Exhibit 3.1

STATE OF DELAWARE

CERTIFICATE of AMENDMENT

to the

TWENTY-THIRD AMENDED AND RESTATED

CERTIFICATE of INCORPORATION

of

ACTELIS NETWORKS, INC.

ACTELIS NETWORKS INC., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (“DGCL”), does hereby certify that:

1. The present name of the Corporation is ACTELIS NETWORKS, INC.

2. The date of filing of the original Certificate of Incorporation of the Corporation with the Secretary of State of the State of Delaware was on November 12, 1998, as ACTEL Networks, Inc. The Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on May 6, 1999. A Certificate of Amendment to the Certificate of Incorporation was filed on June 14, 1999. A Certificate of Amendment to the Certificate of Incorporation was filed on July 6, 1999. A Certificate of Amendment to the Certificate of Incorporation was filed on July 28, 1999. The Second Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on October 19, 1999. The Third Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on December 1, 1999. The Fourth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on April 20, 2001. The Fifth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on April 26, 2001. The Sixth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on June 12, 2001. The Seventh Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on December 9, 2004. The Eighth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on January 7, 2005. A Certificate of Amendment to the Certificate of Incorporation was filed on September 14, 2005. The Ninth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on November 21, 2006. The Tenth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on December 28, 2006. The Eleventh Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on April 30, 2008. A Certificate of Amendment to the Certificate of Incorporation was filed on January 27, 2009. The Twelfth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on March 13, 2009. The Thirteenth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on April 23, 2009. A Certificate of Amendment to the Certificate of Incorporation was filed on June 4, 2009. The Fourteenth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on August 25, 2009. The Fifteenth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on October 2, 2009. The Sixteenth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on February 16, 2011. The Seventeenth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on June 14, 2013. The Eighteenth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on July 1, 2013. The Nineteenth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on March 24, 2014. The Twentieth Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on June 16, 2014. The Twenty First Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on February 24, 2015. The Twenty Second Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on February 27, 2015. A Certificate of Amendment to the Twenty Second Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on December 29, 2015 (the “Certificate of Incorporation”).

3. This Twenty Third Amended and Restated Certificate of Incorporation, which amends and restates the Corporation’s Certificate of Incorporation in its entirety, has been duly adopted pursuant to the provisions of Sections 242 and 245 of the DGCL, and the stockholders of the Corporation have given their written consent hereto in accordance with Section 228 of the DGCL. The provisions of the Twenty Third Amended and Restated Certificate of Incorporation are as follows

FIRST: The name of the corporation is Actelis Networks, Inc. (the “Corporation”).

SECOND: The registered office in the State of Delaware is located at Corporation Trust Center, 1209 Orange Street, in the City of Wilmington, County of New Castle, 19801 and its registered agent at such address is The Corporation Trust Company.

THIRD: The nature of the business, and the objects and purposes proposed to be transacted, promoted and carried on, are to do any lawful act or thing for which a corporation may be organized under the General Corporation Law of the State of Delaware.

FOURTH: The aggregate number of shares of stock which the Corporation shall have authority to issue is 1,002,881,376 shares, consisting of 506,428,470 shares of Common Stock with a par value of US$0.000001 per share (the “Common Stock”), 128,973,588 shares of Non-Voting Common Stock with a par value of US$0.000001 per share (the “Non-Voting Common Stock”) and 367,479,318 shares of preferred stock with a par value of US$0.000001 per share (the “Preferred Stock” or the “Preferred Shares”), of which 229,357,781 are designated the “Series A Preferred Convertible Stock” (the “Series A Preferred Stock”) and 138,121,537 are designated the “Series B Convertible Stock” (the “Series B Preferred Stock”). It is hereby clarified that any reference to Common Stock shall not include a reference to Non-Voting Common Stock.

2

A description of the respective classes of stock and a statement of the designations, preferences, voting powers (or no voting powers), relative, participating, optional or other special rights and privileges and the qualifications, limitations and restrictions of the Preferred Stock, the Common Stock and the Non-Voting Common Stock are as follows:

A. COMMON STOCK

1. General. The voting, dividend and liquidation rights of the holders of the Common Stock are subject to and qualified by the rights of the holders of the Preferred Stock (and any other class or series of capital stock of the Corporation) at the time outstanding having prior rights as to voting, dividends or liquidation, all as set forth herein.

2. Voting. The Common Stock is entitled to one vote for each share with respect to any and all matters presented to the stockholders of the Corporation for their action or consideration. Except as provided by law or as otherwise provided in this Certificate of Incorporation, the Common Stock shall vote together as a single class on all matters with any other class or series of voting capital stock of the Corporation. The Common Stock shall not vote as a separate class with respect to the increase of the authorized number of Common Stock, notwithstanding Section 242(2)(b)(2) of the Delaware Corporation Code.

3. Dividends. The holders of the Common Stock shall be entitled to receive, when and as declared by the Board of Directors, out of any assets of the Corporation legally available therefor, such dividends as may be declared from time to time by the Board of Directors.

4. Liquidation. Subject to Article FOURTH, Sections B.3 and C.2, upon the dissolution, liquidation or winding up of the Corporation, holders of Common Stock will be entitled to receive the assets of the Corporation, pro rata in proportion to the respective number of shares held by each of them, subject to any preferential rights of any then outstanding Preferred Stock or other then outstanding stock ranking on liquidation senior to or on a parity with the Common Stock.

B. NON-VOTING COMMON STOCK

1. Voting. The Non-Voting Common Stock shall not be entitled to vote on any matters presented to the stockholders of the Corporation for their action or consideration (other than as specifically prescribed in Article NINTH, as pertaining to the rights of the holders of the Non-Voting Common Stock in this Section B of Article FOURTH).

2. Dividends. The holders of the Non-Voting Common Stock shall not be entitled to receive any dividends or distributions as may be declared from time to time by the Board of Directors.

3

3. Plan of Distribution. The Non-Voting Common Stock shall have no rights, privileges or preferences in any event of Liquidation (as hereinafter defined) of the Corporation, except that, pursuant to the terms and conditions of that certain Plan of Distribution appended and incorporated into this Twenty Third Amended and Restated Certificate of Incorporation, as Annex I (“Plan of Distribution”), upon certain qualifying events of Liquidation constituting an “Entitling Event” (as defined in the Plan of Distribution), holders of Non-Voting Common Stock may be entitled to a right to receive certain Distributable Proceeds (as defined in the Plan of Distribution), if any, as set forth in the Plan of Distribution, appended, where such Plan of Distribution is integrated with and into this Twenty Third Amended and Restated Certificate of Incorporation. For the sake of clarity, (i) the Primary Distribution Percentage as defined in Section 1(f) of the Plan of Distribution shall be diluted proportionately to the dilution experienced by the Non-Voting Common Stock with respect to the issuance and sale of the Series B Preferred Stock pursuant to that certain Series B Stock Purchase Agreement of the Corporation and (ii) the Acquisition Amount as defined in Section 1(a) of the Plan of Distribution will reflect the additional funding received by the Corporation in the round of financing for which the Series B Preferred Stock were issued and sold.

4. Redemption. Upon Liquidation or any initial public offering of the Corporation, the Corporation shall have a right to redeem any or all of the outstanding shares of Non-Voting Common Stock at a price per share equal to the par value thereof (the “Redemption Price”). In such event, the Corporation shall send written notice of such mandatory redemption (the “Redemption Notice”) to each holder of record of Non-Voting Common Stock, indicating a date of redemption not less than five (5) business days from the date of Redemption Notice (the “Redemption Date”). On or before the Redemption Date, each holder of shares of Non-Voting Common Stock shall surrender the certificate or certificates representing such shares (or, if such registered holder alleges that such certificate has been lost, stolen or destroyed, a lost certificate affidavit and agreement reasonably acceptable to the Corporation to indemnify the Corporation against any claim that may be made against the Corporation on account of the alleged loss, theft or destruction of such certificate) to the Corporation, in the manner and at the place designated in the Redemption Notice, and thereupon the Redemption Price for such shares shall be payable to the order of the person whose name appears on such certificate or certificates as the owner thereof. In the event that the stock certificates representing the redeemed Non-Voting Common Stock are not surrendered to, or an affidavit for loss is not received by the Corporation, then such shares shall nevertheless be redeemed on the applicable Redemption Date, and the Redemption Price payable upon such redemption shall be paid or tendered for payment or deposited with an independent payment agent for the benefit of the holder of Non-Voting Common Stock whose shares have been redeemed. Upon completion of any redemption hereunder, all redeemed shares of Non-Voting Common Stock shall be automatically and immediately cancelled and retired and shall not be reissued, sold or transferred.

5. Non-Transferability. The Non-Voting Common Stock shall not be transferable by the holders thereof to any person or entity (other than by operation of law, intestate succession or the law of wills, descent and distribution). Without derogating from the foregoing, holders of Non-Voting Common Stock shall be able to transfer, by sale or otherwise, their respective shares of Non-Voting Common Stock: (i) to the Corporation or (ii) by any other means as approved by the Board of Directors of the Corporation. Any transfer of Non-Voting Common Stock subject to this section B(5) shall not implicate any rights held by any stockholder of the Corporation including, without limitation, rights of first refusal, co-sale rights, and/or bring-along rights.

4

C. PREFERRED STOCK

1. Dividends.

(a) The holders of Preferred Shares shall be entitled to receive dividends, out of any assets legally available therefor, when and as declared by the Board of Directors from time to time, out of any assets of the Corporation legally available therefor.

(b) the Corporation may not declare or pay any dividend or make any distribution of assets on, or redeem, purchase or otherwise acquire, shares of Common Stock or of any other capital stock of the Corporation ranking junior to the Preferred Shares as to the payment of dividends or the distribution of assets upon liquidation, dissolution or winding up (for purposes of this section a “Distribution”), unless a corresponding Distribution is effected in respect of the Preferred Shares as if the Preferred Shares had been converted into Common Stock.

2. Rights on Liquidation, Dissolution or Winding Up, Etc.

(a) In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, or Deemed Liquidation (each, a “Liquidation”) and subject to parallel distribution of Distributable Proceeds pursuant to the Plan of Distribution, if and to the extent applicable in such Liquidation, the assets of the Corporation available for distribution to its stockholders, whether from capital, surplus or earnings, (the “Available Assets”), shall be distributed in the following order of priority:

(i) First and in preference to any distribution of any Available Assets to the holders of any other class or series of Stock of the Corporation by reason of their ownership thereof, the holders of Series B Preferred Stock shall be entitled to receive an amount per share equal to (i) the Original Issue Price of the Series B Preferred Stock (as hereinafter defined) plus (ii) interest at the rate of 8% per annum from the Original Issue Date of such Series B Preferred Stock (the “B Preference”). In the event that the Available Assets shall be insufficient to pay the B Preference, the Corporation shall distribute the Available Assets to the holders of the Series B Preferred Stock on a pari passu basis in proportion to the full B Preference to which such holders would otherwise be entitled to receive.

(ii) In the event that, following the satisfaction of the B Preference in full, the Available Assets shall exceed the amount necessary to pay the B Preference, the remaining assets (after payment in full of the B Preference) shall be distributed among the holders of Series A Preferred Stock shall be entitled to receive an amount per share equal to (i) the Original Issue Price of the Series A Preferred Stock plus (ii) interest at the rate of 8% per annum from the Original Issue Date of such Series A Preferred Stock (the “A Preference”). In the event that the Available Assets shall be insufficient to pay the A Preference, the Corporation shall distribute the Available Assets to the holders of the Series A Preferred Stock on a pari passu basis in proportion to the full A Preference to which such holders would otherwise be entitled to receive.

(iii) In the event that, following the satisfaction of the B Preference and A Preference in full, the Available Assets shall exceed the amount necessary to pay the B Preference and the A Preference, the remaining assets (after payment in full of the B Preference and the A Preference) shall be distributed among the holders of Common Stock on a pari passu basis and in proportion to the respective percentage holdings of all of the Common Stock.

5

(b) For purposes of Section C.2, in addition to any liquidation of the Corporation under applicable law, whether voluntary or not, the Corporation shall be deemed to undergo a Liquidation (a “Deemed Liquidation”) in the event of (i) a consolidation, combination, merger or reorganization of the Corporation with or into any other company, entity or person (or group of companies, persons or other entities), other than a wholly-owned subsidiary of the Corporation, (ii) the closing of the transfer or issuance (whether by merger, combination, consolidation or otherwise), in one transaction or a series of related transactions to which the Corporation is a party, to a corporation, person or group of affiliated persons (other than an underwriter of the Corporation’s securities), of the Corporation’s securities if, after such closing, such person or group of affiliated persons would hold more than 50% of the outstanding voting stock of the Corporation (other than an transfer or issuance effected primarily for purposes of raising capital for the Corporation or its subsidiaries) or (iii) a sale, lease, assignment, transfer, disposal, exclusive license or other disposition, in a single transaction or series of related transactions, of all or substantially all of the assets or intellectual property of the Corporation (other than (1) a pledge of assets or grant of a security interest therein to a commercial lender in connection with a commercial lending or similar transaction; (2) a sale, lease, exclusive license, assignment, transfer or disposal to a corporation, limited liability company or other entity (or a group of corporations, limited liability companies or other entities) in which the holders of capital stock of the Corporation immediately prior to such sale, lease, exclusive license, assignment, transfer or disposal continue to hold (solely in respect of their interests in the Corporation’s capital stock immediately prior to such merger, combination or consolidation) a majority of the aggregate voting power of the capital stock of the acquiring entity or entities)); and (3) in the case of an exclusive license of assets or intellectual property, an exclusive license of assets or intellectual property constituting less than substantially all of the economic value of the Corporation’s assets or intellectual property or (iv) any transaction resulting in all or substantiality all the Corporation’s securities or assets being traded in exchange for the securities of any non-affiliate entity. Notwithstanding the foregoing, a transaction in which stockholders of the Corporation prior to the transaction will maintain (solely in respect of their interests in the Corporation’s capital stock immediately prior to such merger, combination, consolidation or otherwise) a majority of the voting power of the capital stock of the resulting entity after the transaction (provided, however, that shares of the surviving entity held by stockholders of this Corporation acquired by means other than the exchange or conversion of the shares of this Corporation shall not be used in determining if the stockholders of this Corporation maintain such voting control, but shall be used for determining the total outstanding voting power of the surviving entity) shall not be deemed a Liquidation. The treatment of any particular transaction or series of transactions as a Liquidation may be waived by the vote or written consent of the holders of at least a majority of the then outstanding Preferred Stock (voting together as a single class and on an as-converted to Common Stock basis). Upon the closing of any Liquidation of the Corporation as described herein, the holders of the Preferred Shares shall be entitled to receive in cash, securities and/or other property (valued as provided in Section C.2(c) and (d) below), regardless of whether or not they have exercised their redemption right set forth in this sub-article (b) above, amounts as specified in Section C.2(a) above.

(c) Whenever the distribution provided for in this Section C.2 shall be payable in securities or property other than cash, the value of such distribution shall be the fair market value of such securities or other property as determined in good faith by the Board of Directors.

6

(d) Notwithstanding Section C.2(c) above, any securities shall be valued as follows:

(i) Securities not subject to investment letter or other similar restrictions on free marketability covered by (ii) below:

(A) If traded on a securities exchange or through the Nasdaq National Market, the value shall be deemed to be the average of the closing prices of the securities on such quotation system over the thirty (30) day period ending three (3) days prior to the closing;

(B) If actively traded over-the-counter, the value shall be deemed to be the average of the closing bid or sale prices (whichever is applicable) over the thirty (30) day period ending three (3) days prior to the closing; and

(C) If there is no active public market, the value shall be the fair market value thereof, as determined by the Board of Directors.

(ii) The method of valuation of securities subject to investment letter or other restrictions on free marketability (other than restrictions arising solely by virtue of a stockholder’s status as an affiliate or former affiliate) shall be to make an appropriate discount from the market value determined as above in (i)(A), (B) or (C) to reflect the approximate fair market value thereof, as determined by the Board of Directors.

(e) The Corporation shall give each holder of record of Preferred Shares written notice of any transaction that constitutes a Liquidation as defined under Section C.2(b) above not later than twenty (20) days prior to the stockholders’ meeting called to approve such transaction, or twenty (20) days prior to the closing of such transaction, whichever is earlier, and shall also notify such holders in writing of the final approval of such transaction. The first of such notices shall describe the material terms and conditions of the impending transaction and the provisions of this Section 2, and the Corporation shall thereafter give such holders prompt notice of any material changes. The transaction shall in no event take place sooner than twenty (20) days after the Corporation has given the first notice provided for herein or sooner than ten (10) days after the Corporation has given notice of material changes provided for herein; provided, however, that such periods may be shortened upon the written consent of the holders of Preferred Shares that are entitled to such notice rights or similar notice rights and that represent at least a majority of the voting power of all then outstanding Preferred Shares, voting together as a single class.

7

3. Voting Rights.

(a) Except as otherwise provided by law and with respect to the matters covered by Sections C.4(b) and C.4(c) hereof, the holders of the Preferred Shares shall vote together with and in the same manner and with the same effect as the holders of Common Stock on all matters on which the holders of Common Stock shall be entitled to vote. The holders of Preferred Shares shall be entitled to cast such number of votes in respect of the Preferred Shares held by them as shall equal the largest whole number of shares of Common Stock into which such Preferred Shares are then convertible pursuant to Section 5 hereof.

(b) Until a Qualified IPO, the Corporation shall not, either directly or indirectly, without the prior consent of the holders of at least a majority of the then outstanding Preferred Shares, voting together as a single class, take any of the following actions (whether by amendment, merger, consolidation or otherwise):

(i) adopt any amendment of the Certificate of Incorporation or the Bylaws of the Corporation or take any other action which would have the effect of adversely amending, changing or abrogating the rights, preferences or privileges of the Preferred Shares;

(ii) increase or decrease below the number then outstanding (other than by redemption or conversion) total number of authorized shares of Preferred Shares.

(c) The Board of Directors of the Corporation (the “Board”) shall be composed of up to six (6) directors.

(i) One (1) member shall be elected by Tuvia Barlev. In the event that Tuvia Barlev sells or transfers (other than to “Affiliates”, as such term is defined in the Amended and Restated Stockholders Agreement) more than 50% of his holdings in the Corporation, then Tuvia Barlev shall no longer have the right to elect the said director.

(ii) Three (3) members shall be elected by the holders of Preferred A Shares, voting as a separate class. In the event that the holders of Preferred A Shares on the date of filing this certificate of incorporation sell or transfer (other than to “Affiliates”, as such term is defined in the Amended and Restated Stockholders Agreement) more than 50% of their holdings in the Corporation, then such holders shall have the right to elect one (1) director.

(iii) One (1) member shall be elected by the holders of Preferred B Shares, voting as a separate class. In the event that the holders of Preferred B Shares on the date of filing this certificate of incorporation sell or transfer (other than to “Affiliates”, as such term is defined in the Amended and Restated Stockholders Agreement) more than 50% of their holdings in the Corporation, then such holders shall not have the right to elect one (1) director.

(iv) The appointed directors, voting unanimously, shall be entitled to elect the remaining director, in their discretion, who shall be an industry expert.

8

(d) For purposes of this Certificate:

“Original Issue Date” means, with respect to a share of Series B Preferred Stock or Series A Preferred Stock the first date on which such share was issued;

“Original Issue Price of Series A Stock” means, with respect to a share of Series A Preferred Stock the Series A Price Per Share (subject to adjustment in the event of share splits, share dividends, reclassifications and other like events);

“Original Issue Price of Series B Stock” means, with respect to a share of Series B Preferred Stock the Series B Price Per Share (subject to adjustment in the event of share splits, share dividends, reclassifications and other like events);

“Preferred Director” shall mean any director elected exclusively by the holders of the Series A Preferred Stock; and

“Series A Price Per Share” means, with respect to a share of Series A Preferred Stock, US$0.01308.

“Series B Price Per Share” means, with respect to a share of Series B Preferred Stock, US$0.02232.1

4. Conversion of Preferred Shares.

(a) Each of the holders of Preferred Shares shall have the right, at such holder’s option, at any time or from time to time, to convert each Preferred Share held by it into such number of fully paid and non-assessable shares of Common Stock as is as is determined by dividing the applicable Original Issue Price by the applicable Conversion Price (as hereinafter defined) per share for the Preferred Shares in effect at the time of conversion. The initial “Conversion Price” for each Preferred Share shall be the Original Issue Price for such Preferred Share. Such initial Conversion Price shall be subject to adjustment as provided in this Section 4. The holder of any Preferred Shares exercising the aforesaid right to convert such shares into shares of Common Stock shall be entitled to receive all declared and unpaid dividends with respect to such Preferred Shares up to and including the respective conversion date of such shares of Preferred Shares.

(b) Each outstanding Preferred Share shall automatically be converted into shares of Common Stock at the then effective Conversion Price in accordance with Section 4(a) hereof (i) upon the closing of an underwritten offering of the Corporation’s securities to the public (a) pursuant to a registration statement under the U.S. Securities Act of 1933, as amended, or (b) subject to the consent of holders of at least a majority of the Preferred Shares, on an international stock exchange, pursuant to the securities law of such jurisdiction, in each case yielding at least US$5 million to the Corporation at a Corporation valuation of at least US$15 million (a “Qualified IPO”); or (ii) upon the receipt by the Corporation of a written request for such conversion from either the holders (a) of at least seventy five (75%) of the Series B Preferred Stock then outstanding, or, if later, the effective date for conversion specified in such requests, if the conversion is in respect of the Series B Preferred Stock, or (b) from the holders of at least seventy five (75%) of the Series A Preferred Stock then outstanding, or, if later, the effective date for conversion specified in such requests if the conversion is in respect of the Series A Preferred Stock.

| 1 | The Series B Price Per Share is calculated based only on the fully diluted voting share capital of the Corporation and excludes all issued and outstanding shares of Non-Voting Common Stock of the Corporation. |

9

(c) Before any holder of Preferred Shares shall be entitled (in the case of a conversion at such holder’s option) to convert the same into Common Stock, he shall surrender the certificate or certificates therefor, duly endorsed (or, if such holder alleges that such certificate has been lost, stolen, or destroyed, a lost certificate affidavit and agreement reasonably acceptable to the Corporation to indemnify the Corporation against any claim that may be made against the Corporation on account of the alleged loss, theft or destruction of such certificate), at the office of the Corporation, and shall give written notice by mail, postage prepaid, to the Corporation at its principal corporate office, of the election to convert the same and shall state therein the name or names of any nominee for such holder in which the certificate or certificates for Common Stock are to be issued. Such conversion (in the case of a conversion at such holder’s option) shall be deemed to have been made immediately prior to the close of business on the date of such surrender of the certificate representing the Preferred Shares to be converted, and the person or persons entitled to receive the Common Stock issuable upon such conversion shall be treated for all purposes as the record holder or holders of such Common Stock as of such date. If the conversion is in connection with a Qualified IPO, then the conversion shall be deemed to have taken place automatically regardless of whether the certificates representing such shares have been tendered to the Corporation, but from and after such conversion any such certificates not tendered to the Corporation shall be deemed to evidence solely the Common Stock received upon such conversion and the right to receive a certificate for such Common Stock. If the conversion is in connection with a Qualified IPO, the conversion may, at the option of any holder tendering Preferred Shares for conversion, be conditioned upon the closing with the underwriter of the sale of securities pursuant to such offering, in which event the person(s) entitled to receive the Common Stock issuable upon such conversion of the Preferred Shares shall not be deemed to have converted such Preferred Shares until immediately prior to the closing of such offer of securities. The Corporation shall, as soon as practicable after the conversion and tender of the certificate for the Preferred Shares converted, issue and deliver at such office to such holder of Preferred Shares or to the nominee or nominees of such holder of Preferred Shares or to the nominee or nominees of such holder, a certificate or certificates for the number of Common Stock to which such holder shall be entitled as aforesaid, and cash as provided in Section 4(d) in lieu of any fraction of a share of Common Stock otherwise issuable upon such conversion and payment of any declared but unpaid dividends on the shares of Preferred Stock converted.

(d) No fractional shares shall be issued upon conversion of Preferred Shares into Common Stock. In case the number Preferred Shares represented by the certificate or certificates surrendered pursuant to Section 4(c) exceeds the number of shares converted, the Corporation shall, upon such conversion, execute and deliver to the holder, at the expense of the Corporation, a new certificate or certificates for the number of Preferred Shares represented by the certificate or certificates surrendered which are not to be converted. All shares of Common Stock (including factions thereof) issuable to a holder of Preferred Shares upon conversion of such holder’s Preferred Shares shall be aggregated for purposes of determining whether the conversion would result in the issuance of any fractional share. If, after such aggregation, any fractional share of Common Stock would, except for the provisions of the first sentence of this Section 4(d), be delivered upon such conversion, the Corporation, in lieu of delivering such fractional share, shall pay to the holder surrendering the Preferred Shares for conversion an amount in cash equal to the current market price of such fractional share as determined in good faith by the Board.

10

(e)

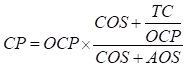

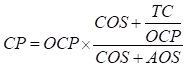

(i) Except as hereinafter provided, in case the Corporation shall at any time after the Original Issue Date, grant or sell any shares of Additional Stock (as hereinafter defined) for a consideration, exercise or conversion price per share less than the Conversion Price in effect for any series of Preferred Shares immediately prior to the issuance or sale of such shares, or without consideration, then forthwith upon such issuance or sale, the Conversion Price for such series of Preferred Shares shall (upon such issuance or sale) be reduced to a price determined by multiplying such Conversion Price immediately prior to such issuance or sale (“OCP”) by a fraction, the numerator of which shall be (x) the number of shares of Common Stock (including Common Stock into which the Preferred Stock could be converted into) outstanding (on an as converted to Common Stock basis) immediately prior to such issuance or sale (“COS”) plus (y) the number of shares of Common Stock which the aggregate consideration received by the Corporation for the total number of Additional Stock so issued would purchase at such Conversion Price in effect immediately prior to such issuance or sale (“TC”), and the denominator of which shall be (x) the COS plus (y) the number of such Additional Stock so issued (“AOS”); provided, however, that in no event shall the Conversion Price be adjusted pursuant to this computation to an amount in excess of the Conversion Price in effect immediately prior to such computation.

For the purposes hereof, “Additional Stock” shall mean Common Stock or options, warrants or other rights to acquire or securities convertible into or exchangeable for shares of Common Stock, including shares held in the Corporation’s treasury, and shares of Common Stock issued upon the exercise of any options, rights or warrants to subscribe for shares of Common Stock and shares of Common Stock issued upon the direct or indirect conversion or exchange of securities for shares of Common Stock, other than:

(A) Common Stock issued or issuable upon the conversion of the Preferred Shares;

(B) Common Stock issued to officers, directors or employees of, or bona fide consultants to, the Corporation pursuant to a stock option plan or purchase plan approved by the Board of Directors for employees, officers, directors or bona fide consultants of the Corporation;

(C) securities issued in connection with any transaction for which adjustment is made pursuant to Section 4(e)(iii) or 4(e)(iv) hereof.

11

For the purpose of any computation to be made in accordance with this Section 4(e), the following provisions shall be applicable:

(1) Insofar as it consists of cash, the consideration for the issuance of Additional Stock shall be deemed to be the amount of cash received therefor after giving effect to any discounts or commissions paid or incurred by the Corporation for any underwriting or otherwise in connection with the issuance and sale thereof, and shall not include consideration other than cash.

(2) The number of shares of Common Stock at any one time outstanding shall include the aggregate number of shares issued or issuable (subject to readjustment upon the actual issuance thereof) upon the exercise of outstanding options, rights, warrants and upon the conversion or exchange of outstanding convertible or exchangeable securities.

(3) Insofar as it consists of property other than cash, the consideration for the issuance of Additional Stock shall be computed at the fair market value thereof at the time of such issue, as determined in good faith by the Board;

(4) In the event the Corporation shall issue on more than one date Additional Stock that is a part of one transaction or a series of related transactions and that would result in an adjustment to the Conversion Price pursuant to the terms of Section 4(e) then, upon the final such issuance, the Conversion Price shall be readjusted to give effect to all such issuances as if they occurred on the date of the first such issuance (and without giving effect to any additional adjustments as a result of any such subsequent issuances within such period).

(5) In the event the Additional Stock is issued together with other shares or securities or other assets of the Corporation for consideration which covers both, be the proportion of such consideration so received, computed as provided in clauses (2) and (3) above, as determined in good faith by the Board.

(ii) In the event the Corporation shall issue any options or warrants to subscribe for, purchase or otherwise acquire Common Stock or Preferred Stock (“Options”) or any evidences of indebtedness, shares or other securities directly or indirectly convertible into or exchangeable for Common Stock, but excluding Options (“Convertible Securities”) and shall fix a record date for the determination of holders of any class of securities entitled to receive any such Options or Convertible Securities, then the maximum number of shares (as set forth in the instrument relating thereto without regard to any provisions contained therein for a subsequent adjustment of such number) of Common Stock issuable upon the exercise of such Options or, in the case of Convertible Securities, the conversion or exchange of such Convertible Securities or, in the case of Options for Convertible Securities, the exercise of such Options and the conversion or exchange of the underlying securities, shall be deemed to have been issued as of the time of such issue or, in case such a record date shall have been fixed, as of the close of business on such record date, provided that in any such case in which shares are deemed to be issued:

12

(A) no further adjustment in the Conversion Price shall be made upon the subsequent issue of Convertible Securities or shares of Common Stock in connection with the exercise of such Options or conversion or exchange of such Convertible Securities;

(B) if such Options or Convertible Securities are revised as a result of any amendment or by their terms provide, with the passage of time or otherwise, for any change in the consideration payable to the Corporation or in the number of shares of Common Stock issuable upon the exercise, conversion or exchange thereof (other than a change pursuant to the anti-dilution provisions of such Options or Convertible Securities such as this Section 4(e)(ii) or pursuant to recapitalization provisions of such Options or Convertible Securities such as Sections 4(e)(iii) and 4(g) hereof), the Conversion Price of the Preferred Stock and any subsequent adjustments based thereon shall be recomputed to reflect such change as if such change had been in effect as of the original issue thereof (or upon the occurrence of the record date with respect thereto);

(C) upon the expiration of any such Options or any rights of conversion or exchange under such Convertible Securities which shall not have been exercised, the Conversion Price of the Preferred Stock computed upon the original issue thereof (or upon the occurrence of a record date with respect thereto) and any subsequent adjustments based thereon shall, upon such expiration, be recomputed as if:

(a) in the case of Convertible Securities or Options exercisable for Common Stock, the only Additional Stock issued was the Common Stock, if any, actually issued upon the exercise of such Options or the conversion or exchange of such Convertible Securities and the consideration received therefor was the consideration actually received by the Corporation for the issue of such exercised Options plus the consideration actually received by the Corporation upon such exercise or for the issue of all such Convertible Securities which were actually converted or exchanged, plus the additional consideration, if any, actually received by the Corporation upon such conversion or exchange, and

(b) in the case of Options exercisable for Convertible Securities, only the Convertible Securities, if any, actually issued upon the exercise thereof were issued at the time of issue of such Options, and the consideration received by the Corporation for the Additional Stock deemed to have been then issued was the consideration actually received by the Corporation for the issue of such exercised Options, plus the consideration deemed to have been received by the Corporation (determined pursuant to Section 3(d)(v)) upon the issue of the Convertible Securities with respect to which such Options were actually exercised; and

(c) if such record date shall have been fixed and such Options or Convertible Securities are not issued on the date fixed therefor, the adjustment previously made in the Conversion Price which became effective on such record date shall be canceled as of the close of business on such record date, and thereafter the Conversion Price shall be adjusted pursuant to this paragraph 4(e)(ii) as of the actual date of their issuance.

13

(iii) If the Corporation subdivides or combines its Common Stock, each Conversion Price shall be proportionately reduced, in case of subdivision of shares, as at the effective date of such subdivision, or if the Corporation fixes a record date for the purpose of so subdividing, as at such record date, whichever is earlier, or shall be proportionately increased, in the case of combination of shares, as the effective date of such combination, or, if the Corporation fixes a record date for the purpose of so combining, as at such record date, whichever is earlier.

(iv) If the Corporation at any time pays a dividend, with respect to its Common Stock only, payable in additional shares of Common Stock or other securities or rights convertible into, or entitling the holder thereof to receive directly or indirectly, additional shares of Common Stock, without any comparable payment or distribution to the holders of Preferred Shares (hereinafter referred to as “Common Stock Equivalents”), then each Conversion Price shall be adjusted as at the date the Corporation fixes as a record date for the purpose of receiving such dividend (or if no such record date is fixed, as at the date of such payment) to that price determined by multiplying the applicable Conversion Price in effect immediately prior to such record date (or if no record date is fixed then immediately prior to such payment) by a fraction (a) the numerator of which shall be the total number of shares of Common Stock outstanding and those issuable with respect to Common Stock Equivalents prior to the payment of such dividend, and (b) the denominator of which shall be the total number of shares of Common Stock outstanding and those issuable with respect to such Common Stock Equivalents immediately after the payment of such dividend (plus, in the event that the Corporation paid cash for fractional shares, the number of additional shares which would have been outstanding had the Corporation issued fractional shares in connection with such dividend).

(v) No adjustment in the Conversion Price for the Preferred Shares shall be required in an amount less than one cent (US$0.01) per share; provided, however, that any adjustments which by reason of this Section 4(d)(iv) are not required to be made shall be carried forward and taken into account in any subsequent adjustment required to be made hereunder.

(f) In the event the Corporation declares a distribution payable in securities of other persons, evidences of indebtedness issued by the Corporation or other persons, assets (excluding cash dividends) or options or rights not referred to in sub-article (e)(iv), then, in each such case, the holders of the Preferred Shares shall be entitled to receive such distribution, in respect of their holdings on an as-converted basis as of the record date for such distribution.

(g) If at any time or from time to time there shall be a recapitalization of the Common Stock (other than a subdivision, combination or merger or sale of assets transaction provided for elsewhere in this Section 4 or in Section 3(b)), provision shall be made so that the holders of the Preferred Shares shall thereafter be entitled to receive upon conversion of the Preferred Shares the number of shares of stock or other securities or property of the Corporation or otherwise, to which a holder of Common Stock deliverable upon conversion would have been entitled on such recapitalization. In any such case, appropriate adjustment shall be made in the application of the provisions of this Section 4 with respect to the rights of the holders of the Preferred Shares after the recapitalization to the end that the provisions of this Section 4 (including adjustment of the Conversion Price for the Preferred Shares then in effect and the number of shares issuable upon conversion of the Preferred Shares) shall be applicable after that event as nearly equivalent as may be practicable.

14

(h) The Corporation will not, by amendment of its Certificate of Incorporation or through any reorganization, recapitalization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Corporation, but will at all times in good faith assist in the carrying out of all the provisions of this Section 4 and in the taking of all such action as may be necessary or appropriate in order to protect the conversion rights of the holders of the Preferred Shares against impairment.

(i) Upon the occurrence of each adjustment or readjustment of the Conversion Price of any series of Preferred Shares pursuant to this Section 4, the Corporation, at its expense, shall promptly compute such adjustment or readjustment in accordance with the terms hereof and prepare and furnish to each holder of such series of Preferred Shares a statement, signed by its chief financial officer, setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Corporation shall, upon the written request at any time of any holder of Preferred Shares, furnish or cause to be furnished to such holder a like certificate setting forth (A) such adjustment and readjustment, (B) the Conversion Price for such Preferred Shares at the time in effect, and (C) the number of shares of Common Stock and the amount, if any, of other property which at the time would be received upon the conversion of a share of such Preferred Shares.

(j) The Corporation shall at all times reserve and keep available out of its authorized but unissued shares of Common Stock, solely for the purpose of effecting the conversion of the shares of the Preferred Shares, such number of its shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding Preferred Shares; and if at any time the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then outstanding shares of the Preferred Shares, in addition to such other remedies as shall be available to the holder of such Preferred Shares, the Corporation will take such corporate action as may, in the opinion of its counsel, be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purposes, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to these provisions.

(k) The Corporation shall pay all documentary, stamp or other transactional taxes attributable to the issuance or delivery of shares of capital stock of the Corporation upon conversion of any shares Preferred Shares; provided, however, that the Corporation shall not be required to pay any taxes which may be payable in respect of any transfer involved in the issuance or delivery of any certificate for such shares in a name other than that of the holder of the Preferred Shares in respect of which such shares are being issued.

(l) All shares of Common Stock which may be issued in connection with the conversion provisions set forth herein will, upon issuance by the Corporation, be validly issued, fully paid and nonassessable and free from all taxes, liens or charges with respect thereto.

15

(m) In the event any Preferred Shares shall be converted pursuant to Section 4 hereof or otherwise reacquired by the Corporation, the shares so converted or reacquired shall be cancelled and may not be reissued. The Certificate of Incorporation of the Corporation may be appropriately amended from time to time to effect the corresponding reduction in the Corporation’s authorized capital stock.

(n) If the Corporation shall propose at any time: (i) to declare any dividend or distribution upon its Common Stock, whether in cash, property, stock or other securities, whether or not a regular cash dividend and whether or not out of earnings or earned surplus; (ii) to offer for subscription pro rata to the holders of any class or series of its stock any additional shares of stock of any class or series or other rights; (iii) to effect any reclassification or recapitalization of its Common Stock outstanding involving a change in the Common Stock; or (iv) to merge or consolidate with or into any other corporation, or sell, lease or convey all or substantially all of its assets, or to liquidate, dissolve or wind up; then, in connection with each such event, the Corporation shall send to the holders of the Preferred Shares: (1) at least twenty (20) days prior written notice of the date on which a record shall be taken for such dividend, distribution or subscription rights (and specifying the date on which the holders of Common Stock shall be entitled thereto) or for determining rights to vote, if any, in respect of the matters referred to in (iii) and (iv) above; and (2) in the case of the matters referred to in (iii) and (iv) above, at least twenty (20) days prior written notice of the date when the same shall take place (and specifying the date on which the holders of Common Stock shall be entitled to exchange their Common Stock for securities or other property deliverable upon the occurrence of such event).

FIFTH: The holders of Common Stock and Preferred Shares shall have preemptive rights as set forth in the Amended and Restated Stockholders Agreement dated on or about the Original Issue Date of the Series B Preferred Stock by and between the Corporation and certain of its stockholders, as amended (“Amended and Restated Stockholders Agreement”).

SIXTH: To the fullest extent permitted by law, a director of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director except for liability (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the DGCL, or (iv) for any transaction from which the director derived an improper personal benefit. If the DGCL is amended after the filing of the Certificate of Incorporation of which this article is a part to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent permitted by the DGCL, as so amended. Any repeal or modification of the foregoing paragraph by the stockholders of the Corporation shall not adversely affect any right or protection of a director of the Corporation existing at the time of such repeal or modification.

SEVENTH: The Corporation shall, to the fullest extent permitted by Section 145 of the General Corporation Law of the State of Delaware, as the same may be amended and supplemented, indemnify directors and officers of the Corporation whom it shall have power to indemnify under said section from and against any and all of the expenses, liabilities or other matters referred to in or covered by said section, and the indemnification provided for herein shall not be deemed exclusive of any other rights to which those indemnified may be entitled under any By-Laws, agreement, vote of stockholders or disinterested directors or otherwise, both as to action in their official capacities and as to action in another capacity while holding such offices, and shall continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of the heirs, executors and administrators of such person.

16

EIGHT: The Board of Directors shall have the power to make, alter, or repeal the By-Laws subject to the provisions of Section C.3(b) of Article FOURTH.

NINTH: The Corporation reserves the right to amend, alter, change or repeal any provision contained in this Certificate of Incorporation, and any other provisions authorized by the laws of the State of Delaware at the time in force may be added or inserted, subject to the limitations set forth in this Certificate of Incorporation and any agreement or undertaking by which the Corporation is bound and in the manner now or hereafter provided by statute, and, subject to the foregoing, all rights, preferences and privileges of whatsoever nature conferred upon stockholders, directors or any other persons whomsoever by and pursuant to this Certificate of Incorporation in its present form or as amended are granted subject to the rights reserved in this Article NINTH.

TENTH: All Preferred Shares held or acquired (or Common Stock issuable upon conversion thereof) by affiliated entities shall be aggregated together for the purpose of determining whether a minimum stock ownership threshold has been satisfied.

ELEVENTH: Drag-Along.

(a) Notwithstanding the restrictions on transferability applicable to any stockholder, at any time prior to a Qualified IPO, if any person or entity (an “Acquirer”) makes a detailed offer to purchase all of the issued and outstanding capital stock or all or substantially all of the assets of the Corporation (whether structured as merger, consolidation, sale of assets or other similar transaction)(the “Purchase Offer”), and holders of 66% of the issued and outstanding Common Stock (including Preferred Shares on an as-converted basis), accept the Purchase Offer (“Proposing Stockholders”), then, at the closing of the Purchase Offer, the Proposing Stockholders and all of the other holders of Common Stock and Preferred Stock (“Non-Proposing Stockholders” and, together with the Proposing Stockholders, the “Stockholders”) will vote their shares in favor of the Purchase Offer and, to the extent applicable, transfer such Shares to such person or entity. In such event, each stockholder shall deliver the stock certificate(s), accompanied by a duly executed stock powers or other instrument of transfer duly endorsed in blank, representing the Shares to the Corporation or to an agent designated by the Corporation, for the purpose of effectuating the transfer of the shares to the Acquirer and the disbursement of the proceeds of such transaction. The aggregate consideration payable by the Acquirer shall be distributed among the stockholders of the Corporation in accordance with the provisions of the Article FOURTH C.1 hereof.

(b) To the maximum extent under the DGCL and applicable law that this Certificate of Incorporation may so lawfully require of each stockholder of the Corporation, if such transaction underlying the Purchase Offer is structured as a merger, consolidation, sale of assets or other similar transaction, each stockholder of the Corporation will waive any dissenter’s rights, appraisal rights or similar rights in connection with such merger, consolidation or other similar transaction, and raise no objections thereto, and if such transaction is structured as a sale of stock or other similar transaction, each stockholder will agree to sell all of his or its shares of stock in the Corporation, as the case may be, and rights to acquire shares, as the case may be, on the terms and conditions of the Purchase Offer as approved by the Board.

17

(c) Notwithstanding the foregoing, a Stockholder will not be required to comply with this ARTICLE ELEVENTH, unless:

(1) Limitations on Representations and Warranties. The only representations, warranties or covenants that any Stockholder shall be required to make in connection with an agreement in respect of a Purchase Offer are representations and warranties with respect to its own ownership of the Corporation’s securities to be sold by it and its ability to convey title thereto free and clear of liens, encumbrances or adverse claims and reasonable covenants regarding confidentiality and publicity; and

(2) Indemnity Provisions. The liability of any Stockholder with respect to any representation and warranty or covenant made by the Corporation in connection with an agreement in respect of a Purchase Offer, as applicable, must be several and not joint with any other person; and such Stockholder’s liability (other than with respect to the representations, warranties and covenants made by such holder in connection with such Purchase Offer with respect to ownership and ability to convey title) must be limited to its pro rata share (based on transaction proceeds actually received) of an escrow account into which a portion of the aggregate consideration paid to all Stockholders will be deposited to cover any indemnification liabilities by the Stockholders after the closing date (as that term is defined in the document for the transaction giving rise to the escrow); and

(3) Out of Pocket Expenditures. No Stockholder shall be obligated to make any out of pocket expenditure prior to the consummation of the Purchase Offer (excluding modest expenditures for postage, copies, etc.) or be obligated to pay any expenses incurred in connection with a consummated Purchase Offer, as applicable, except indirectly to the extent such costs are incurred for the benefit of all of the Stockholders and are paid by the Corporation or the Acquirer; where costs incurred by or on behalf of any holder for its sole benefit will not be considered costs of the transaction hereunder.

TWELFTH: Excluded Opportunity.

The Corporation renounces, to the fullest extent permitted by law, any interest or expectancy of the Corporation in, or in being offered an opportunity to participate in, any Excluded Opportunity. An “Excluded Opportunity” is any matter, transaction or interest that is presented to, or acquired, created or developed by, or which otherwise comes into the possession of, (i) any director of the Corporation who is not an employee of the Corporation or any of its subsidiaries, or (ii) any holder of Preferred Stock or any partner, member, director, stockholder, employee or agent of any such holder, other than someone who is an employee of the Corporation or any of its subsidiaries (collectively, “Covered Persons”), unless such matter, transaction or interest is presented to, or acquired, created or developed by, or otherwise comes into the possession of, a Covered Person expressly and solely in such Covered Person’s capacity as a director of the Corporation.

(remainder of page left intentionally blank)

18

THE UNDERSIGNED, being the President of the Corporation, for the purpose of amending and restating the Corporation’s Certificate of Incorporation pursuant to the DGCL, does make this certificate, hereby declaring and certifying that this is my act and deed on behalf of the Corporation this ___ day of January, 2016.

| Name: | Tuvia Barlev | |

| Title: | President | |

19