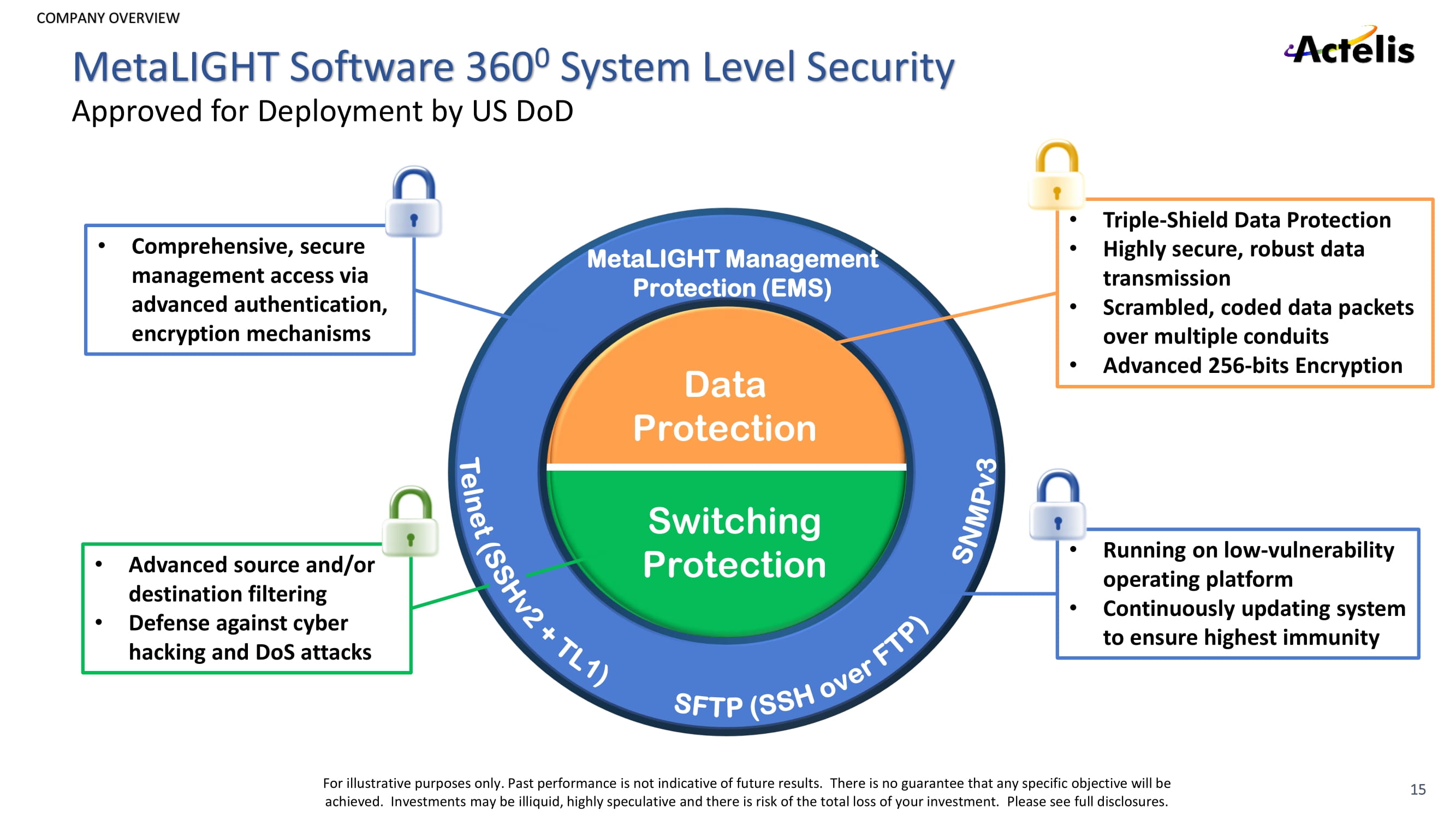

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. • Triple - Shield Data Protection • Highly secure, robust data transmission • Scrambled, coded data packets over multiple conduits • Advanced 256 - bits Encryption • Advanced source and/or destination filtering • Defense against cyber hacking and DoS attacks • Comprehensive, secure management access via advanced authentication, encryption mechanisms • Running on low - vulnerability operating platform • Continuously updating system to ensure highest immunity Data Protection Switching Protection MetaLIGHT Management Protection (EMS) 15 MetaLIGHT Software 360 0 System Level Security Approved for Deployment by US DoD

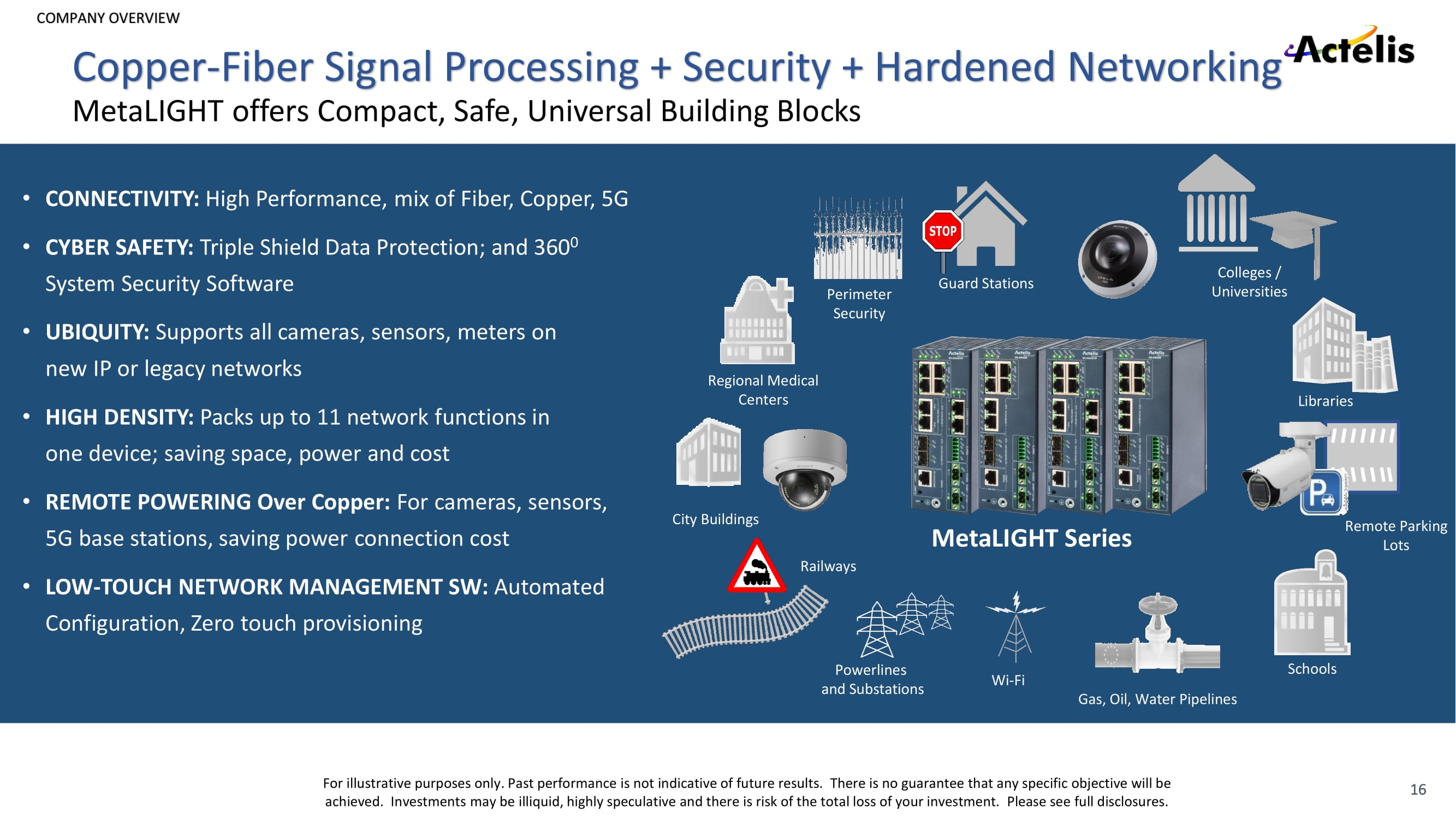

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. • CONNECTIVITY: High Performance, mix of Fiber, Copper, 5G • CYBER SAFETY: Triple Shield Data Protection; and 360 0 System Security Software • UBIQUITY: Supports all cameras, sensors, meters on new IP or legacy networks • HIGH DENSITY: Packs up to 11 network functions in one device; saving space, power and cost • REMOTE POWERING Over Copper: For cameras, sensors, 5G base stations, saving power connection cost • LOW - TOUCH NETWORK MANAGEMENT SW: Automated Configuration, Zero touch provisioning Libraries Schools City Buildings Regional Medical Centers Colleges / Universities Remote Parking Lots Guard Stations Perimeter Security Railways Powerlines and Substations Gas, Oil, Water Pipelines Wi - Fi MetaLIGHT Series 16 Copper - Fiber Signal Processing + Security + Hardened Networking MetaLIGHT offers Compact, Safe, Universal Building Blocks

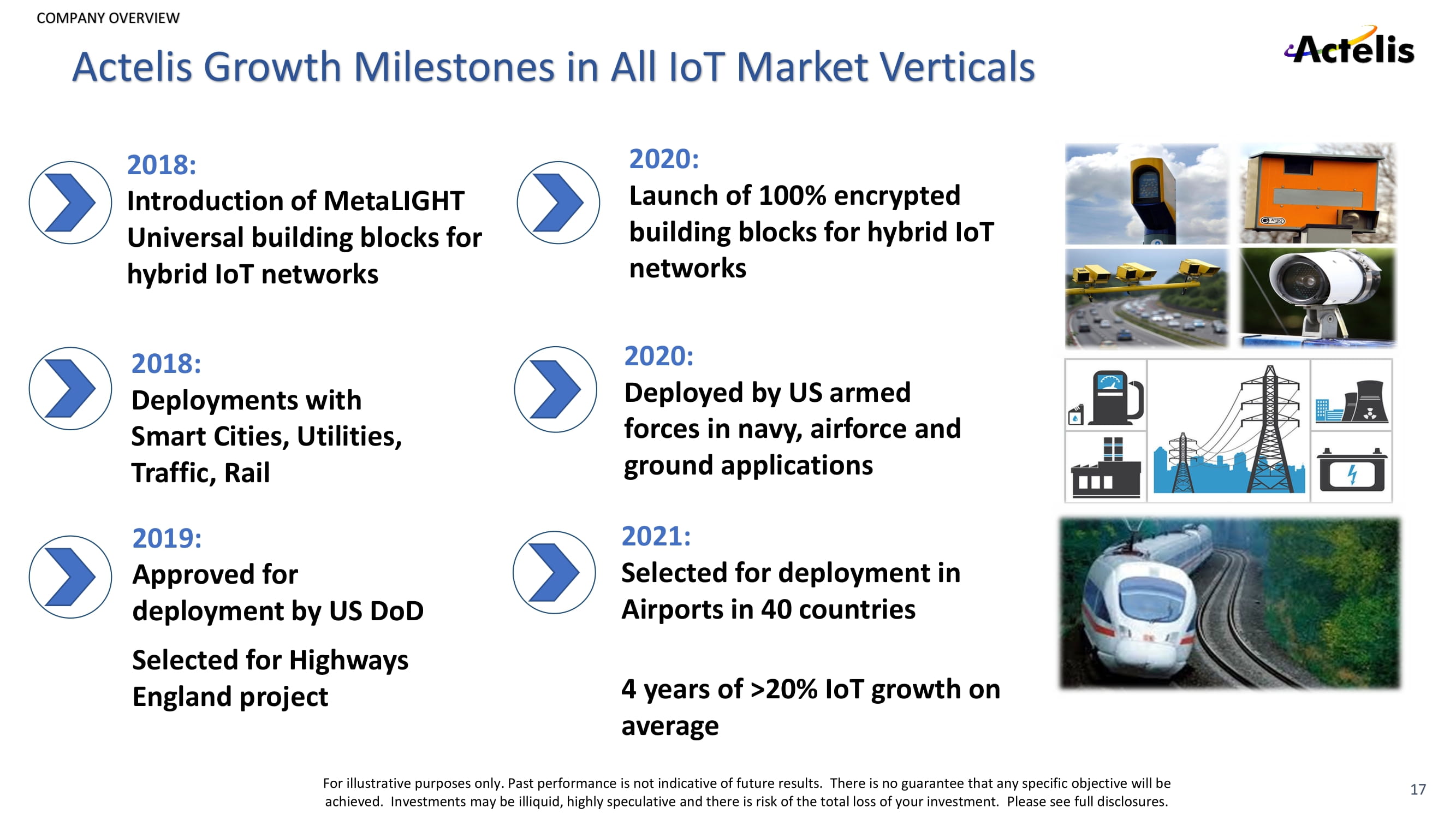

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Actelis Growth Milestones in All IoT Market Verticals 2018: Introduction of MetaLIGHT Universal building blocks for hybrid IoT networks 2020: Launch of 100% encrypted building blocks for hybrid IoT networks 2021: Selected for deployment in Airports in 40 countries 4 years of >20% IoT growth on average 2019: Approved for deployment by US DoD Selected for Highways England project 2018 : Deployments with Smart Cities, Utilities, Traffic, Rail 2020: Deployed by US armed forces in navy, airforce and ground applications 17

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Stanford University City of Frankfurt Energy Austria Japanese Army SMART TRANSPORTATION SMART GRID SMART CITY SMART CAMPUS Gov, MILITARY & POLICE Canadian rail Swiss rail Belgian Police East Midland BB Consortium UK 18 Select IoT Customers

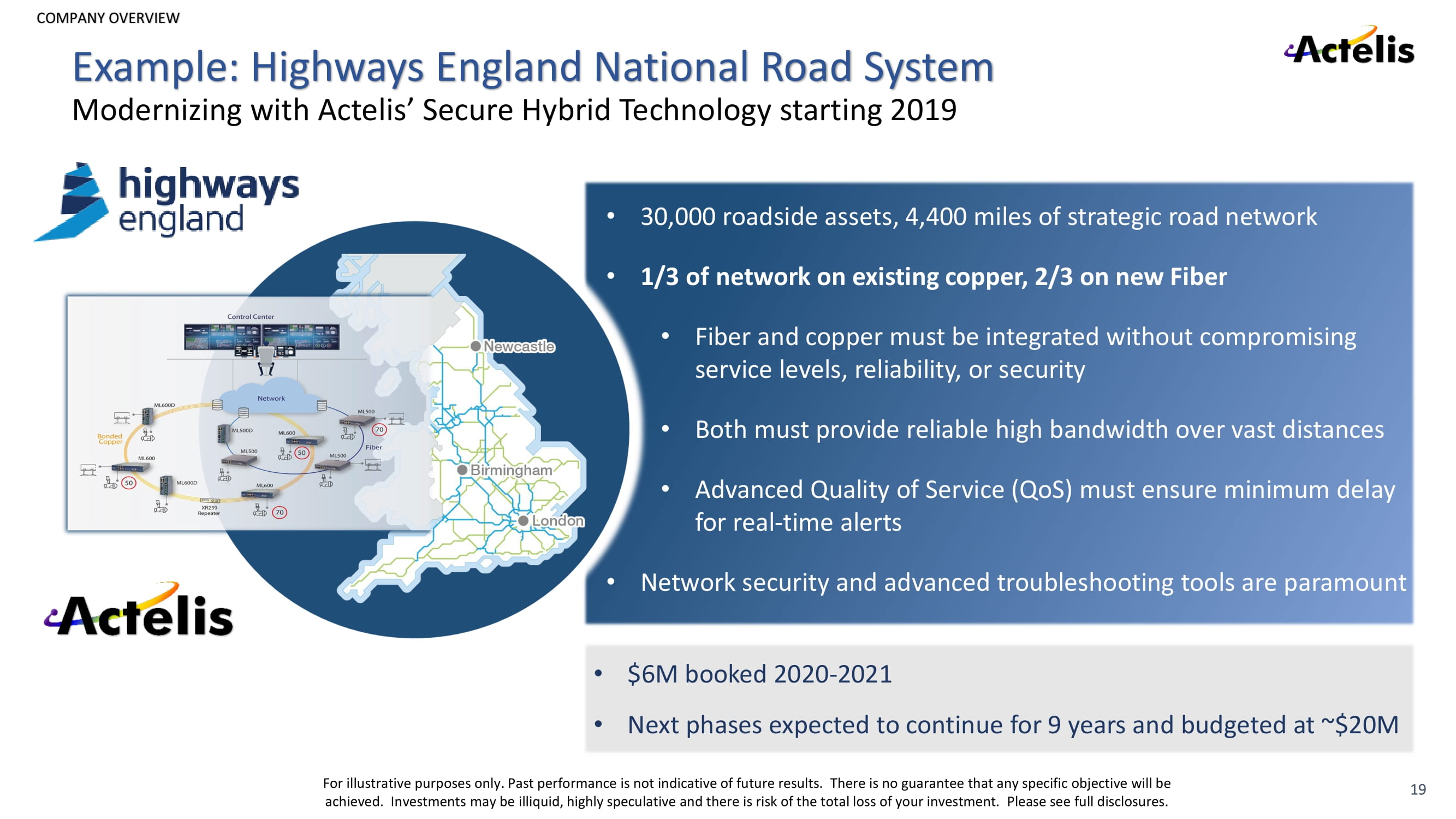

COMPANY OVERVIEW For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. • 30,000 roadside assets, 4,400 miles of strategic road network • 1 / 3 of network on existing copper, 2 / 3 on new Fiber • Fiber and copper must be integrated without compromising service levels, reliability, or security • Both must provide reliable high bandwidth over vast distances • Advanced Quality of Service (QoS) must ensure minimum delay for real - time alerts • Network security and advanced troubleshooting tools are paramount • $ 6 M booked 2020 - 2021 • Next phases expected to continue for 9 years and budgeted at ~$ 20 M 19 Modernizing with Actelis’ Secure Hybrid Technology starting 2019 Example: Highways England National Road System

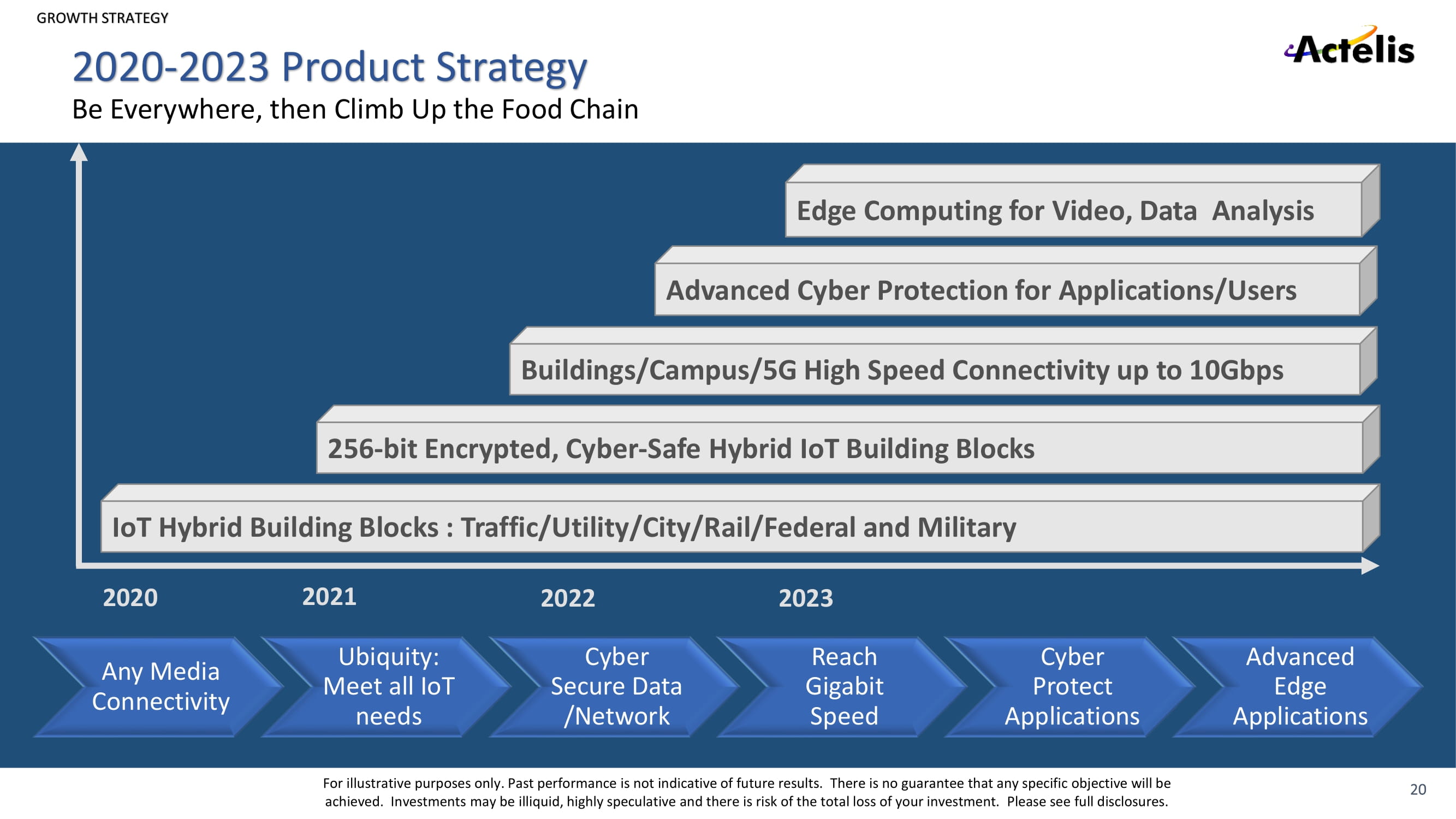

GROWTH STRATEGY For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. IoT Hybrid Building Blocks : Traffic/Utility/City/Rail/Federal and Military Edge Computing for Video, Data Analysis Advanced Cyber Protection for Applications/Users ϮϬϮϭ ϮϬϮϮ ϮϬϮϯ 256 - bit Encrypted, Cyber - Safe Hybrid IoT Building Blocks Buildings/Campus/ 5 G High Speed Connectivity up to 10 Gbps ϮϬϮ 0 Any Media Connectivity Ubiquity: Meet all IoT needs Cyber Secure Data /Network Reach Gigabit Speed Cyber Protect Applications Advanced Edge Applications 20 Be Everywhere, then Climb Up the Food Chain 2020 - 2023 Product Strategy

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. COMPETITIVE OVERVIEW 21 Leading Unique Real - Life Hybrid Offering Time/cost per bit Low High Low High Security Real Life Hybrid Networks Actelis ’ solutions offer significant competitive advantages in performance and security layers in both Fiber and copper. When combined into real - life hybrid copper - fiber networks, they offer higher security, faster deployment and lower cost. Competitive Landscape

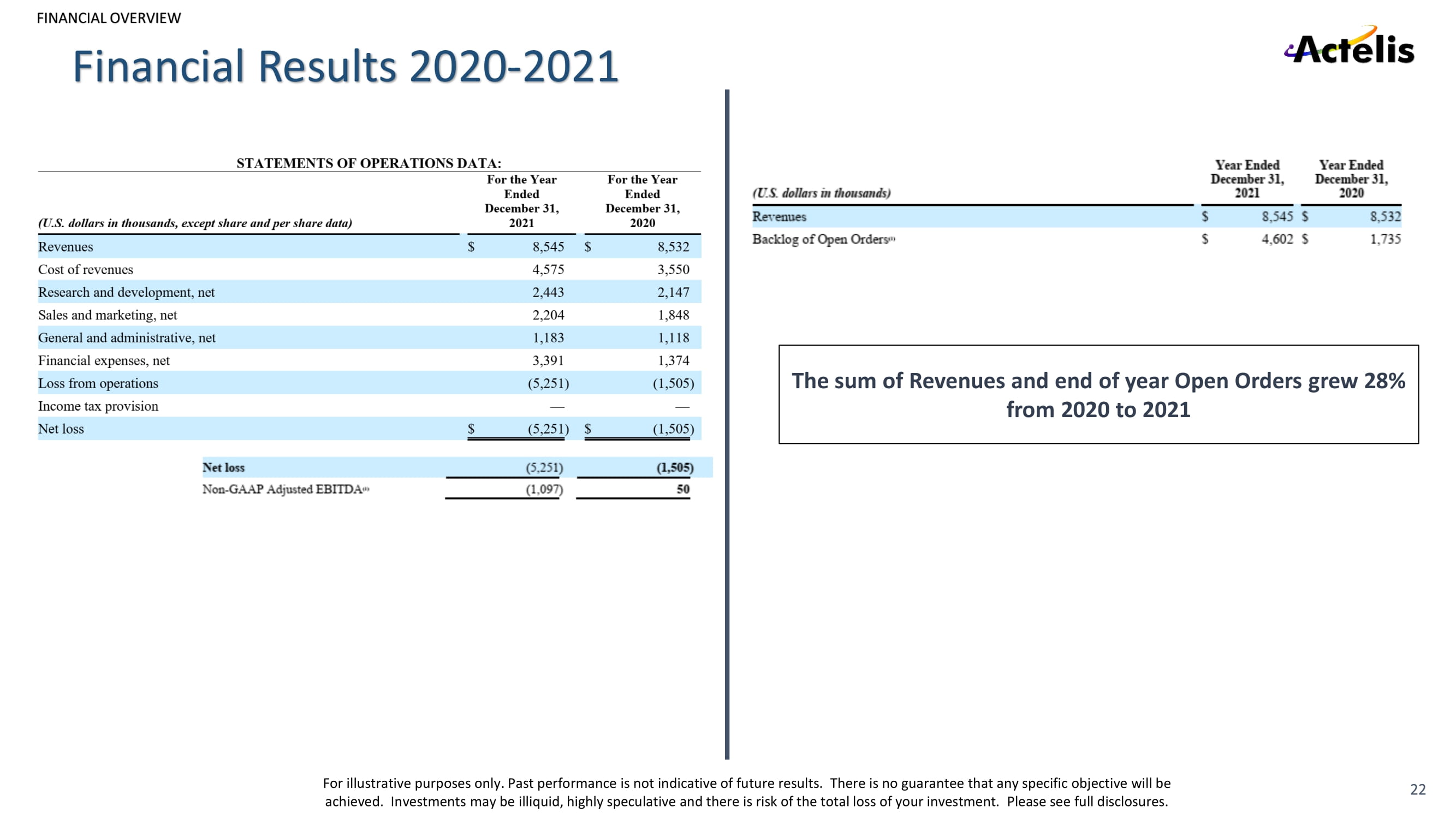

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. FINANCIAL OVERVIEW 22 Financial Results 2020 - 2021 The sum of Revenues and end of year Open Orders grew 28 % from 2020 to 2021

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. EXECUTIVE SUMMARY Experienced, committed, highly efficient management team with unique industry knowledge Addressing a pain point of many major growth verticals, totaling >$ 1 T Proven cyber - hardened hybrid technology, strong differentiated offering Protected by > 30 patents 4 years of >20% Ave. growth in IOT Expanding from a strong, multi - national customer base Actelis is Positioned for Success With IoT Growth 23 >$4M Strong backlog into 2022

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. 24 Offering Summary Issuer Actelis Networks, Inc. Offering Amount $15 Million Shares Offered Common Stock of the company Price Range $4.00 - $6.00 per share Overallotment Option 15% of shares sold in the offering Use of Proceeds Sales and marketing, R&D, G&A, capital investments and working capital Ticker Symbol / Exchange ASNS / Nasdaq CM Expected Pricing May 5, 2022 Bookrunner Boustead Securities, LLC

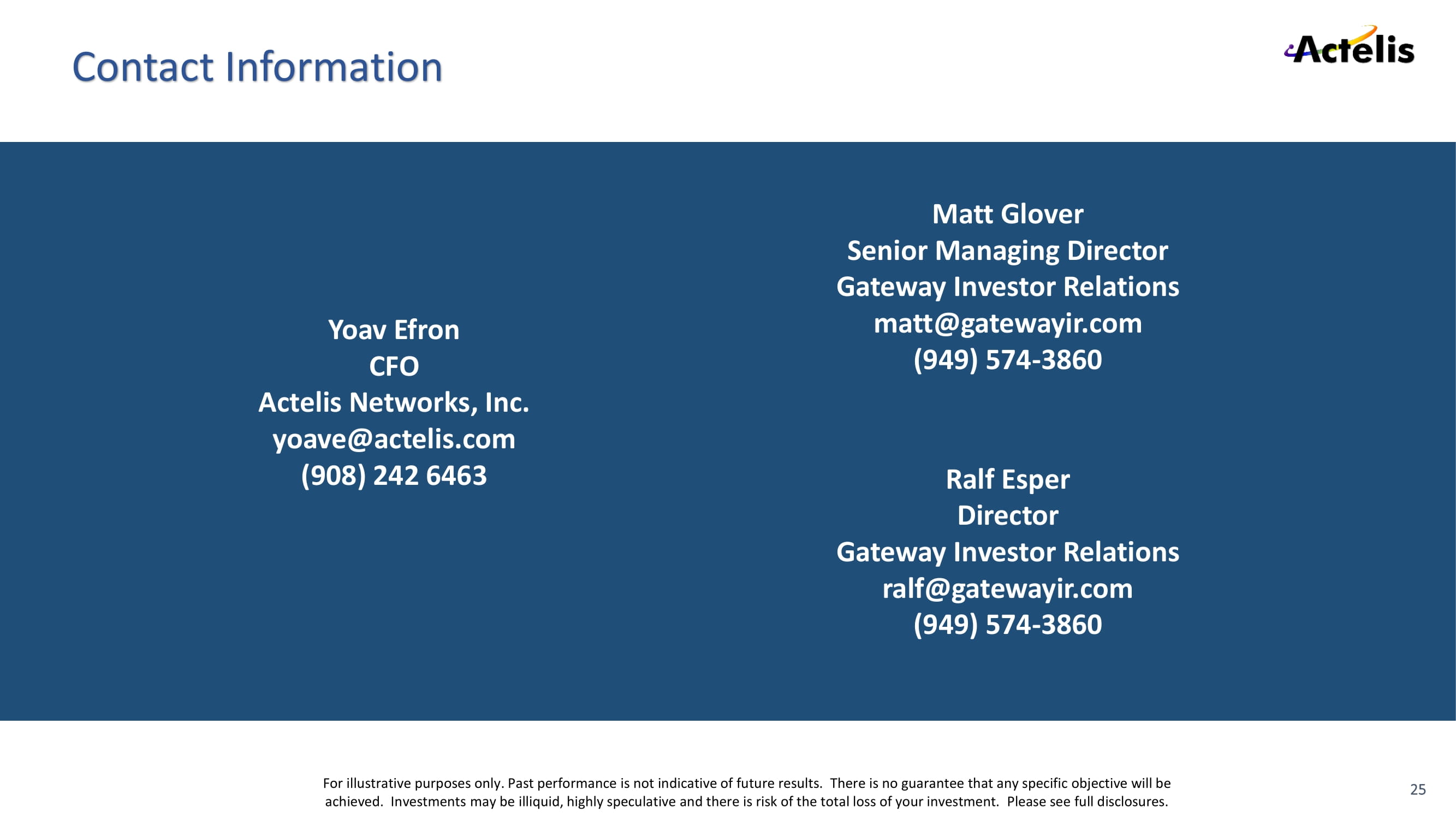

For illustrative purposes only. Past performance is not indicative of future results. There is no guarantee that any specifi c o bjective will be achieved. Investments may be illiquid, highly speculative and there is risk of the total loss of your investment. Please se e f ull disclosures. Matt Glover Senior Managing Director Gateway Investor Relations matt@gatewayir.com ( 949 ) 574 - 3860 Yoav Efron CFO Actelis Networks, Inc. yoave@actelis.com ( 908 ) 242 6463 Ralf Esper Director Gateway Investor Relations ralf@gatewayir.com ( 949 ) 574 - 3860 25 Contact Information